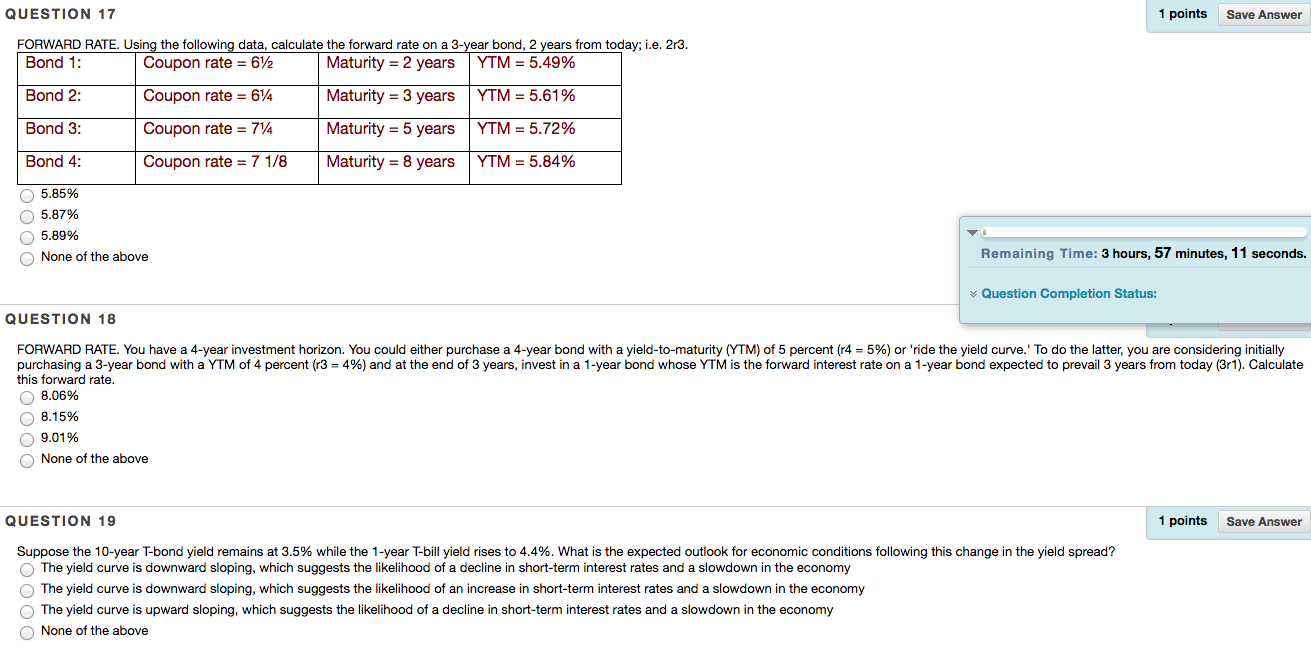

Question: Using the following data, calculate the forward rate on a 3-year bind, 2 years from today; i.e. 2r3. 5.85% 5.87% 5.89% None of the above

Using the following data, calculate the forward rate on a 3-year bind, 2 years from today; i.e. 2r3. 5.85% 5.87% 5.89% None of the above FORWARD RATE. You have a 4-year investment horizon. You could either purchase a 4-year bond with a yield-to-maturity (YTM) of 5 percent (r4 = 5%) or 'ride the yield curve.' To do the latter, you are considering initially purchasing a 3-year bond with a YTM of 4 percent (r3 = 4%) and at the end of 3 years, invest in a 1-year bond whose YTM is the forward interest rate on a 1-year bond expected to prevail 3 years from today (3r1). Calculate this forward rate. 8.06% 8.15% 9.01% None of the above Suppose the 10-year T-bond yield remains at 3.5% while the 1-year T-bill yield rises to 4.4%. What is the expected outlook for economic conditions following this change in the yield spread? The yield curve is downward sloping, which suggests the likelihood of a decline in short-term interest rates and a slowdown in the economy The yield curve is downward sloping, which suggests the likelihood of an increase in short-term interest rates and a slowdown in the economy The yield curve is upward sloping, which suggests the likelihood of a decline in short-term interest rates and a slowdown in the economy None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts