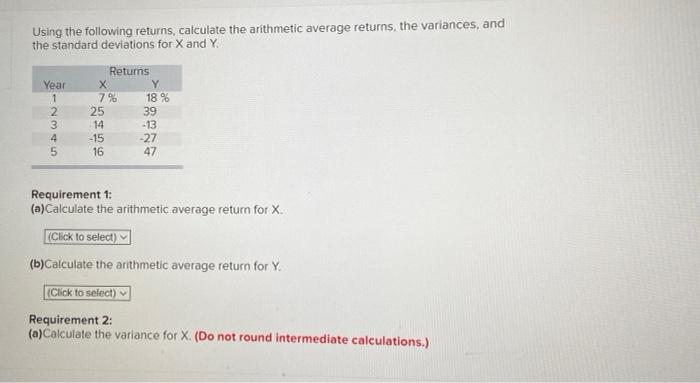

Question: Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y Year -NM Returns X Y 7%

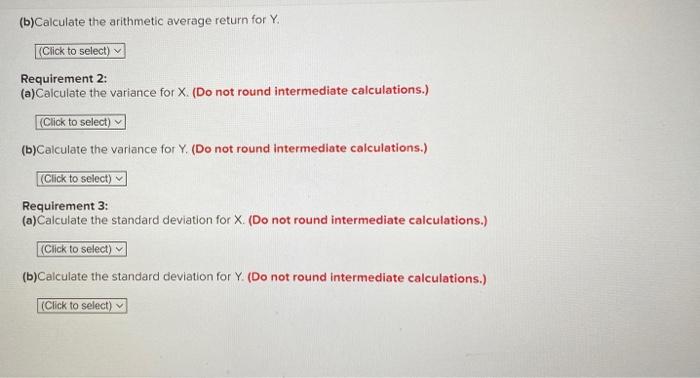

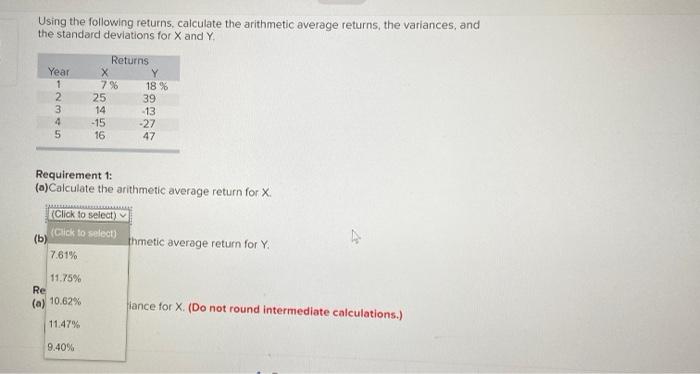

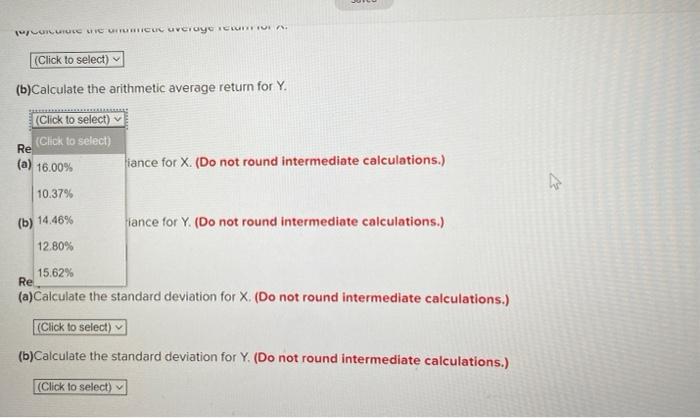

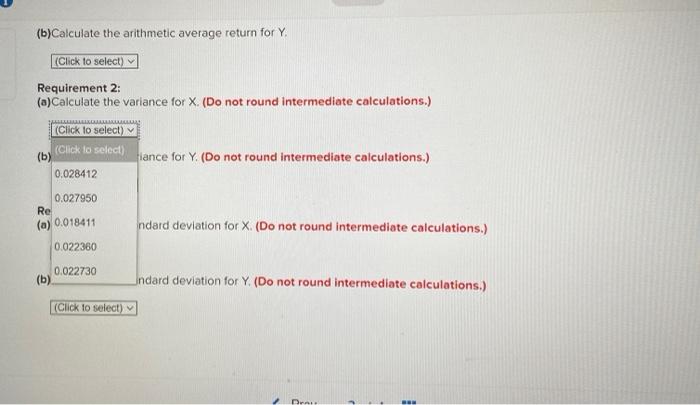

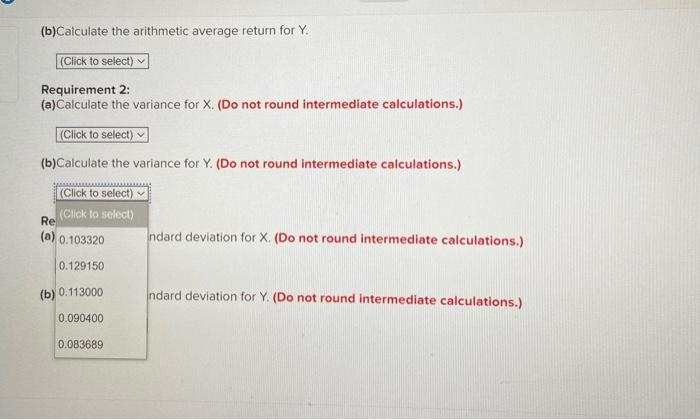

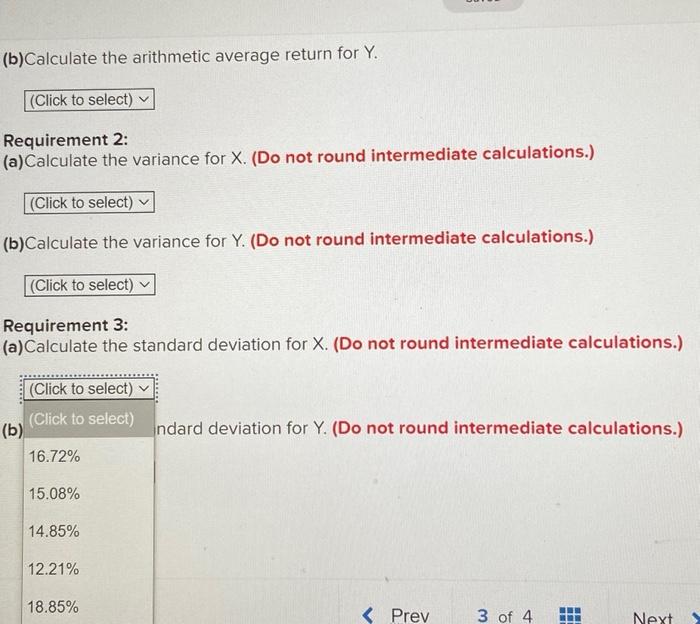

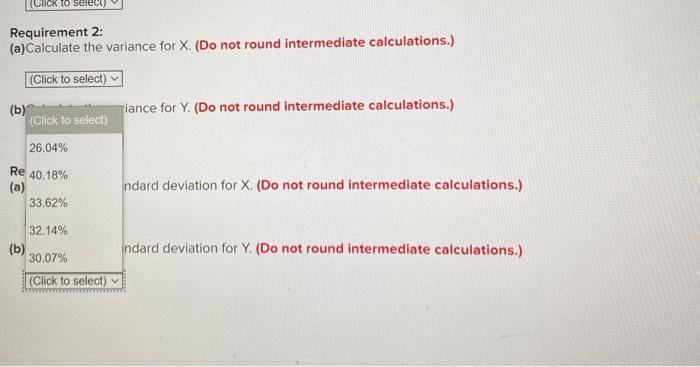

Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y Year -NM Returns X Y 7% 18 % 25 39 14 -15 27 16 47 -13 Requirement : (a)Calculate the arithmetic average return for X (Click to select) (b)Calculate the arithmetic average return for Y (Click to select) Requirement 2: (a)Calculate the variance for X. (Do not round intermediate calculations.) (b)Calculate the arithmetic average return for Y. (Click to select) Requirement 2: (a)Calculate the variance for X. (Do not round intermediate calculations.) (Click to select) (b)Calculate the variance for Y. (Do not round Intermediate calculations.) (Click to select) Requirement 3: (a)Calculate the standard deviation for X. (Do not round intermediate calculations.) (Click to select) (b)Calculate the standard deviation for Y. (Do not round intermediate calculations.) (Click to select) Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. Returns Year WN - 2 3 79% 25 14 -15 16 18 % 39 13 -27 47 Requirement 1: (a)Calculate the arithmetic average return for X (Click to select) (Click to select (b) 7.61% thmetic average return for Y 11.75% Re (a) 10.62% fance for X. (Do not round intermediate calculations.) 11.47% 9.40% RIU WYCHICu uveraye YOL (Click to select) (b)Calculate the arithmetic average return for Y. (Click to select) (Click to select) Re (a) 16.00% iance for X. (Do not round intermediate calculations.) 10.37% fance for Y. (Do not round intermediate calculations.) (b) 14.46% 12.80% 15.62% Re (a)Calculate the standard deviation for X. (Do not round intermediate calculations.) (Click to select) (b)Calculate the standard deviation for Y. (Do not round intermediate calculations.) (Click to select) (b)Calculate the arithmetic average return for Y (Click to select) Requirement 2: (a)Calculate the variance for X (Do not round intermediate calculations.) (Click to select) (Click to select) (b) 0.028412 fiance for Y. (Do not round intermediate calculations.) 0.027950 Re (a) 0.018411 0.022360 ndard deviation for X. (Do not round intermediate calculations.) 0.022730 (b) Indard deviation for Y. (Do not round intermediate calculations.) (Click to select) Dr --- (b)Calculate the arithmetic average return for Y. (Click to select) Requirement 2: (a)Calculate the variance for X. (Do not round intermediate calculations.) (Click to select) (b)Calculate the variance for Y. (Do not round intermediate calculations.) (Click to select) (Click to select) Re (0) 0.103320 Indard deviation for X. (Do not round Intermediate calculations.) 0.129150 (b) 0.113000 ndard deviation for Y (Do not round intermediate calculations.) 0.090400 0.083689 (b)Calculate the arithmetic average return for Y. (Click to select) Requirement 2: (a)Calculate the variance for X. (Do not round intermediate calculations.) (Click to select) (b)Calculate the variance for Y. (Do not round intermediate calculations.) (Click to select) Requirement 3: (a)Calculate the standard deviation for X. (Do not round intermediate calculations.) (Click to select) (b) (Click to select) ndard deviation for Y. (Do not round intermediate calculations.) 16.72% 15.08% 14.85% 12.21% 18.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts