Question: Using the following income statement and balance sheet, create a pro-forma income statement and balance sheet. Assume a growth rate of 30%, and that the

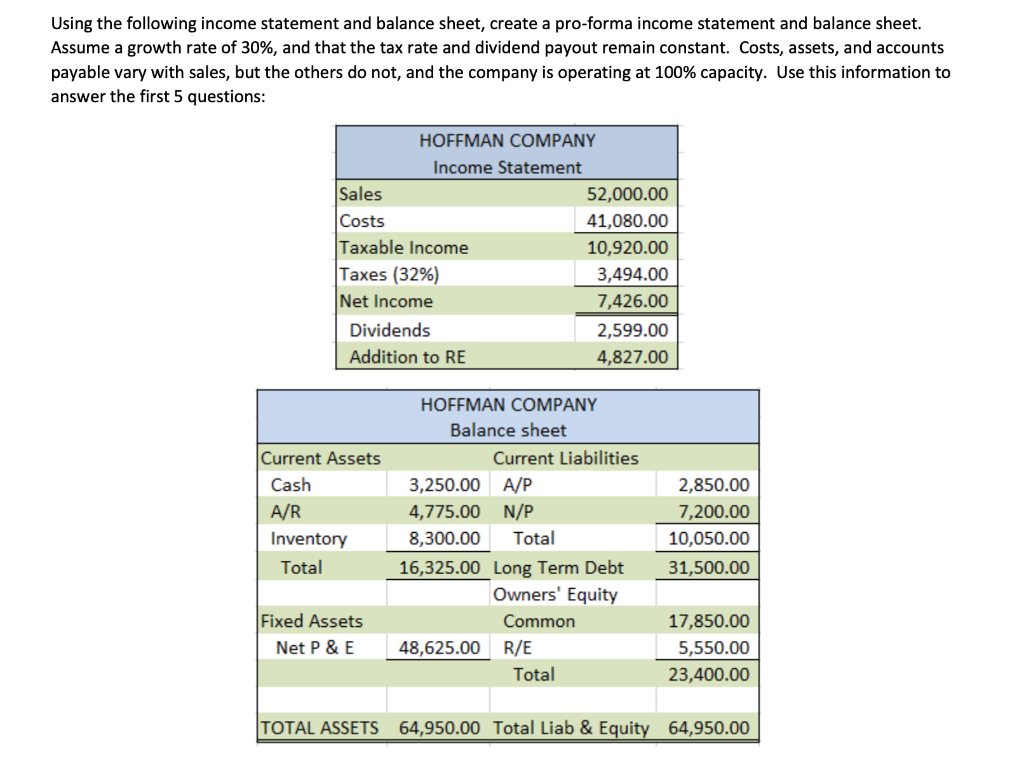

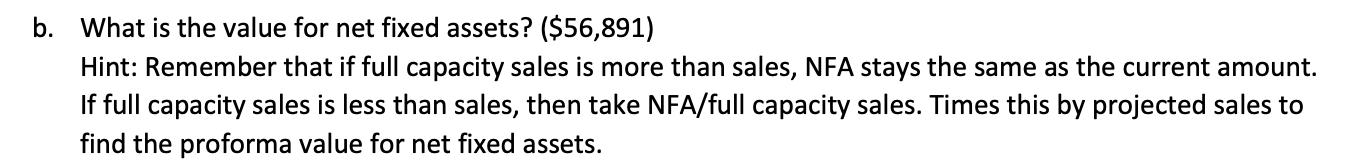

Using the following income statement and balance sheet, create a pro-forma income statement and balance sheet. Assume a growth rate of 30%, and that the tax rate and dividend payout remain constant. Costs, assets, and accounts payable vary with sales, but the others do not, and the company is operating at 100% capacity. Use this information to answer the first 5 questions: HOFFMAN COMPANY Income Statement Sales 52,000.00 Costs 41,080.00 Taxable Income 10,920.00 Taxes (32%) 3,494.00 Net Income 7,426.00 Dividends 2,599.00 Addition to RE 4,827.00 Current Assets Cash A/R Inventory Total HOFFMAN COMPANY Balance sheet Current Liabilities 3,250.00 A/P 4,775.00 N/P 8,300.00 Total 16,325.00 Long Term Debt Owners' Equity Common 48,625.00 R/E Total 2,850.00 7,200.00 10,050.00 31,500.00 Fixed Assets Net P&E 17,850.00 5,550.00 23,400.00 TOTAL ASSETS 64,950.00 Total Liab & Equity 64,950.00 b. What is the value for net fixed assets? ($56,891) Hint: Remember that if full capacity sales is more than sales, NFA stays the same as the current amount. If full capacity sales is less than sales, then take NFA/full capacity sales. Times this by projected sales to find the proforma value for net fixed assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts