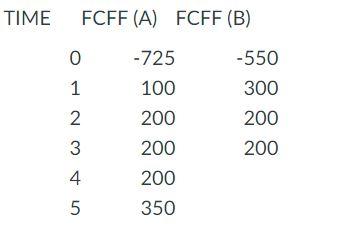

Question: Using the following, please answer the next 7 questions: Two projects have the following cash flows and the WACC is 10%: What is the NPV

Using the following, please answer the next 7 questions: Two projects have the following cash flows and the WACC is 10%:

What is the NPV of project A) Round your answer to two decimal places (e.g., 12.34)

What is the NPV of project B) Round your answer to two decimal places (e.g., 12.34)

What is the IRR of project A) Answer in decimal form (not percent) and round to four decimal places (e.g., 0.0123)

What is the IRR of project B) Put answer in decimal form (not percent) and round to four decimal places (e.g., 0.0123)

What is the MIRR of project A) Put answer in decimal form (not percent) and round to four decimal places (e.g., 0.0123)

What is the MIRR of project B) Put answer in decimal form (not percent) and round to four decimal places (e.g., 0.0123)

If you created an NPV profile for the two projects, what discount rate would be the crossover point? Put answer in decimal form (not percent) and round to four decimal places (e.g., 0.0123)

TIME FCFF (A) FCFF (B) -550 Omtu -725 100 200 200 300 200 200 3 4 5 200 350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts