Question: using the first page please help me figure pit the answers to the second page a) Current reserves for bank A = cash in vault

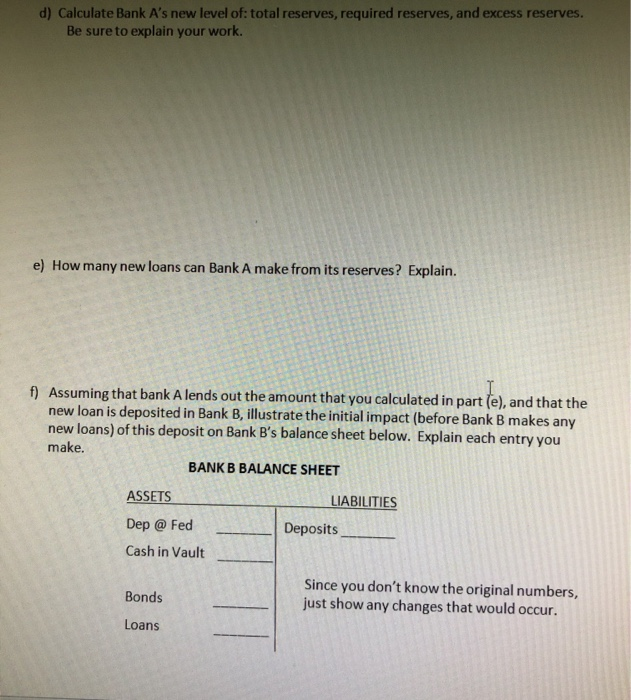

a) Current reserves for bank A = cash in vault + dep@ fed =$500+1500=$2000 b) The required reserve ratio is 20% je 20% of 10,000= $2000 Since the required reserve and actual reserve is equal, so there would be no excess reserves and hence no new loans would be made. c) Bank A balance sheet Assets liabilities Cash in vault 1000 Deposit 10500 Dep@ fed Bonds 3000 Loans 15000 1500 So the cash at bank vault and the deposits both would be increased by 500$. This change would be before any new loans. d) Calculate Bank A's new level of: total reserves, required reserves, and excess reserves. Be sure to explain your work. e) How many new loans can Bank A make from its reserves? Explain. f) Assuming that bank A lends out the amount that you calculated in part (e), and that the new loan is deposited in Bank B, illustrate the initial impact (before Bank B makes any new loans) of this deposit on Bank B's balance sheet below. Explain each entry you make. BANKB BALANCE SHEET LIABILITIES ASSETS Dep @ Fed Cash in Vault Deposits Bonds Since you don't know the original numbers, just show any changes that would occur. Loans a) Current reserves for bank A = cash in vault + dep@ fed =$500+1500=$2000 b) The required reserve ratio is 20% je 20% of 10,000= $2000 Since the required reserve and actual reserve is equal, so there would be no excess reserves and hence no new loans would be made. c) Bank A balance sheet Assets liabilities Cash in vault 1000 Deposit 10500 Dep@ fed Bonds 3000 Loans 15000 1500 So the cash at bank vault and the deposits both would be increased by 500$. This change would be before any new loans. d) Calculate Bank A's new level of: total reserves, required reserves, and excess reserves. Be sure to explain your work. e) How many new loans can Bank A make from its reserves? Explain. f) Assuming that bank A lends out the amount that you calculated in part (e), and that the new loan is deposited in Bank B, illustrate the initial impact (before Bank B makes any new loans) of this deposit on Bank B's balance sheet below. Explain each entry you make. BANKB BALANCE SHEET LIABILITIES ASSETS Dep @ Fed Cash in Vault Deposits Bonds Since you don't know the original numbers, just show any changes that would occur. Loans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts