Question: Using the following short-term discount factor tree implied by the Ho-Lee model: A Do, 0.9540 t = 0 B D,2 = 0.9294 D1,2 =

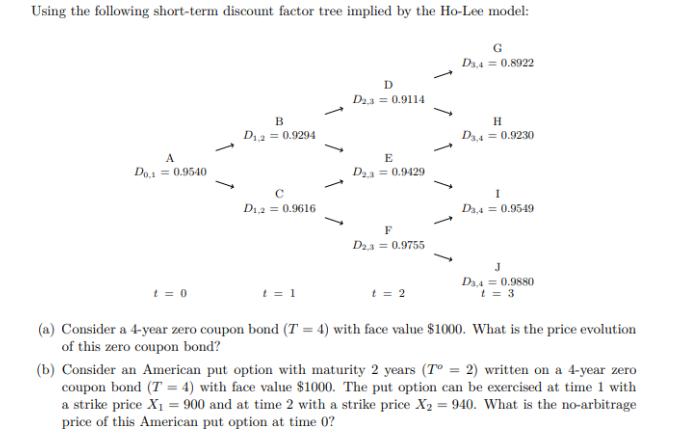

Using the following short-term discount factor tree implied by the Ho-Lee model: A Do, 0.9540 t = 0 B D,2 = 0.9294 D1,2 = 0.9616 t = 1 1 D D23= 0.9114 E Da= 0.9429 F D2,3 = 0.9755 t = 2 D,4 = 0.8922 H D,4 = 0.9230 I D3,4 = 0.9549 J D,4 = 0.9880 t = 3 (a) Consider a 4-year zero coupon bond (T= 4) with face value $1000. What is the price evolution of this zero coupon bond? (b) Consider an American put option with maturity 2 years (T = 2) written on a 4-year zero coupon bond (7= 4) with face value $1000. The put option can be exercised at time 1 with a strike price X = 900 and at time 2 with a strike price X=940. What is the no-arbitrage price of this American put option at time 0?

Step by Step Solution

There are 3 Steps involved in it

The image provided includes a question with two parts a Consider a 4year zero coupon bond T 4 with face value 1000 What is the price evolution of this zero coupon bond b Consider an American put optio... View full answer

Get step-by-step solutions from verified subject matter experts