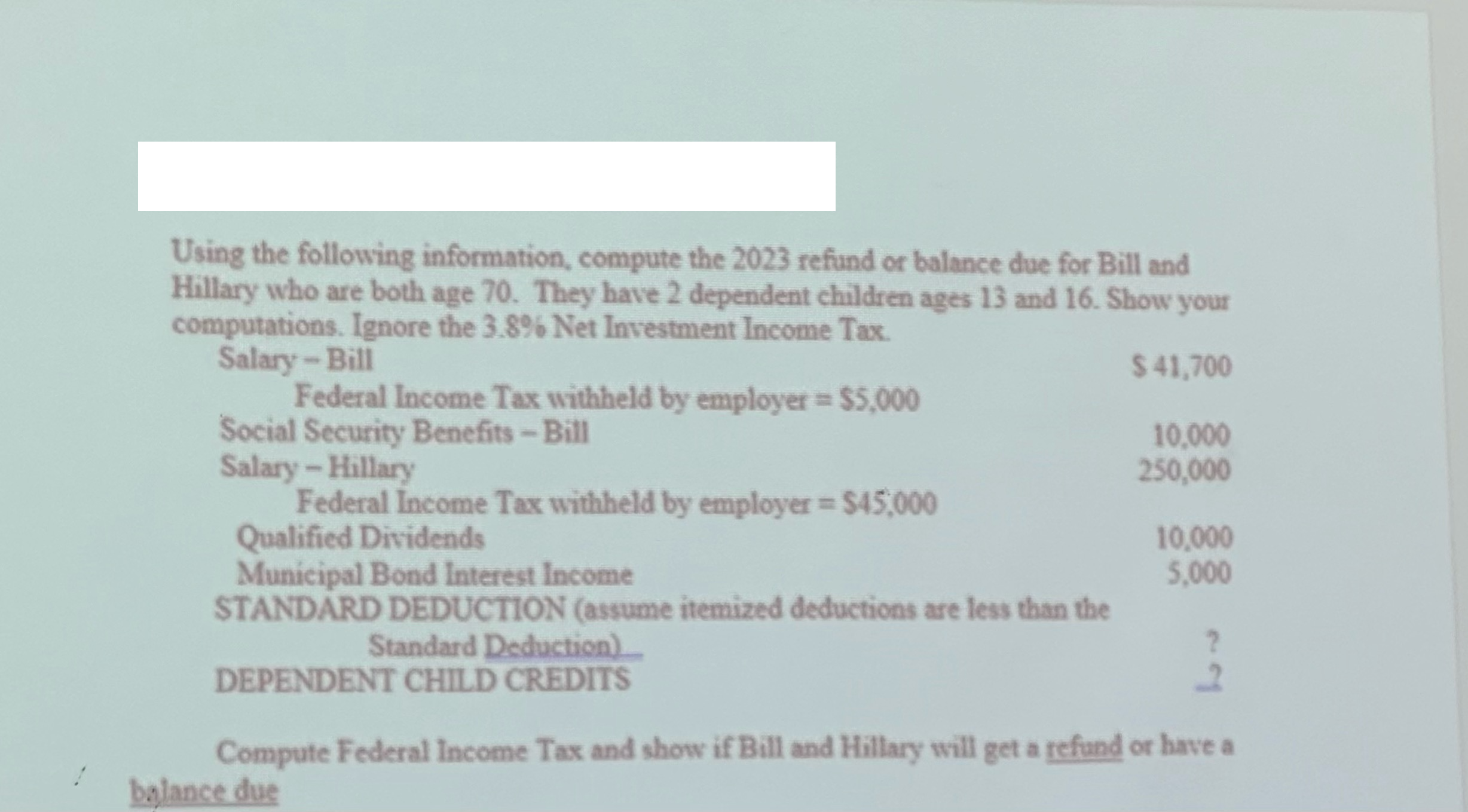

Question: Using the following information, compute the 2023 refund or balance due for Bill and Hillary who are both age 70. They have 2 dependent

Using the following information, compute the 2023 refund or balance due for Bill and Hillary who are both age 70. They have 2 dependent children ages 13 and 16. Show your computations. Ignore the 3.8% Net Investment Income Tax. Salary-Bill Federal Income Tax withheld by employer = $5,000 Social Security Benefits - Bill Salary - Hillary Federal Income Tax withheld by employer = $45,000 Qualified Dividends Municipal Bond Interest Income STANDARD DEDUCTION (assume itemized deductions are less than the Standard Deduction) DEPENDENT CHILD CREDITS $41,700 10,000 250,000 10,000 5,000 2 2 Compute Federal Income Tax and show if Bill and Hillary will get a refund or have a balance due

Step by Step Solution

There are 3 Steps involved in it

Answer To compute the federal income tax for Bill and Hillary we need to calculate their taxable inc... View full answer

Get step-by-step solutions from verified subject matter experts