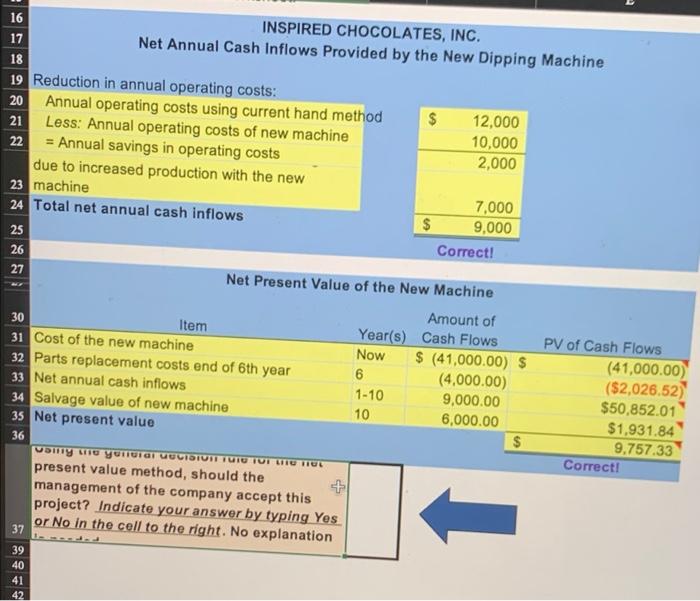

Question: using the general decision rule for the net present value method, should the management accept this project? 16 INSPIRED CHOCOLATES, INC. 17 Net Annual Cash

16 INSPIRED CHOCOLATES, INC. 17 Net Annual Cash Inflows Provided by the New Dipping Machine 18 19 Reduction in annual operating costs: 20 Annual operating costs using current hand method $ 12,000 21 Less: Annual operating costs of new machine 10,000 22 = Annual savings in operating costs 2,000 due to increased production with the new 23 machine 7,000 24 Total net annual cash inflows $ 9,000 25 Correct! 26 27 Net Present Value of the New Machine Amount of 30 Year(s) Cash Flows PV of Cash Flows 31 Cost of the new machine Now $ (41,000.00) $ 32 Parts replacement costs end of 6th year (41,000.00) 6 (4,000.00) 33 Net annual cash inflows ($2,026.52) 1-10 9,000.00 34 Salvage value of new machine $50,852.01 10 6,000.00 35 Net present value $1,931.84 $ 9.757.33 36 VOIT TO YOGI LUCIDIUTI TUI TUI UTU TOE Correct! present value method, should the management of the company accept this project? Indicate your answer by typing Yes or No in the cell to the right. No explanation 37 Item 39 40 41 42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts