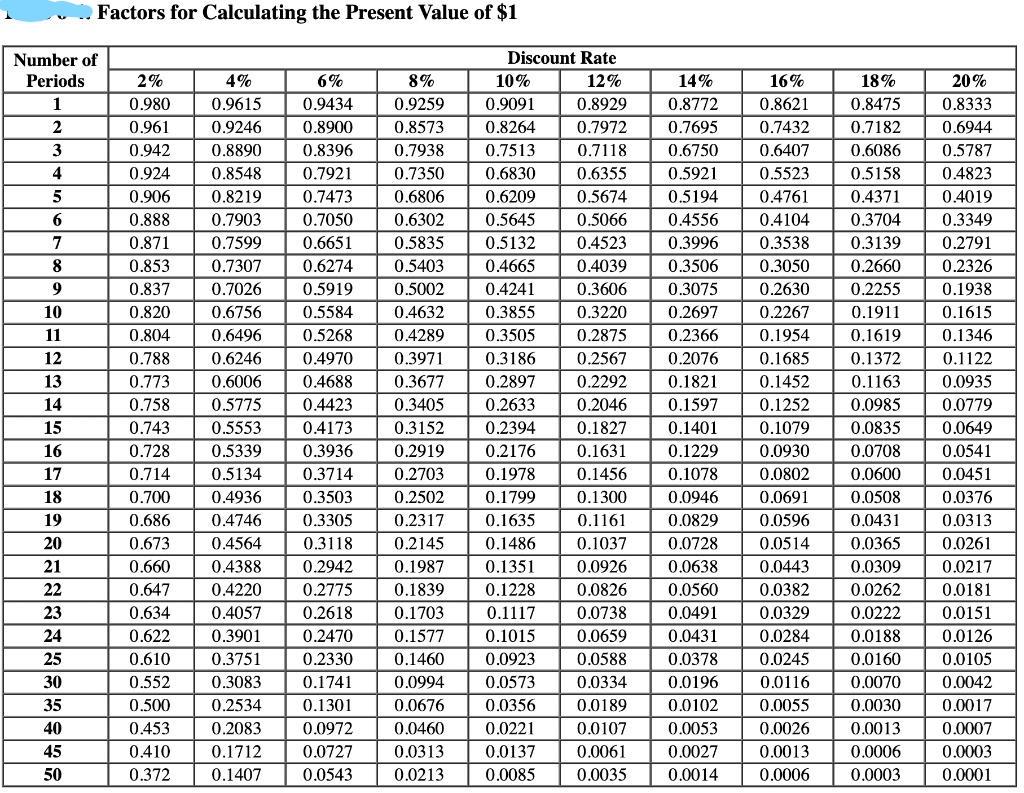

Question: Using the following present value tables, calculate the present value for the following: Note: Use the appropriate value(s) from the tables provided and final answers

Using the following present value tables, calculate the present value for the following:

Note: Use the appropriate value(s) from the tables provided and final answers to the nearest whole dollar.

Required:

a. A car down payment of $9,050 that will be required in two years, assuming an interest rate of 12%.

b. A lottery prize of $18.2 million to be paid at the rate of $910,000 per year for 20 years, assuming an interest rate of 12%.

c. The same annual amount as in part b, but assuming an interest rate of 16%.

d. A financing lease obligation that calls for the payment of $24,500 per year for 10 years, assuming a discount rate of 6%.

Factors for Calculating the Present Value of $1 Number of Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 45 50 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.660 0.647 0.634 0.622 0.610 0.552 0.500 0.453 0.410 0.372 4% 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.6496 0.6246 0.6006 0.5775 0.5553 0.5339 0.5134 0.4936 0.4746 0.4564 0.4388 0.4220 0.4057 0.3901 0.3751 0.3083 0.2534 0.2083 0.1712 0.1407 6% 8% 0.9434 0.9259 0.8900 0.8573 0.8396 0.7938 0.7921 0.7350 0.7473 0.6806 0.7050 0.6302 0.6651 0.5835 0.6274 0.5403 0.5919 0.5002 0.5584 0.4632 0.5268 0.4289 0.4970 0.3971 0.4688 0.3677 0.4423 0.3405 0.4173 0.3152 0.3936 0.2919 0.3714 0.2703 0.3503 0.2502 0.3305 0.2317 0.3118 0.2145 0.2942 0.1987 0.2775 0.1839 0.2618 0.1703 0.2470 0.1577 0.2330 0.1460 0.1741 0.0994 0.1301 0.0676 0.0972 0.0460 0.0727 0.0313 0.0543 0.0213 Discount Rate 12% 0.8929 0.7972 0.7118 10% 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.3506 0.4241 0.3075 0.3855 0.3220 0.2697 0.3505 0.2875 0.2366 0.3186 0.2567 0.2076 0.2897 0.2292 0.1821 0.2633 0.2046 0.1597 0.2394 0.1827 0.1401 0.2176 0.1631 0.1229 0.1978 0.1456 0.1078 0.1799 0.1300 0.0946 0.1635 0.1161 0.0829 0.1486 0.1037 0.0728 0.0926 0.0638 0.0826 0.0560 0.0738 0.0491 0.0659 0.1351 0.1228 0.1117 0.1015 0.0923 0.0573 0.0356 0.0221 0.0137 0.0085 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 14% 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.0588 0.0334 0.0189 0.0107 0.0061 0.0035 0.0431 0.0378 0.0196 0.0102 0.0053 0.0027 0.0014 16% 0.8621 0.7432 0.6407 0.5523 0.4761 0.4104 0.3538 0.3050 0.2630 0.2267 0.1954 0.1685 0.1452 0.1252 0.1079 0.0930 0.0802 0.0691 0.0596 0.0514 0.0443 0.0382 0.0329 0.0284 0.0245 0.0116 0.0055 0.0026 0.0013 0.0006 18% 0.8475 0.7182 0.6086 0.5158 0.4371 0.3704 0.3139 0.2660 0.2255 0.1911 0.1619 0.1372 0.1163 0.0985 0.0835 0.0708 0.0600 0.0508 0.0431 0.0365 0.0309 0.0262 0.0222 0.0188 0.0160 0.0070 0.0030 0.0013 0.0006 0.0003 20% 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.1346 0.1122 0.0935 0.0779 0.0649 0.0541 0.0451 0.0376 0.0313 0.0261 0.0217 0.0181 0.0151 0.0126 0.0105 0.0042 0.0017 0.0007 0.0003 0.0001 Factors for Calculating the Present Value of $1 Number of Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 45 50 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.660 0.647 0.634 0.622 0.610 0.552 0.500 0.453 0.410 0.372 4% 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.6496 0.6246 0.6006 0.5775 0.5553 0.5339 0.5134 0.4936 0.4746 0.4564 0.4388 0.4220 0.4057 0.3901 0.3751 0.3083 0.2534 0.2083 0.1712 0.1407 6% 8% 0.9434 0.9259 0.8900 0.8573 0.8396 0.7938 0.7921 0.7350 0.7473 0.6806 0.7050 0.6302 0.6651 0.5835 0.6274 0.5403 0.5919 0.5002 0.5584 0.4632 0.5268 0.4289 0.4970 0.3971 0.4688 0.3677 0.4423 0.3405 0.4173 0.3152 0.3936 0.2919 0.3714 0.2703 0.3503 0.2502 0.3305 0.2317 0.3118 0.2145 0.2942 0.1987 0.2775 0.1839 0.2618 0.1703 0.2470 0.1577 0.2330 0.1460 0.1741 0.0994 0.1301 0.0676 0.0972 0.0460 0.0727 0.0313 0.0543 0.0213 Discount Rate 12% 0.8929 0.7972 0.7118 10% 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.3506 0.4241 0.3075 0.3855 0.3220 0.2697 0.3505 0.2875 0.2366 0.3186 0.2567 0.2076 0.2897 0.2292 0.1821 0.2633 0.2046 0.1597 0.2394 0.1827 0.1401 0.2176 0.1631 0.1229 0.1978 0.1456 0.1078 0.1799 0.1300 0.0946 0.1635 0.1161 0.0829 0.1486 0.1037 0.0728 0.0926 0.0638 0.0826 0.0560 0.0738 0.0491 0.0659 0.1351 0.1228 0.1117 0.1015 0.0923 0.0573 0.0356 0.0221 0.0137 0.0085 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 14% 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.0588 0.0334 0.0189 0.0107 0.0061 0.0035 0.0431 0.0378 0.0196 0.0102 0.0053 0.0027 0.0014 16% 0.8621 0.7432 0.6407 0.5523 0.4761 0.4104 0.3538 0.3050 0.2630 0.2267 0.1954 0.1685 0.1452 0.1252 0.1079 0.0930 0.0802 0.0691 0.0596 0.0514 0.0443 0.0382 0.0329 0.0284 0.0245 0.0116 0.0055 0.0026 0.0013 0.0006 18% 0.8475 0.7182 0.6086 0.5158 0.4371 0.3704 0.3139 0.2660 0.2255 0.1911 0.1619 0.1372 0.1163 0.0985 0.0835 0.0708 0.0600 0.0508 0.0431 0.0365 0.0309 0.0262 0.0222 0.0188 0.0160 0.0070 0.0030 0.0013 0.0006 0.0003 20% 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.1346 0.1122 0.0935 0.0779 0.0649 0.0541 0.0451 0.0376 0.0313 0.0261 0.0217 0.0181 0.0151 0.0126 0.0105 0.0042 0.0017 0.0007 0.0003 0.0001

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Formula for Present value ... View full answer

Get step-by-step solutions from verified subject matter experts