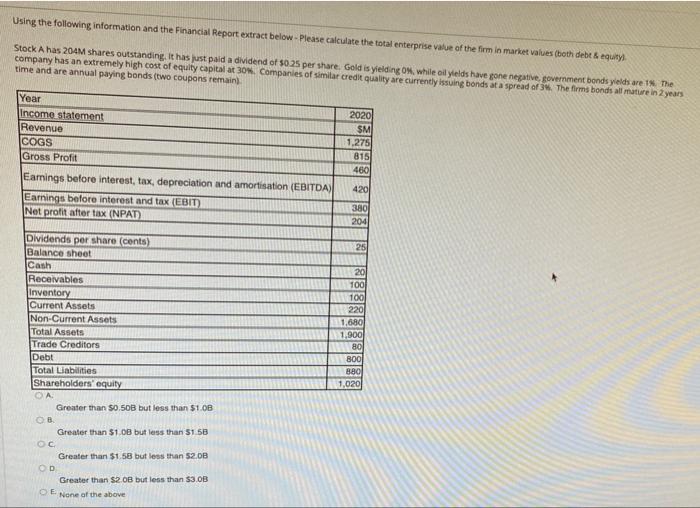

Question: Using the following information and the Financial Report extract below. Please calculate the total enterprise value of the firm in market values (both debt &

Using the following information and the Financial Report extract below. Please calculate the total enterprise value of the firm in market values (both debt & equity Stock A has 204M shares outstanding. It has just paid a dividend of 50.25 per share. Gold is yielding on while all yields have gone negative, government bonds yields are the company has an extremely high cost of equity capital 30Companies of similar credit quality are currently issuing bonds at a spread of 3. The firms bonds all mature in 2 years time and are annual paying bonds (two coupons remain Year Income statement Revenue COGS Gross Profit Earings before interest, tax, depreciation and amortisation (EBITDA) Earnings before interest and tax (EBIT) Net profit after tax (NPAD 2020 SM 1.2751 815 460 420 380 2041 25 Dividends per share (cents) Balance sheet Cash Receivables Inventory Current Assets Non-Current Assets Total Assets Trade Creditors Debt Total Liabilities Shareholders' equity OA Greater than 50.50B but less than 51.0B OB Greater than $1.0B but less than 51 5B , Greater than $1.58 but less than 52.0B OD Greater than $2.0B but less than 53.00 None of the above 20 100 100 220 1.680 1,900 80 800 880 1,020 Using the following information and the Financial Report extract below. Please calculate the total enterprise value of the firm in market values (both debt & equity Stock A has 204M shares outstanding. It has just paid a dividend of 50.25 per share. Gold is yielding on while all yields have gone negative, government bonds yields are the company has an extremely high cost of equity capital 30Companies of similar credit quality are currently issuing bonds at a spread of 3. The firms bonds all mature in 2 years time and are annual paying bonds (two coupons remain Year Income statement Revenue COGS Gross Profit Earings before interest, tax, depreciation and amortisation (EBITDA) Earnings before interest and tax (EBIT) Net profit after tax (NPAD 2020 SM 1.2751 815 460 420 380 2041 25 Dividends per share (cents) Balance sheet Cash Receivables Inventory Current Assets Non-Current Assets Total Assets Trade Creditors Debt Total Liabilities Shareholders' equity OA Greater than 50.50B but less than 51.0B OB Greater than $1.0B but less than 51 5B , Greater than $1.58 but less than 52.0B OD Greater than $2.0B but less than 53.00 None of the above 20 100 100 220 1.680 1,900 80 800 880 1,020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts