Question: Using the formulas in Table 4.1 and the data in your companys latest financial statements, calculate the following measures of financial performance for your company:

Using the formulas in Table 4.1 and the data in your company’s latest financial statements, calculate the following measures of financial performance for your company:

a. Operating profit margin

b. Total return on total assets

c. Current ratio

d. Working capital

e. Long-term debt-to-capital ratio

f. Price-to-earnings ratio

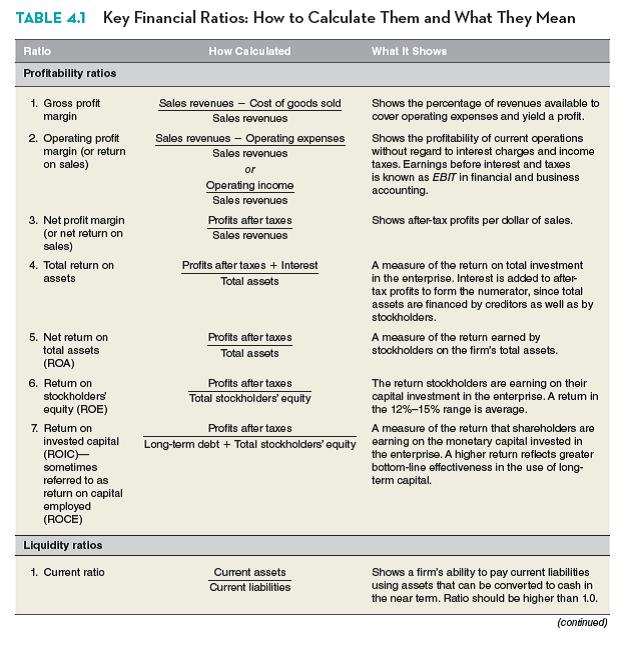

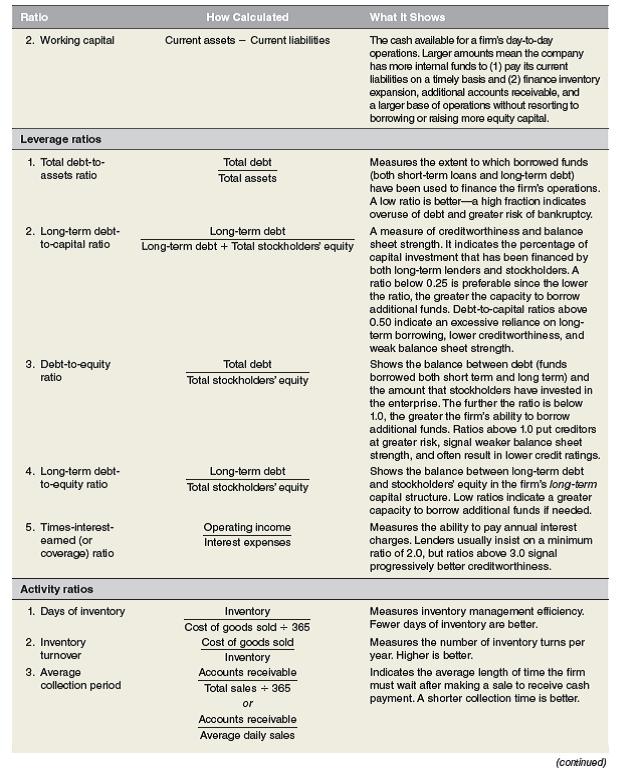

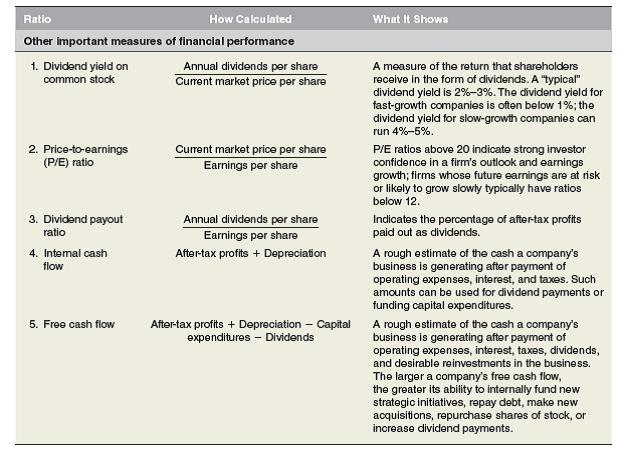

TABLE 4.1 Key Financial Ratios: How to Calculate Them and What They Mean Ratio How Calcu lated What It Shows Profitability ratios 1. Gross profit Sales revenues - Cost of goods sold Shows the percentage of revenues available to cover operating expenses and yield a profit. margin Sales revenues Sales revenues - Operating expenses 2. Operating profit margin (or return on sales) Shows the profitability of current operations without regard to interest charges and income taxes. Earnings before interest and taxes is known as EBIT in financial and business accounting. Sales rovenues or Operating income Sales revenuos 3. Net profit margin (or net return on sales) Profits after taxes Shows after-tax profits per dollar of sales. Sales revenues 4. Total return on Profits after taxes + Interest A measure of the return on total investment assets in the enterprise. Interest is added to after tax profits to form the numerator, since total assets are financed by creditors as well as by stockholders. Total assets 5. Net retum on Profits after taxes A measure of the return earned by stocokholders on the firm's total assets. Total assets total assets (ROA) Profits aftor taxes Total stockholders' oquity The return stookholders aro earning on their capital investment in the enterprise. A retum in the 12%-15% range is average. 6. Retum on stockholders equity (ROE) 7. Retum on invested capital (ROIC)- Profits after taxes A measure of the return that shareholders are Long-term debt + Total stockholders' equity earning on the monetary capital invested in the enterprise. A higher return reflects greater bottom-line offectiveness in the use of long- term capital. sometimes referred to as return on capital employed (ROCE) Liquidity ratios 1. Current ratio Current assets Shows a firm's ability to pay current liabilities using assets that can be converted to cash in the near tem. Ratio should be higher than 1.0. Current liabilitios (continued)

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Solution Company chosen for the study The company chosen for the study is an eme... View full answer

Get step-by-step solutions from verified subject matter experts