Question: Using the general ledger account information provided assumes necessary adjusting entries have been prepared and included in all transactions for April 20X1, the first

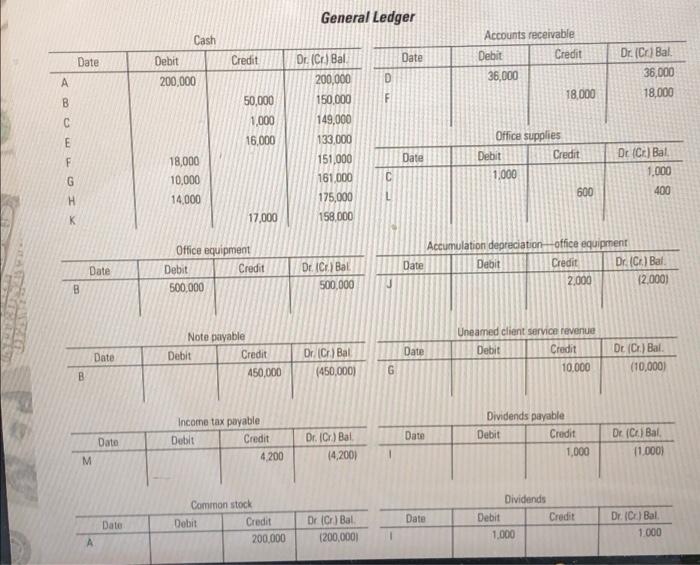

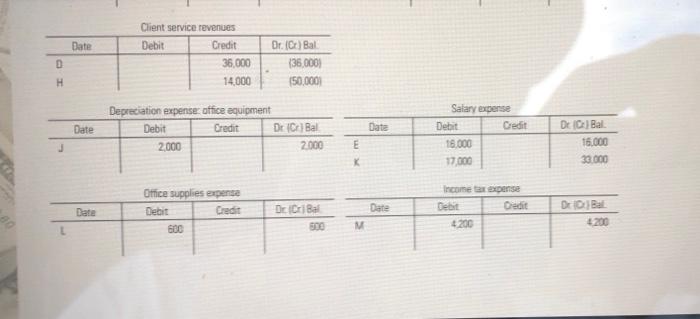

Using the general ledger account information provided assumes necessary adjusting entries have been prepared and included in all transactions for April 20X1, the first month of operations, prepare an adjusted trial balance for Davis Designs, Ine as of April 30, 20X1. which General Ledger Accounts receivable Cash Credit Dr. (Cr) Bl. Date Debit Credit Dr. (Cr) Bal. Date Debit 200,000 36,000 36,000 200,000 50,000 150,000 F 18,000 18,000 B. 1,000 149,000 16,000 133,000 Office supplies Debit Credit Dr (Cr) Bal. 18,000 151,000 Date 1,000 1,000 10,000 161,000 600 400 14,000 175,000 K 17.000 158.000 Office equipment Credit Accumulation depreciationoffice equipmentr Dr. (Cr) Bal Dr ICt ) Bal. S0000 Date Debit Credit Date Debit 2,000 (2,000) B. 500,000 Uneamed client service revenue Note payable Dr. (Cr) Bal Date Debit Credit Dr (Cr.) Bal. Date Debit Credit 450,000 (450,000) G 10.000 (10,000) Dividends payable Income tax payable Dr. (Cr) Bal. Credit Dr. (Cr) Bl. Date Debit Credit Date Debit 4,200 (4,200) 1,000 (1.000) M Dividends Common stock Credit Dr (Cr) Bal. Date Debit Credit Dr. (C) Bal. Date Debit 200,000 (200,000) 1,000 1.000 A. Client service revenues Date Debit Credit Dr. (C) Bal 36,000 (36,000) H. 14,000 (50,0001 Salary expense Depreciation expense: office equipment Credit Date Debit Dr (Cr) Bal Date Debit Credit Dr C) Bal. 2,000 2.000 16.000 16,000 17,000 33,000 Income tax expense Office supplies expense D D Bal Dr Cri Bal 600 Debit Credit Date Debit Credit Date 4200 4.200 600

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Adjusted trial balance as of April 30 202x cash 158000 account receivables 18000 office ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

625d5660c912e_april18.xlsx

300 KBs Excel File