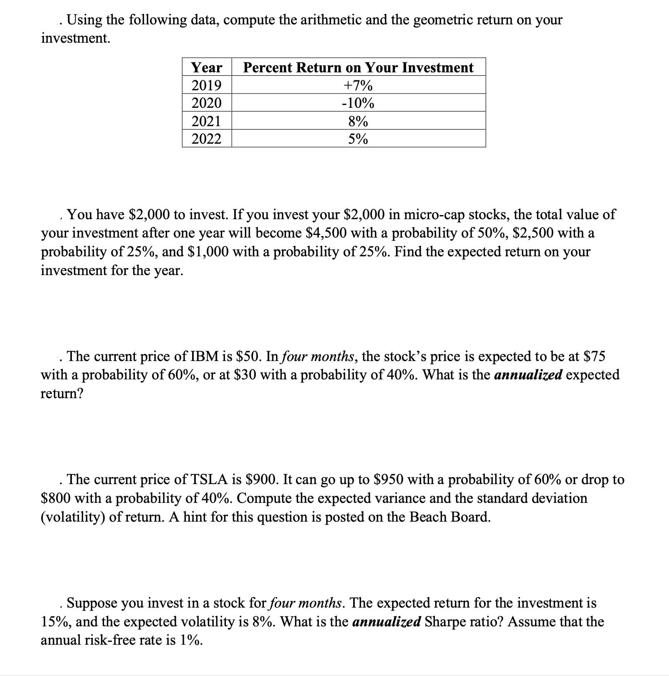

Question: . Using the following data, compute the arithmetic and the geometric return on your investment. Year 2019 2020 2021 2022 Percent Return on Your

. Using the following data, compute the arithmetic and the geometric return on your investment. Year 2019 2020 2021 2022 Percent Return on Your Investment +7% -10% 8% 5% You have $2,000 to invest. If you invest your $2,000 in micro-cap stocks, the total value of your investment after one year will become $4,500 with a probability of 50%, $2,500 with a probability of 25%, and $1,000 with a probability of 25%. Find the expected return on your investment for the year. . The current price of IBM is $50. In four months, the stock's price is expected to be at $75 with a probability of 60%, or at $30 with a probability of 40%. What is the annualized expected return? . The current price of TSLA is $900. It can go up to $950 with a probability of 60% or drop to $800 with a probability of 40%. Compute the expected variance and the standard deviation (volatility) of return. A hint for this question is posted on the Beach Board. Suppose you invest in a stock for four months. The expected return for the investment is 15%, and the expected volatility is 8%. What is the annualized Sharpe ratio? Assume that the annual risk-free rate is 1%.

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

SOLUTION To compute the arithmetic and geometric returns on your investment we will use the given data Year Percent Return on Your Investment 2019 7 2... View full answer

Get step-by-step solutions from verified subject matter experts