Question: Using the forecasted financial statements from integrative Case 10.1 involves projecting financial statements for Walmart for Years 1 through 5. Using the attached for the

Using the forecasted financial statements from integrative Case 10.1 involves projecting financial statements for Walmart for Years 1 through 5. Using the attached for the various valuation methods.

The attachment shows us the following:

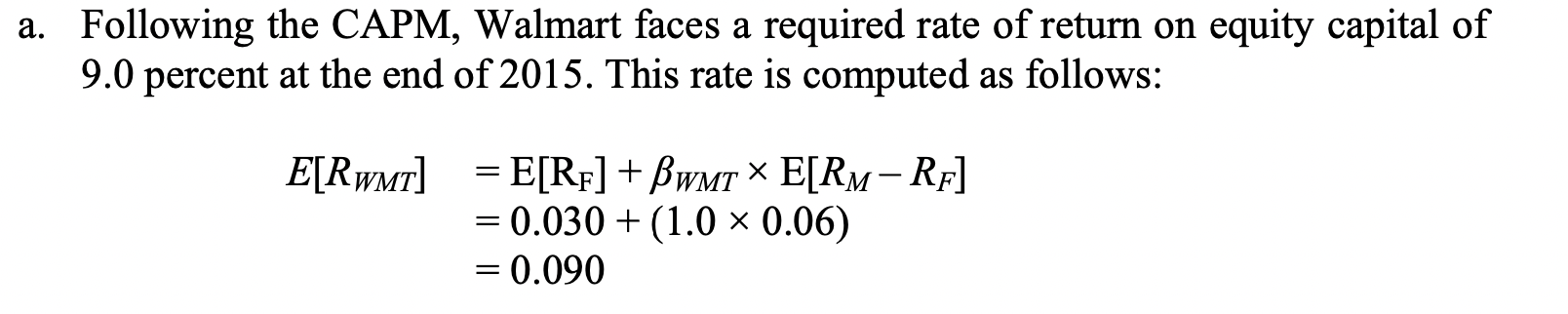

- Using the CAPM computed the required rate of return on common equity capital for Walmart.

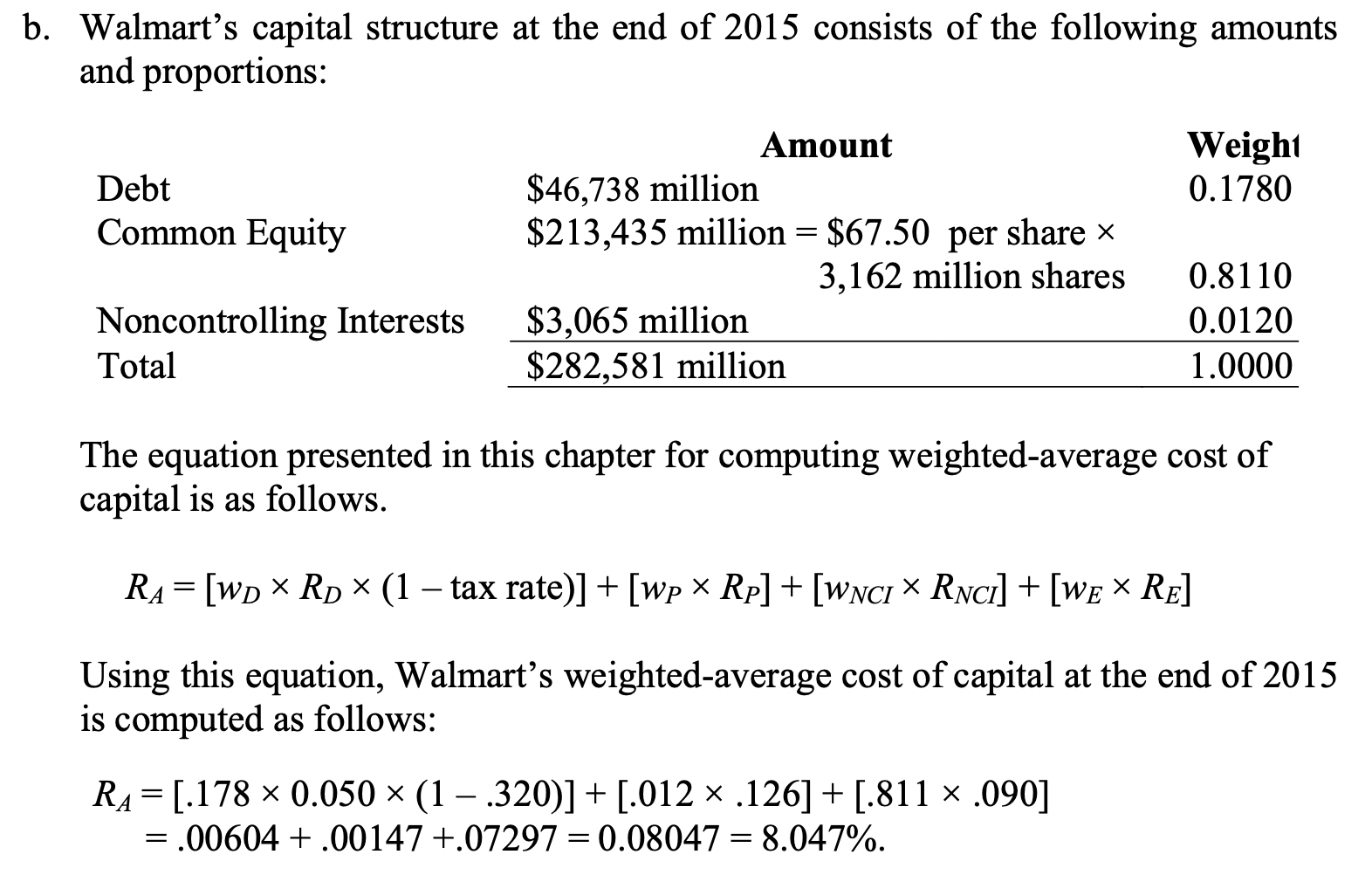

2. The weighted average cost of capital for Walmart as of the start of Year 1.

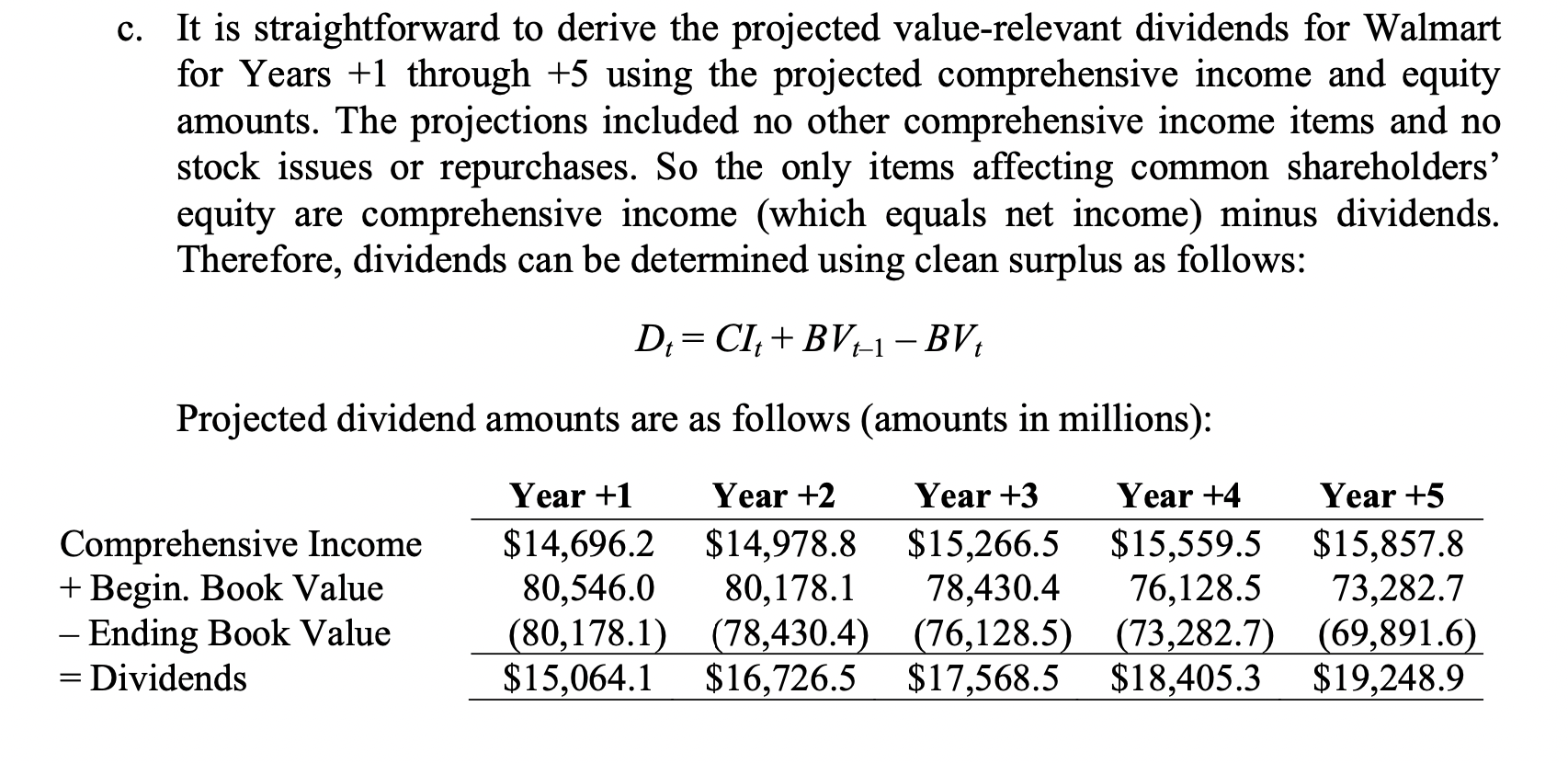

3. The clean surplus accounting approach to derive the projected dividends for common shareholders for Years 1 through 5 based on the projected comprehensive income and shareholders equity amounts.

REQUIRED

What reasonable range of share values would you expect for Walmart common stock? Where is the current price for Walmart shares relative to this range? What do you recommend?

a. Following the CAPM, Walmart faces a required rate of return on equity capital of 9.0 percent at the end of 2015 . This rate is computed as follows: E[RWMT]=E[RF]+WMTE[RMRF]=0.030+(1.00.06)=0.090 Walmart's capital structure at the end of 2015 consists of the following amounts and proportions: The equation presented in this chapter for computing weighted-average cost of capital is as follows. RA=[wDRD(1taxrate)]+[wPRP]+[wNCIRNCI]+[wERE] Using this equation, Walmart's weighted-average cost of capital at the end of 2015 is computed as follows: RA=[.1780.050(1.320)]+[.012.126]+[.811.090]=.00604+.00147+.07297=0.08047=8.047%. c. It is straightforward to derive the projected value-relevant dividends for Walmart for Years +1 through +5 using the projected comprehensive income and equity amounts. The projections included no other comprehensive income items and no stock issues or repurchases. So the only items affecting common shareholders' equity are comprehensive income (which equals net income) minus dividends. Therefore, dividends can be determined using clean surplus as follows: Dt=CIt+BVt1BVt Projected dividend amounts are as follows (amounts in millions): Comprehensive Income + Begin. Book Value - Ending Book Value = Dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts