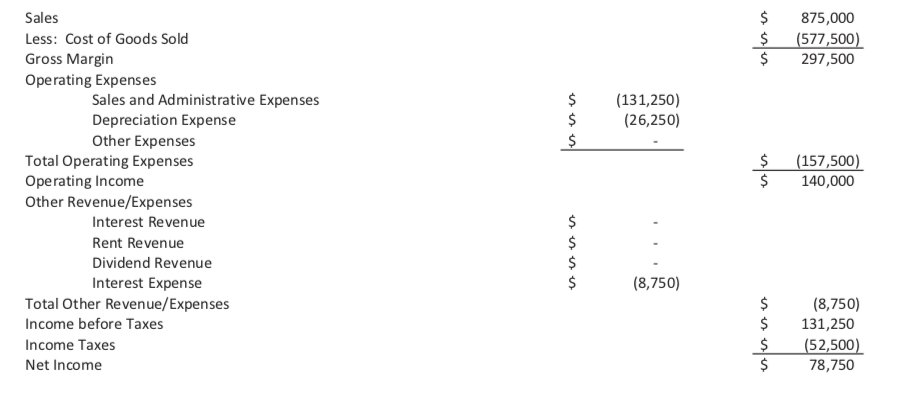

Question: Using the financial information provided for orange Incorporated, prepare a statement of Cash flows using the indirect method and direct method. Orange Inc. Income Statement

Using the financial information provided for orange Incorporated, prepare a statement of Cash flows using the indirect method and direct method.

Orange Inc.

Income Statement

For the year ended December 31, 2015 Orange Inc.

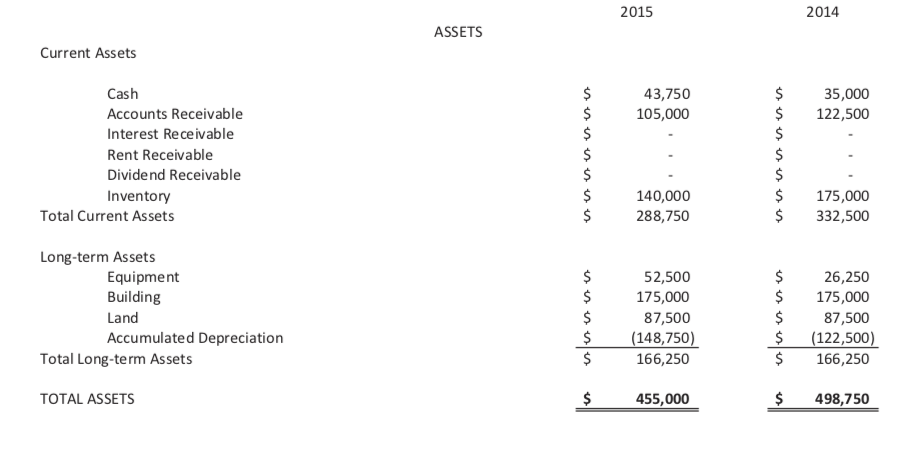

Orange Inc.

Statement of Retained Earnings

For the year ended December 31, 2015

Orange Inc.

Balance Sheet

For the year ended December 31, 2014 and 2015

Sales Less: Cost of Goods Sold Gross Margin Operating Expenses $ 875,000 (577,500 $297,500 Sales and Administrative Expenses Depreciation Expense Other Expenses (131,250) (26,250) Total Operating Expenses Operating Income Other Revenue/Expenses $(157,500 140,000 Interest Revenue Rent Revenue Dividend Revenue Interest Expense (8,750) Total Other Revenue/Expenses Income before Taxes Income Taxes Net Income $(8,750) 131,250 52,500 $78,750 Beginning Retained Earnings Balance Add: Net Income Less: Dividends Ending Retained Earning Balance 147,000 $78,750 (119,000) $106,750 2015 2014 ASSETS Current Assets $35,000 $122,500 Cash Accounts Receivable Interest Receivable Rent Receivable Dividend Receivable Inventory 43,750 105,000 140,000 288,750 175,000 $332,500 Total Current Assets Long-term Assets Equipment Building Land Accumulated Depreciation 52,500 175,000 87,500 148,750 166,250 $26,250 175,000 $87,500 S (122,500 166,250 Total Long-term Assets TOTAL ASSETS $455,000 498.750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts