Question: using the formulas. stated of the same as for last year d. How many books must JWG sell this year to achieve the breakeven point

using the formulas.

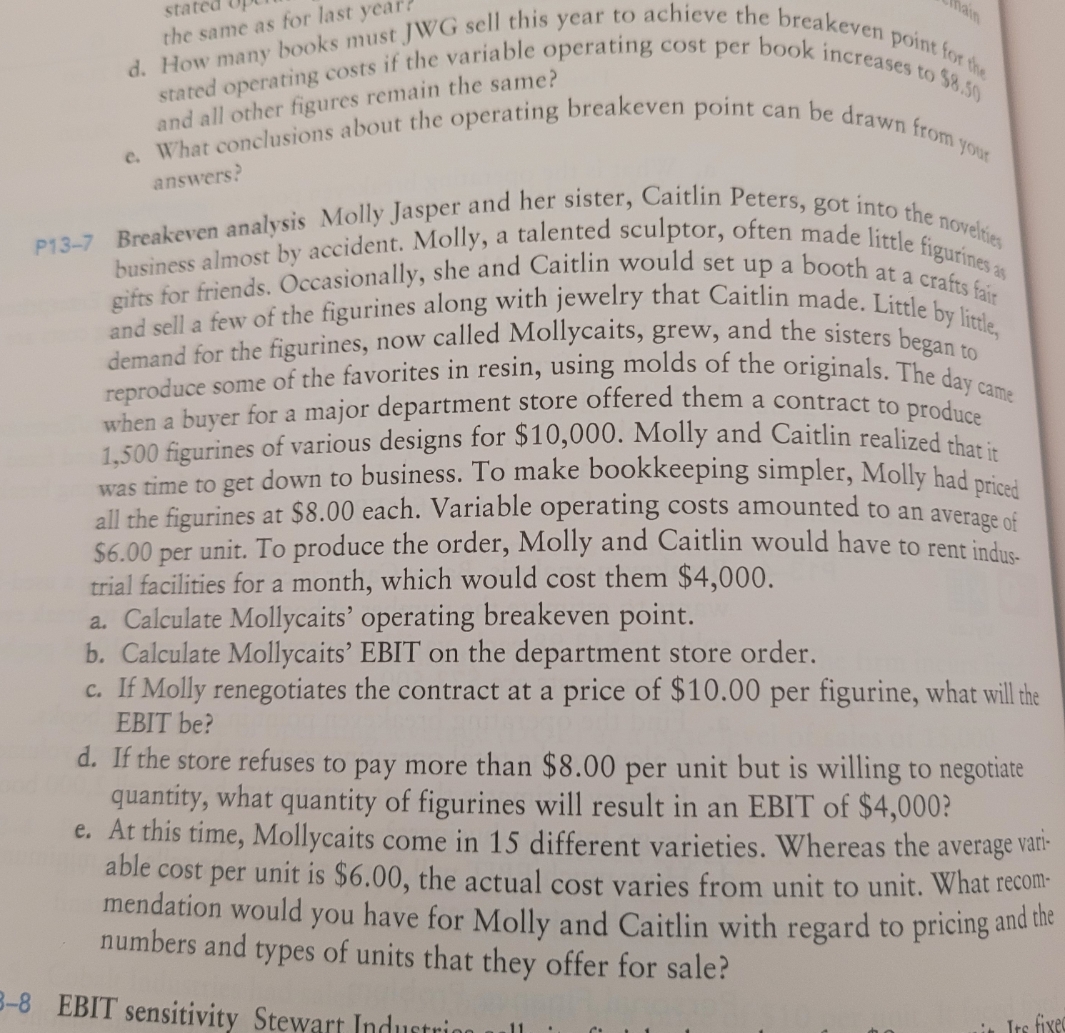

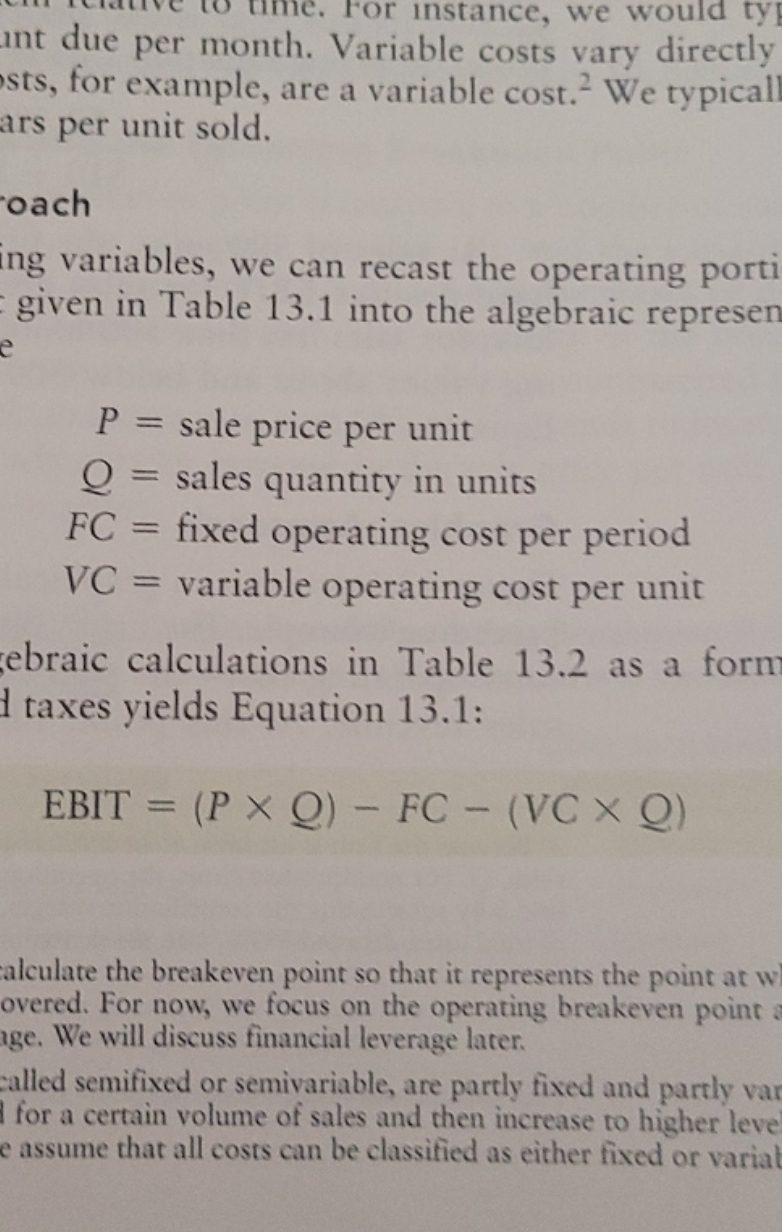

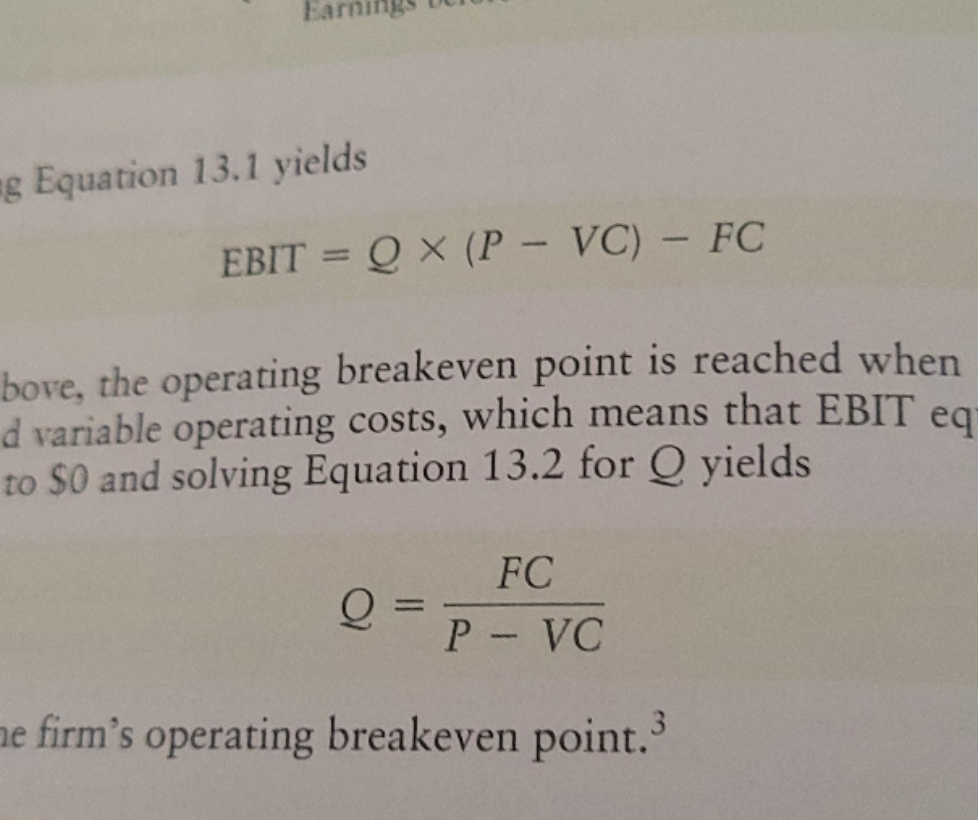

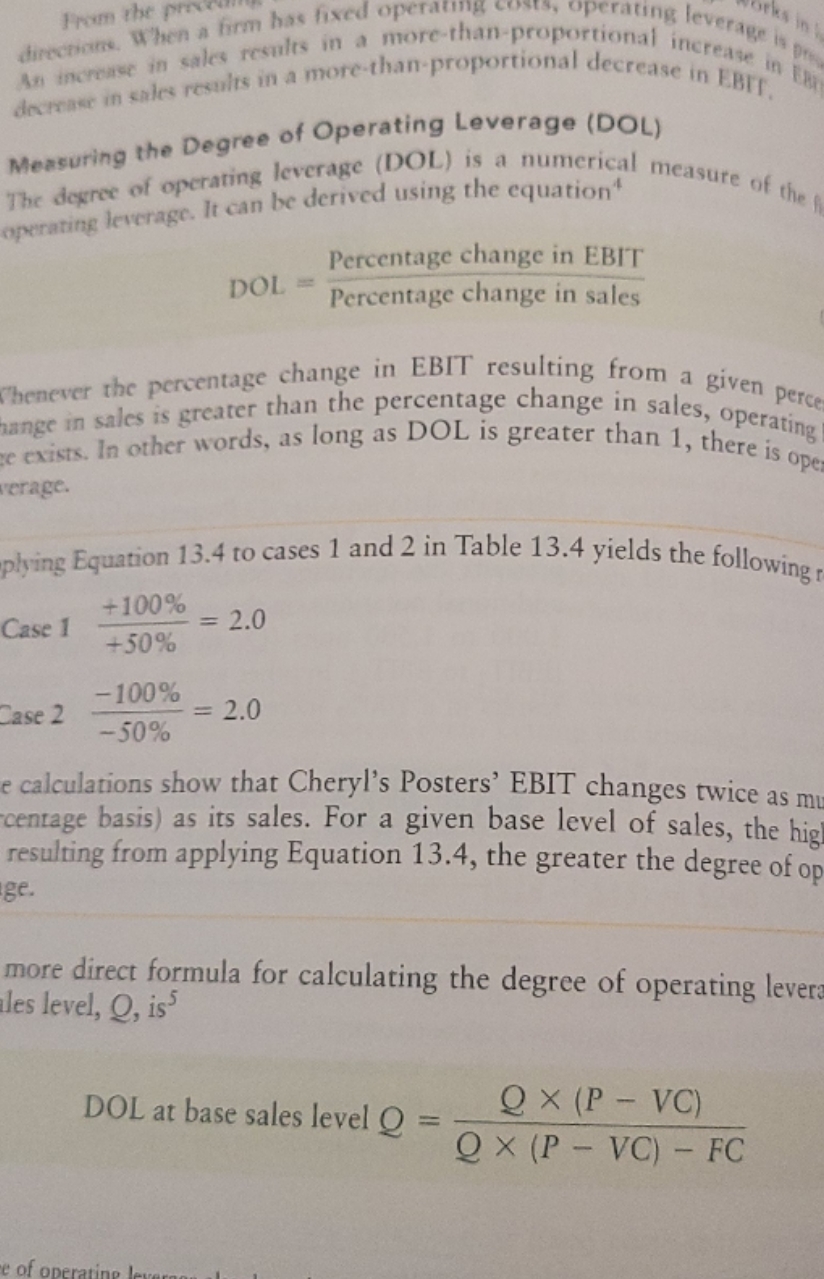

stated of the same as for last year d. How many books must JWG sell this year to achieve the breakeven point for the stated operating costs if the variable operating cost per book increases to $8.50 and all other figures remain the same? e. What conclusions about the operating breakeven point can be drawn from your answers? P13-7 Breakeven analysis Molly Jasper and her sister, Caitlin Peters, got into the novelties business almost by accident. Molly, a talented sculptor, often made little figurines a gifts for friends. Occasionally, she and Caitlin would set up a booth at a crafts fair and sell a few of the figurines along with jewelry that Caitlin made. Little by little, demand for the figurines, now called Mollycaits, grew, and the sisters began to reproduce some of the favorites in resin, using molds of the originals. The day came when a buyer for a major department store offered them a contract to produce 1,500 figurines of various designs for $10,000. Molly and Caitlin realized that it was time to get down to business. To make bookkeeping simpler, Molly had priced all the figurines at $8.00 each. Variable operating costs amounted to an average of $6.00 per unit. To produce the order, Molly and Caitlin would have to rent indus- trial facilities for a month, which would cost them $4,000. a. Calculate Mollycaits' operating breakeven point. b. Calculate Mollycaits' EBIT on the department store order. c. If Molly renegotiates the contract at a price of $10.00 per figurine, what will the EBIT be? d. If the store refuses to pay more than $8.00 per unit but is willing to negotiate quantity, what quantity of figurines will result in an EBIT of $4,000? e. At this time, Mollycaits come in 15 different varieties. Whereas the average vari- able cost per unit is $6.00, the actual cost varies from unit to unit. What recom- mendation would you have for Molly and Caitlin with regard to pricing and the numbers and types of units that they offer for sale? -8 EBIT sensitivity Stewart Intime. For instance, we would ty ant due per month. Variable costs vary directly sts, for example, are a variable cost. We typicall ars per unit sold. oach ng variables, we can recast the operating port given in Table 13.1 into the algebraic represen P = sale price per unit Q = sales quantity in units FC = fixed operating cost per period VC = variable operating cost per unit ebraic calculations in Table 13.2 as a form I taxes yields Equation 13.1: EBIT = (P X Q) - FC - (VC X Q) calculate the breakeven point so that it represents the point at w overed. For now, we focus on the operating breakeven point age. We will discuss financial leverage later. called semifixed or semivariable, are partly fixed and partly var for a certain volume of sales and then increase to higher leve e assume that all costs can be classified as either fixed or variatEarnings g Equation 13.1 yields EBIT = Q X (P - VC) - FC bove, the operating breakeven point is reached when d variable operating costs, which means that EBIT eq to $0 and solving Equation 13.2 for Q yields FC Q = P - VC e firm's operating breakeven point.From the proved directions. When a firm has fixed operating costs, operating leverage An Increase in sales results in a more-than proportional increase in decrease in sales results in a more-than-proportional decrease in EBIT Measuring the Degree of Operating Leverage (DOL) The degree of operating leverage (DOL) is a numerical measure of the operating leverage. It can be derived using the equation Percentage change in EBIT DOL = Percentage change in sales Thenever the percentage change in EBIT resulting from a given perce ange in sales is greater than the percentage change in sales, operating e exists. In other words, as long as DOL is greater than 1, there is ope verage. plying Equation 13.4 to cases 1 and 2 in Table 13.4 yields the following +100% Case 1 = 2.0 +50% -100% Case 2 = 2.0 -50% e calculations show that Cheryl's Posters' EBIT changes twice as mu centage basis) as its sales. For a given base level of sales, the high resulting from applying Equation 13.4, the greater the degree of op ge. more direct formula for calculating the degree of operating lever iles level, O, iss DOL at base sales level Q = Q X (P - VC) Q X (P - VC) - FC