Question: Using the following information and table, prepare Jordyn Inc.'s Statement of cash flows in 2016 using the INDIRECT METHOD. 1) The cash equivalents are term

Using the following information and table, prepare Jordyn Inc.'s Statement of cash flows in 2016 using the INDIRECT METHOD.

1) The cash equivalents are term deposits that mature on average in sixty days. The bank over drafts are temporary revolving lines of credit and typically reverse within a few days. Jordyn Inc. has elected to include both of these in cash and cash equivalents.

2) There were no disposals of buildings in 2016.

3) Amortization of patents is included in other operating expenses.

4) Equipment with an original cost of $46,000 and a carrying value of $28,000 was sold during the year.

5) During the year, Jordyn Inc. acquired land with a fair value of $200,000 in exchange for some preferred shares.

6) There were no purchases or sales of long-term investments during 2016.

7) During the year, the company initiated an executive stock option plan. The entire contributed surplus balance relates to that plan.

8) No bonds were issued or redeemed in 2016.

9) Jordyn Inc. follows the usual Canadian practice with respect to its classification of interest and dividends received and interest and dividends paid.

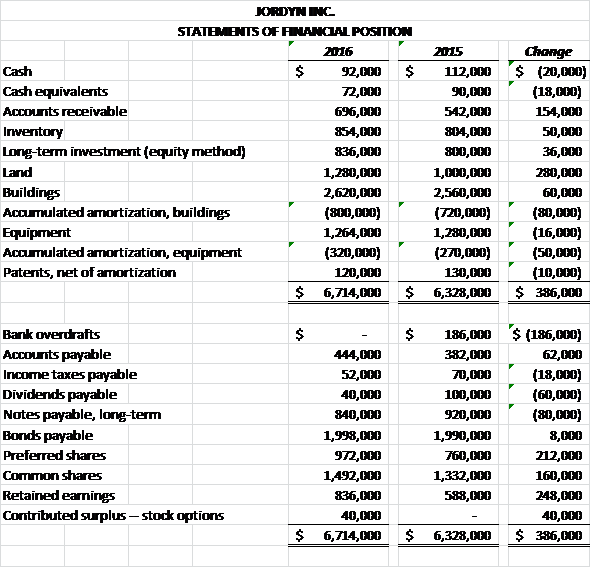

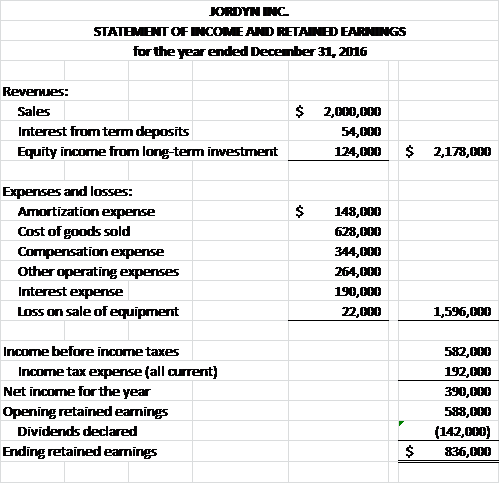

Following is Jordyn Inc.s comparative balance sheets at December 31, 2015 and 2016 and statement of income and retained earnings for the year ended on December 31, 2016:

Cash KORDYNC STATEMENTS OF ANARKIALPOSITKON 2016 $ 92,000 $ Cash equivalents 72,000 Accounts receivable 696,000 Inventory 854,000 Long-term inwestment (equity method) 836,000 Land 1,280,000 Buildings 2,620,000 Accumulated amortization, buildings (800,000) Equipment 1,264,000 Accumulated amortization, equipment (320,000) Patents, net of amortization 120,000 $ 6,714,000 $ 2015 112,000 90,000 542,000 804,000 800,000 1,000,000 2,560,000 (720,000) 1,280,000 (270,000) 130,000 6,328,000 Change $ (20,000) (18,000) 154,000 50,000 36,000 280,000 60,CED (80,000 (16,000) (50,000) (10,000) $ 386,000 Bank overdrafts Accounts payable Income taxes payable Dividends payable Notes payable, long-term Bonds payable Preferred shares Common shares Retained earnings Contributed surplus-stock options 444,000 52,000 40,000 840,000 1,998,000 972,000 1,492,000 836,000 40,000 6,714,000 186,000 382,000 70,000 100,000 920,000 1,990,000 760,000 1,332,000 589,000 $ (186,600) 62,000 (18,000) (60,000) (80,000) 8,000 212,000 160,000 248,000 40,000 $ 386,000 $ $ 6,328,000 KORDYN INC STATEMENT OF INCOME AND RETAINED EARNINGS for the year ended December 31, 2016 $ Revernes: Sales Interest from term deposits Equity income from long-term investment 2,000,000 54,000 124,000 $ 2,178,000 Expenses and losses: Amortization expense Cost of goods sold Compensation expense Other operating expenses Interest expense Loss on sale of equipment 148,000 628,000 344,000 264,000 190,000 22,000 1,596,000 Income before income taxes Income tax expense (all aurrent) Net income for the year Opening retained earnings Dividends declared Ending retained earnings 582,000 192,000 390,000 589,000 (142,000) 836,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts