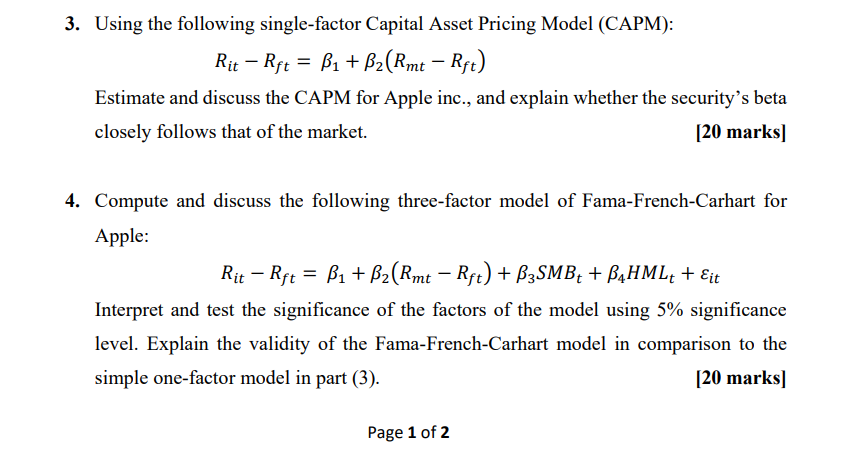

Question: Using the following single-factor Capital Asset Pricing Model (CAPM): RitRft=1+2(RmtRft) Estimate and discuss the CAPM for Apple inc., and explain whether the security's beta closely

Using the following single-factor Capital Asset Pricing Model (CAPM): RitRft=1+2(RmtRft) Estimate and discuss the CAPM for Apple inc., and explain whether the security's beta closely follows that of the market. [20 marks] Compute and discuss the following three-factor model of Fama-French-Carhart for Apple: RitRft=1+2(RmtRft)+3SMBt+4HMLt+it Interpret and test the significance of the factors of the model using 5% significance level. Explain the validity of the Fama-French-Carhart model in comparison to the simple one-factor model in part (3). [20 marks] Using the following single-factor Capital Asset Pricing Model (CAPM): RitRft=1+2(RmtRft) Estimate and discuss the CAPM for Apple inc., and explain whether the security's beta closely follows that of the market. [20 marks] Compute and discuss the following three-factor model of Fama-French-Carhart for Apple: RitRft=1+2(RmtRft)+3SMBt+4HMLt+it Interpret and test the significance of the factors of the model using 5% significance level. Explain the validity of the Fama-French-Carhart model in comparison to the simple one-factor model in part (3). [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts