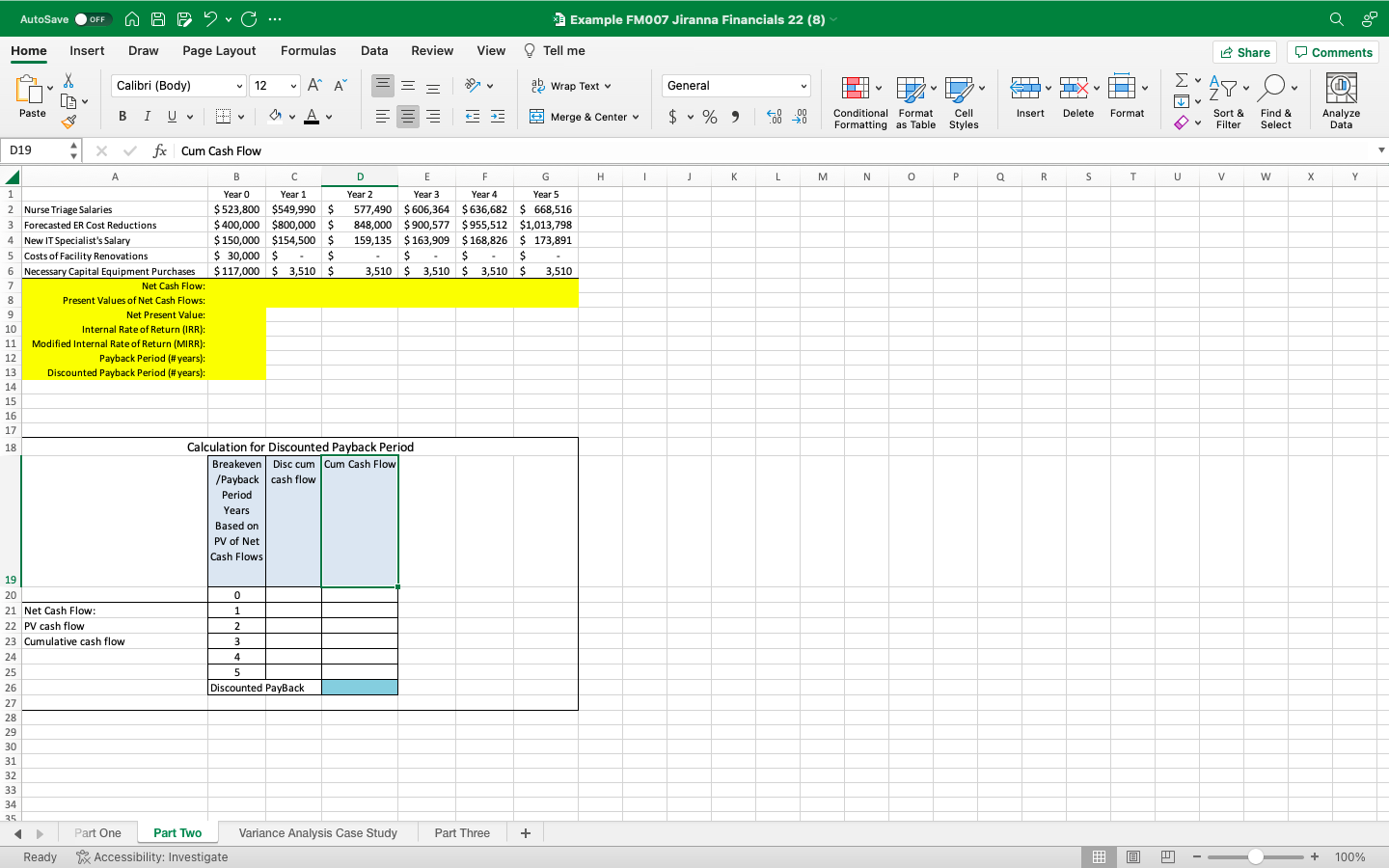

Question: using the following formulas how do i solve this ? Net Cash Flow = Total Cash Inflows - Total Cash Outflows Present Value Formula: PV

using the following formulas how do i solve this ?

using the following formulas how do i solve this ?

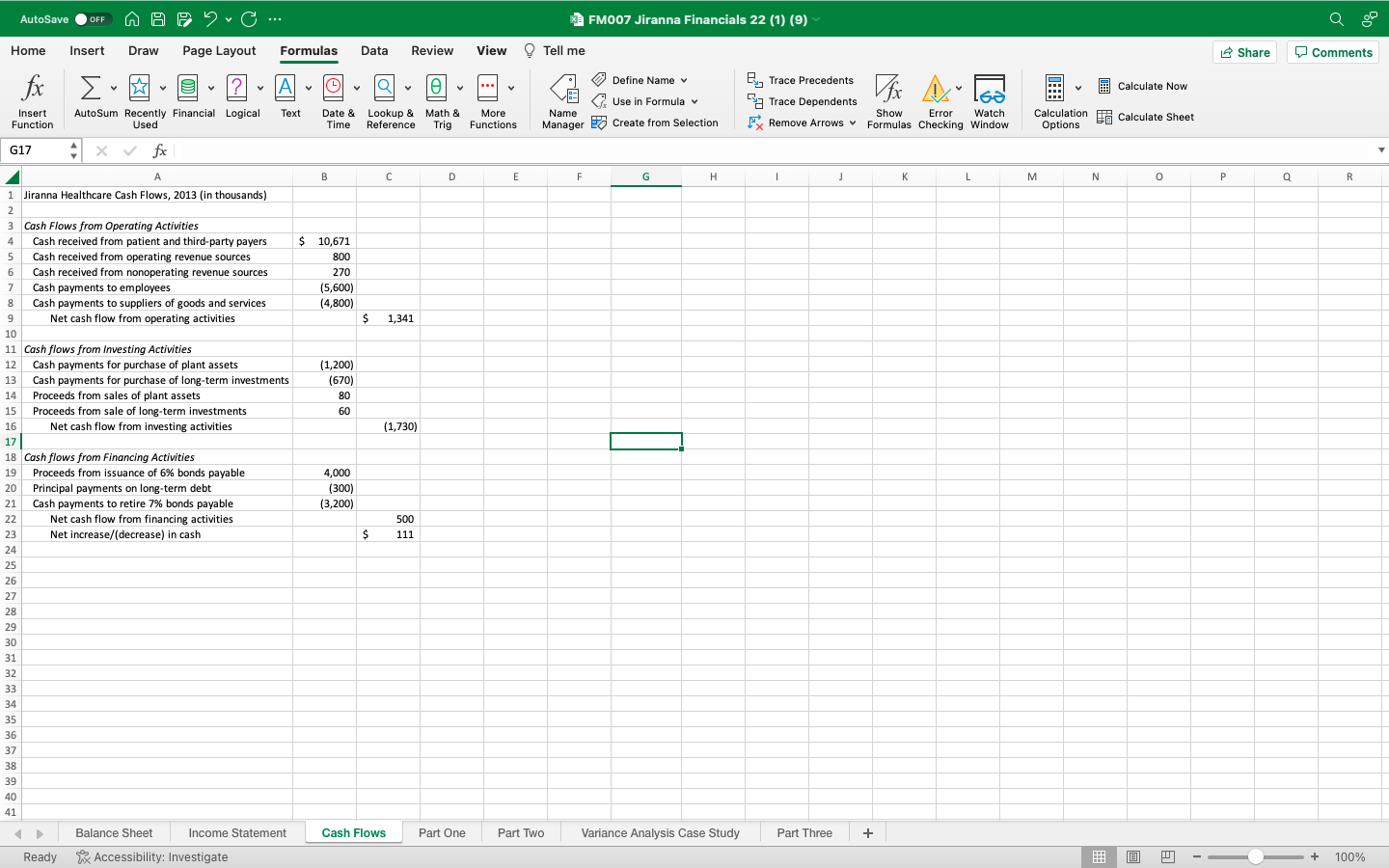

Net Cash Flow = Total Cash Inflows - Total Cash Outflows Present Value Formula: PV = FV/(1 + i) n where PV = present value, FV = future value, i = decimalized interest rate, and n = number of periods. NPV = Cash flow / (1 + i)^t - initial investment where i = required return or discount rate and t = number of time periods. or it can be, NPV = Today's value of the expected cash flows Today's value of invested cash (if has multiple cashflows) MIRR = Positive cash flows x the cost of capital by the initial outlays x the financing cost.

IRR: 0 = NPV = tt=1 Ct/(1+IRR)t C0 (*equate the NPV to 0)

Where:

Ct = Net cash inflow during period t

C0 = Initial investment cost

IRR = Internal rate of return

t = Number of time periods Payback Period = Initial investment / Cash flow per year Discounted Payback Period: DPP = y + abs(n) / p,

where y = the period preceding the period in which the cumulative cash flow turns positive, p = discounted value of the cash flow of the period in which the cumulative cash flow is => 0, abs(n) = absolute value of the cumulative discounted cash flow in period y.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts