Question: using the GIVEN format can someone help me solve/fix this problem, thanks! all the information I was given Leach Inc, experienced the following events for

using the GIVEN format can someone help me solve/fix this problem, thanks!

all the information I was given

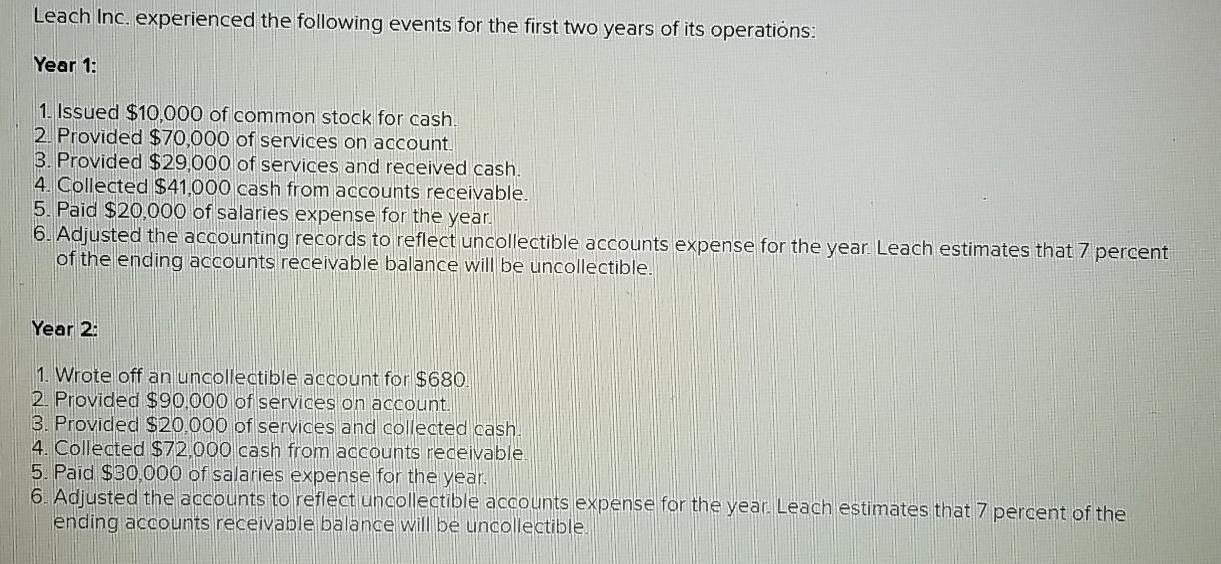

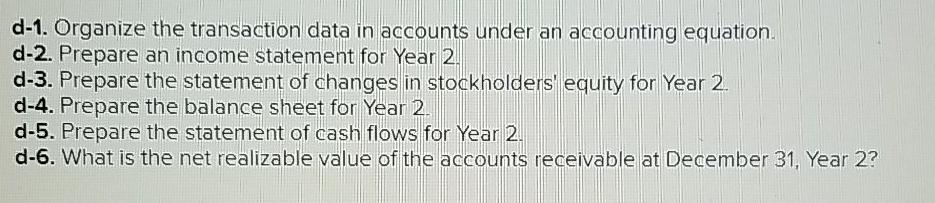

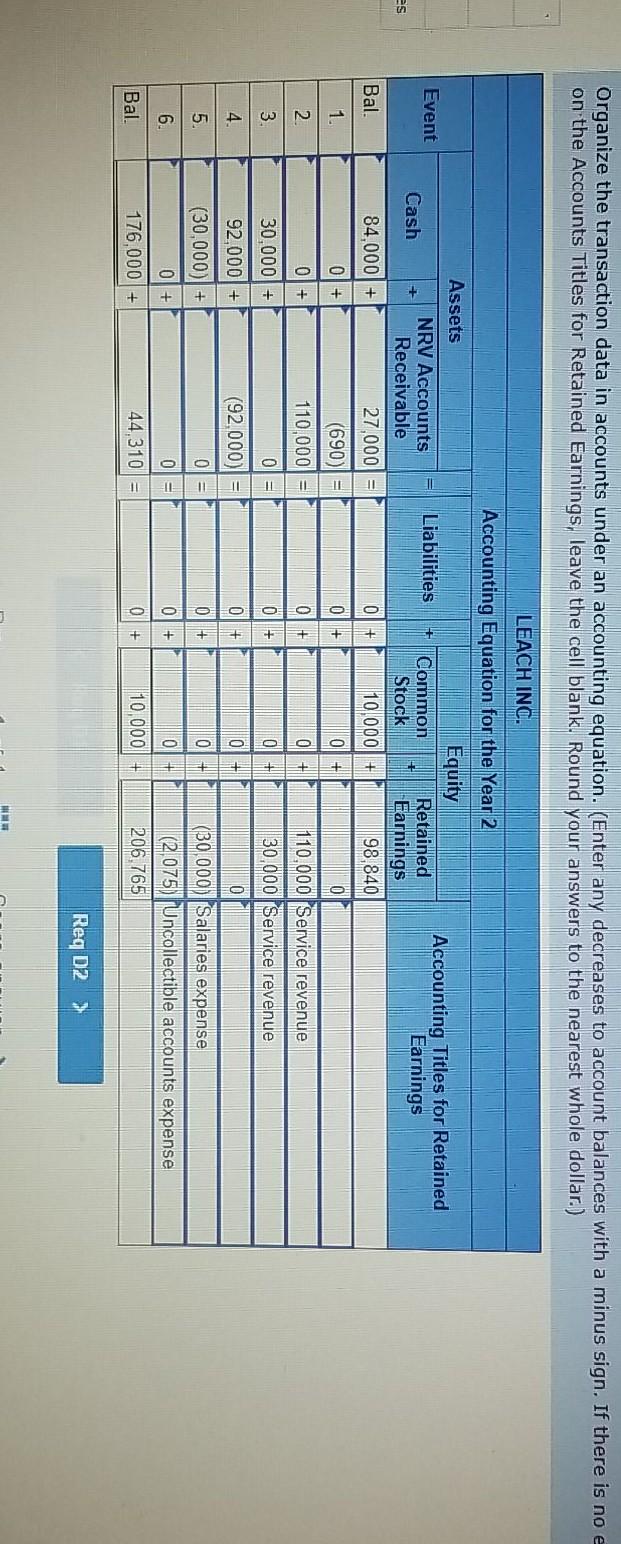

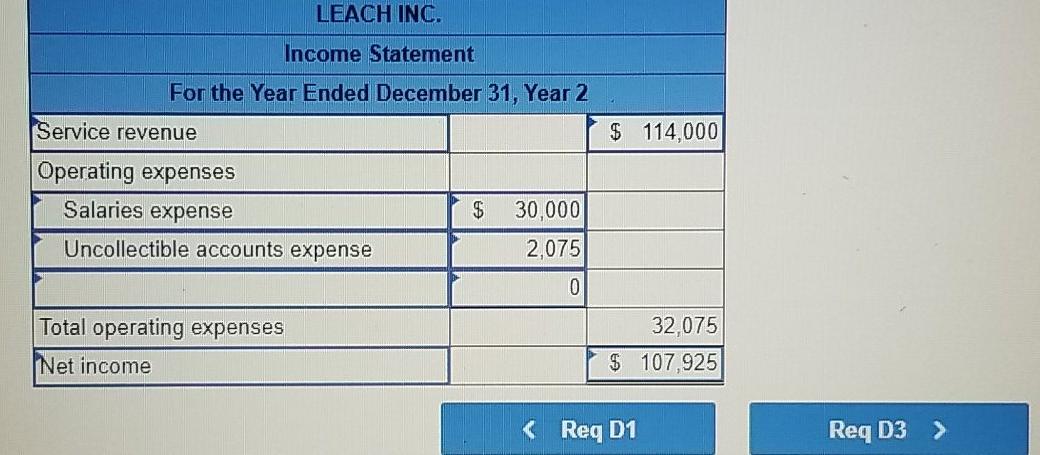

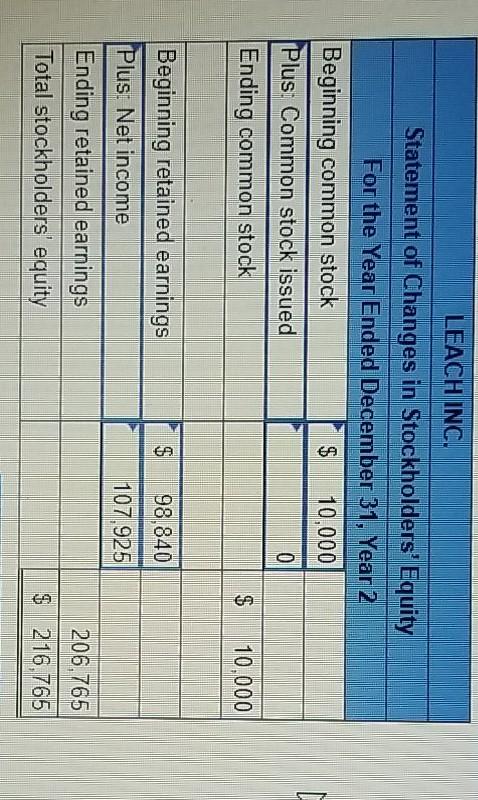

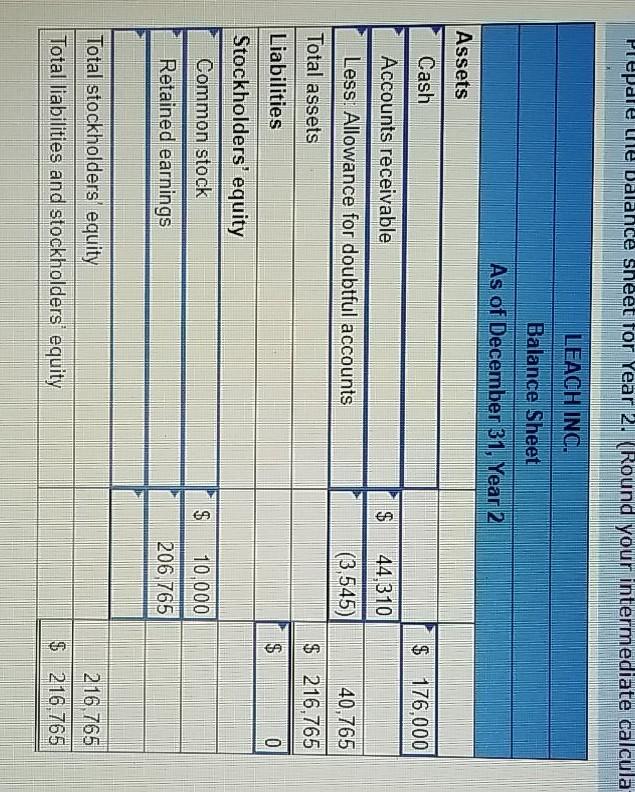

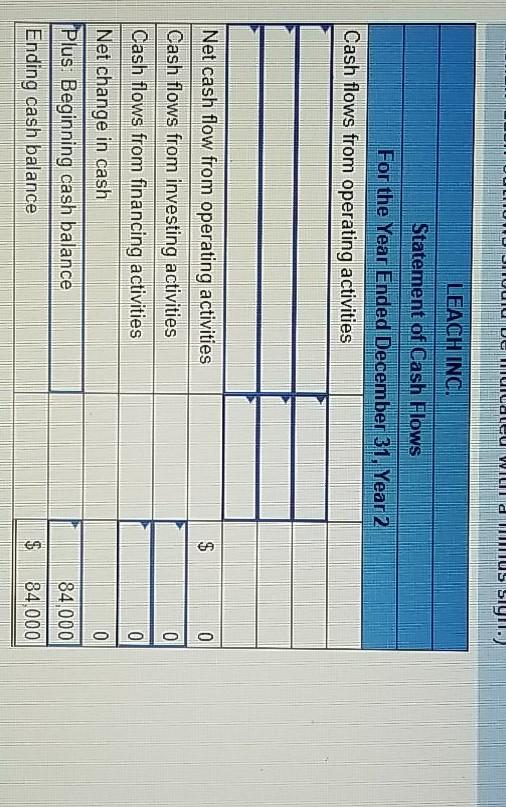

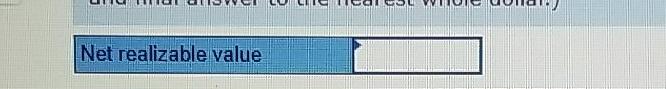

Leach Inc, experienced the following events for the first two years of its operations: Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $70,000 of services on account. 3. Provided $29,000 of services and received cash. 4. Collected $41,000 cash from accounts receivable. 5. Paid $20,000 of salaries expense for the year 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 7 percent of the ending accounts receivable balance will be uncollectible. Year 2: 1. Wrote off an uncollectible account for $680. 2. Provided $90,000 of services on account. 3. Provided $20,000 of services and collected cash. 4. Collected $72,000 cash from accounts receivable 5. Paid $30,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 7 percent of the ending accounts receivable balance will be uncollectible. d-1. Organize the transaction data in accounts under an accounting equation. d-2. Prepare an income statement for Year 2. d-3. Prepare the statement of changes in stockholders' equity for Year 2 d-4. Prepare the balance sheet for Year 2 d-5. Prepare the statement of cash flows for Year 2. d-6. What is the net realizable value of the accounts receivable at December 31, Year 2? Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no e on the Accounts Titles for Retained Earnings, leave the cell blank. Round your answers to the nearest whole dollar.) LEACH INC. Accounting Equation for the Year 2 Equity Liabilities Common Retained Stock Earnings 0 + 10 000 + 98 840 Event Assets NRV Accounts Cash Receivable 84,000 + 27,000 Accounting Titles for Retained Earnings + es Bal. 1 01 + (690) = OT + 0 2 0 + 110,000 01 + 3. 0 O + Ol + +++ FARE 110.000 Service revenue 30,000 Service revenue 0 30.000+ 92.000 + (30,000)| + 4 (92000) O + 0 1 5. 0 01 + 0 6. 0 + 0 0 + (30,000) Salaries expense (2 075) Uncollectible accounts expense 206.765 Bal. 176,000 + 44,310 0 + 10,000 + Req D2 > LEACH INC. Income Statement For the Year Ended December 31, Year 2 Service revenue $ 114,000 Operating expenses Salaries expense Uncollectible accounts expense $ 30,000 2,075 0 Total operating expenses Net income 32,075 $ 107,925 LEACH INC. Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 2 Beginning common stock $ 10,000 Plus: Common stock issued 0 Ending common stock 10.000 $ $ 98,840 107,925 Beginning retained earnings Plus: Net income Ending retained earnings Total stockholders' equity 206.765 $ 216.765 Prepare te balance sheet for Year 2. Round your intermediate calcula LEAGHING. Balance Sheet As of December 31, Year 2 Assets Cash $ 176,000 Accounts receivable $ 44,310 Less: Allowance for doubtful accounts (3,545) 40,765 Total assets $ 216.765 Liabilities $ 0 Stockholders' equity Common stock Retained earnings $ 10.000 206 765 216.765 Total stockholders equity Total liabilities and stockholders' equity $ 216.765 ULUUIUUGILITUuduU WILL US SIyil. LEACH ING! Statement of Cash Flows For the Year Ended December 31. Year 2 Cash flows from operating activities $ $ 0 0 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Plus: Beginning cash balance Ending cash balance 0 84.000 84 000 $ Net realizable value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts