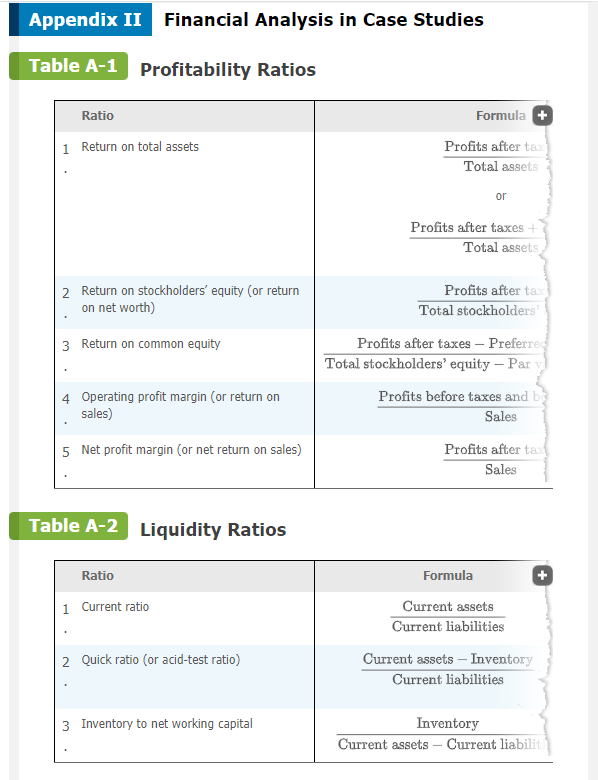

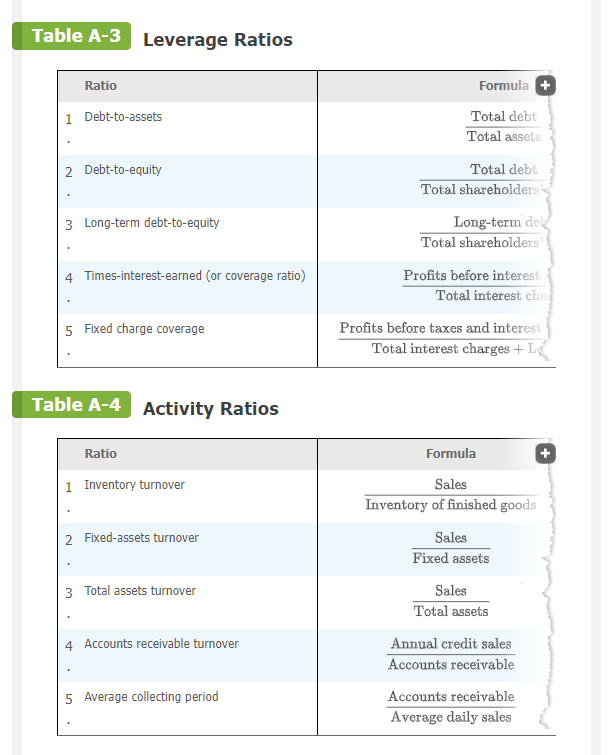

Question: Using the formulas listed below, calculate at least one ratio from each of the five categories (financial ratios, including profitability, liquidity, leverage, activity, and shareholders'

Using the formulas listed below, calculate at least one ratio from each of the five categories (financial ratios, including profitability, liquidity, leverage, activity, and shareholders' return), though you may apply as many of the ratios for which you can find the required information in the firm's financial reports. On your calculations page, specify for which formulas you are solving for the selected company HomeGoods.

- Determine which of the ratios provide the most key insights into the firm's current level of performance and provide the ratio calculations. How can you assess whether the results of your calculations are positive or negative? Explain which of the ratios give you reason to be concerned with the organization's current strategy and why.

- The Organizational and Operational Plans assignment references the possible benefits and risks of forming a strategic alliance. What would be the risks of forming a strategic alliance in terms of the firm's profitability ratios? Which of those five ratios is most likely to reveal immediate information for analysis of the alliance's effectiveness?

- Considering today's financial climate, how likely is it that the organization could acquire the capital necessary to support an aggressive value-enhancement strategy? From where would that capital originate? Compared to current interest rates, what do you believe is a realistic interest rate the firm might incur? Which of the liquidity ratios will be impacted by the influx of capital, if borrowed?

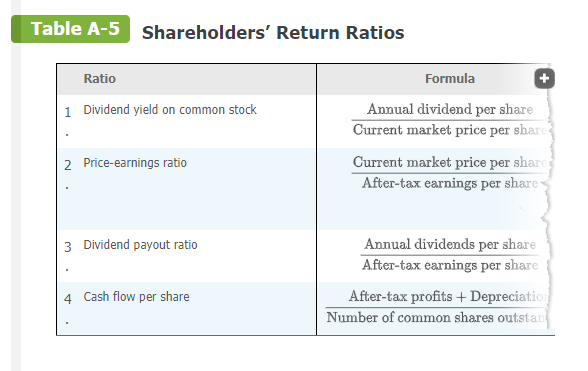

CLC- Organizational and Operations Plan HomeGoods, A TJX company is a discounted retail store that sells name brand products for less. This company creates value for customers by giving them trendy and unique products that can't be found at other stores. HomeGoods has grown in popularity, increased its suppliers, and has become a well-known discounted store in the U.S. and abroad. This company has learned to make strategies and decisions that will create value and a competitive advantage for themselves. This paper will go over how they have created value for themselves through competitive advantage, strategic alliance, partnerships, business level cooperative strategies and organizational/operational structure. Organizational and Operational Structure: Benefits and Challenges Organizational structure defines the hierarchy within an organization. "It specifies the firm's formal reporting relationships, procedures, controls, authority and decision-making processes" (Hitt et al 2017). The corporate governance of an organization provides the framework for attaining the company's objectives. It specifies the set of rules, controls, and policies to direct corporate behavior at all levels; from the Board, to the CEO, and all the way to each employee. The TJX Companies operate under a divisional multidivisional (M-form) structure, which structures its leadership team based on the products, projects, or subsidiaries they operate. Within TJX, the HomeGoods chain has its own Group President in John Ricciuti. Both Carol Meyrowitz, Chairman of the Board, and Ernie Herrman, CEO of The TJX Companies (TJX.com) were promoted from within the company (businesswire.com), as thecompany's record of internal promotion proves to be a strong attribute to their organizational structure. Essentially, "having an organizational structure in place allows companies to remain efficient and focused" (Investopedia.com). HomeGoods track record supports this assessment. It appears there is no impedance of the firm's success that could be contributed to their operational system. HomeGoods is a solid division within The TJX Companies, which states in its annual report (2022) as "the leading off-price apparel and home fashions retailer in the United States and worldwide". Strategic Alliance: Benefits and Risks The benefit of a strategic alliance is to gain competitive advantage. Two main points of joining an alliance is gaining value that couldn't be gained by a company acting alone and companies lacking the full set of resources needed to establish all opportunities. TJX Company came out with a credit card that gives rewards for every purchase. This credit card was created with a partnership with Synchrony Bank and TJX Company. Risks include a firm acting a certain way where its partner thinks is opportunistic and when a firm misleads the resources it can offer to the partnership. For a partnership not to lead to opportunism, the firms must know clearly and exactly what a firm wants from each other. For no misleading to occur, a firm should "ask the partner to provide evidence that it does, in fact, possess the resources (even when they are largely intangible) it will share in the cooperative strategy (Hitt et al, 2017).Business Level Cooperative Strategies Due to heavy competition, one may nd it challenging to maintain market power. l'u'Iarl-zet power might be reduced due to improved competition norms. Market power might be reduced due to enhanced competition norms when utilizing a cooperative technique. The concept of mutual forbearance refers to conditions in which rms do not engage in aggressive behavior with competitors across several markets- Ioint ventures and strategic alliances might be formed when resources are not available for proper competition while seeking a competitive advantage. These resources are then viewed as complementary- The four BusinessLevel Cooperative Strategies include competitionreducing. uncertainty- reducing, competitive response, and complementary strategic alliances. Homegoods has beneted from and will continue to prot from strategic relationships. For years: HomeGoods has established these collaborations at the heart ofHomeGoods' commercial plans. These alliances take different forms, such as the collaboration with TJ'Max that enabled the usage of their location and its wellknown brand. There is also product development and information sharing. Understanding consumer behavior is incredibly valuable since the}.r allow HomeGoods to expand and improve in all areas. Due to HomeGoods experience and competency with these alliances, risk has not been a problem. However, there is a risk of expansion, from brick-and- mortar sales to online sales. Internal Governance Mechanisms: Decision Making Internal governance is the process by which an organization regulates and directs authority inside itself. Another way to look at it is that if we let corporate leaders do anything they want, conflict will follow. Oversight and audits are the most effective ways to curb this tendency and have leaders and managers make better decisions for a company via internal governance. Oversight bodies give information, manage disagreement, and ensure that a corporation is meeting the needs of its stakeholders. An auditor can check that systems are operational, people are functioning efficiently, figures are properly reported, and managers are working in the best interests of their staff. These two internal governance collaborate to ensure that corporations are continually striving for the ideal and are transparent and honest with their stakeholders. More precisely, when managers are audited, they are exposed to criticism that they may not have gotten from subordinates or even supervisors. This will also help a corporation to determine how well a specific executive handles being audited. A corporation must constantly be able to expand and advance in their industry. If CEOs are hesitant to accept feedback or are unable to fulfilltheir tasks adequately, this may generate future problems or serve to conceal current problems in a company. Through auditing and oversight, a manager can begin to observe how their decisions are influencing the organization and either grow or decrease their positive and/or negative habits and deficiencies. Strategy and Structure: Reciprocal Relationship Value creation at HomeGoods can be traced back to the company's competitive advantage, strategic alliances, partnerships, business-level cooperative strategies, and organizational operational structure, demonstrating the symbiotic nature of strategy and structure. HomeGoods' performance and competitive advantage have both increased thanks to the company's successful adjustment of these factors.As a result of its competitive advantage, strategic alliance, partnerships, business-level cooperation tactics, and organizational and operational structure, HomeGoods has been able to produce value for itself. It differentiates itself from rivals in the market by stocking goods that are both on-trend and one-of-a-kind. Because of this, HomeGoods has been able to rise in popularity and become a recognized bargain retailer in the United States and around the world.By joining forces with TJMax, HomeGoods has gained access to TJMax's storefronts and name recognition. Due to their collaboration with Synchrony Bank, they are now able to issue a rewards credit card to their customers. Further, it has been able to extend its operations and gain a deeper understanding of consumer behavior because of its cooperative initiatives at the corporate level. Ultimately. HomeGoods has succeeded because of its well-organized business operations. The company's management is organized into divisions and multi divisions (M-form) depending on the different lines of business, or "divisions," they oversee. Because of this. HomeGoods is able to make choices that will ultimately benefit the firm financially and give it a leg up in the marketplace. Conclusion HomeGoods companies organizational and operational structure helps with dividing duties among employees and having the company in order for success. This company has also been able to have a strategic alliance which benefits them and their partners. Having strategies has helped this company with competitive advantage, growth, consistency, and happy customers. HomeGoods has become a successful business because they listen to customer demand and follow procedures that will ensure success.Appendix II Financial Analysis in Case Studies Table A-1 Profitability Ratios Ratio Formula + 1 Return on total assets Profits after tax Total assets or Profits after taxes Total assets 2 Return on stockholders' equity (or return Profits after tax on net worth) Total stockholders' 3 Return on common equity Profits after taxes - Preferred Total stockholders' equity - Par 4 Operating profit margin (or return on Profits before taxes and b sales) Sales 5 Net profit margin (or net return on sales) Profits after tax Sales Table A-2 Liquidity Ratios Ratio Formula 1 Current ratio Current assets Current liabilities 2 Quick ratio (or acid-test ratio) Current assets - Inventory Current liabilities 3 Inventory to net working capital Inventory Current assets - Current liabilitiTable A-3 Leverage Ratios Ratio Formula + 1 Debt-to-assets Total debt Total assets 2 Debt-to-equity Total debt Total shareholders 3 Long-term debt-to-equity Long-term dek Total shareholders Times-interest-earned (or coverage ratio) Profits before interest Total interest cha 5 Fixed charge coverage Profits before taxes and interest Total interest charges + Le Table A-4 Activity Ratios Ratio Formula 1 Inventory turnover Sales Inventory of finished goods 2 Fixed-assets turnover Sales Fixed assets 3 Total assets turnover Sales Total assets 4 Accounts receivable turnover Annual credit sales Accounts receivable 5 Average collecting period Accounts receivable Average daily salesTable A-5 Shareholders' Return Ratios Ratio Formula + 1 Dividend yield on common stock Annual dividend per share Current market price per share 2 Price-earnings ratio Current market price per share After-tax earnings per share 3 Dividend payout ratio Annual dividends per share After-tax earnings per share 4 Cash flow per share After-tax profits + Depreciation Number of common shares outstan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts