Question: Using the following information, complete an indirect method SCF in good form. The SCF should be presented in the worksheet labeled Statement of Cash Flows.

Using the following information, complete an indirect method SCF in good form. The SCF should be presented in the worksheet labeled "Statement of Cash Flows".

This homework is worth a total of possible points for the SCF and for appropriate use of Excel ieno amounts hard coded, use of formulas where possible and proper formattingwithin the SCF

Tips:

Follow the steps provided in class to create the SCFincluding using supporting T accounts.

Record the journal entry for the sale of equipment to determine the cash effect of this transaction

If ending cash on the SCF doesn't equal ending cash per the Balance Sheet, you've made a mistake somewhere. To find the error, recheck your work once, then redo the problem if you can't find your error.

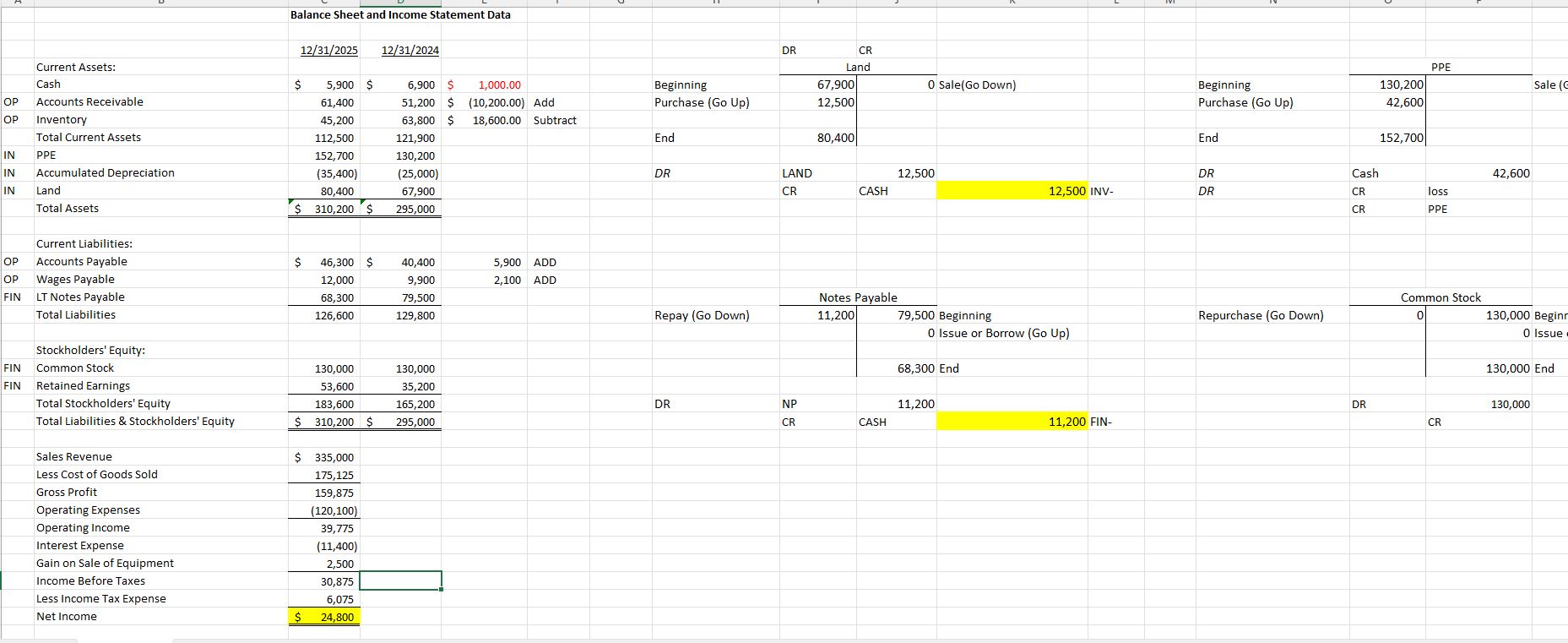

Martinez Inc

Balance Sheet and Income Statement Data

Current Assets:

Cash $ $

Accounts Receivable

Inventory

Total Current Assets

PPE

Accumulated Depreciation

Land

Total Assets $ $

Current Liabilities:

Accounts Payable $ $

Wages Payable

LT Notes Payable

Total Liabilities

Stockholders' Equity:

Common Stock

Retained Earnings

Total Stockholders' Equity

Total Liabilities & Stockholders' Equity $ $

Sales Revenue $

Less Cost of Goods Sold

Gross Profit

Operating Expenses

Operating Income

Interest Expense

Gain on Sale of Equipment

Income Before Taxes

Less Income Tax Expense

Net Income $

Additional Information:

The company sold equipment that had an original cost of $

Amount equipment was depreciated at sale

There have been no sales of land during the year.

Depreciation expense is included in operating expenses.

There have been no additional borrowings under the long term note payable.

There has been no repurchase of treasury stock.

Dividends were declared and paid during

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock