Question: Using the Heinz Case from your Harvard Business course pack case and discussions from lecture, answer the questions below. You should download the accompanying excel

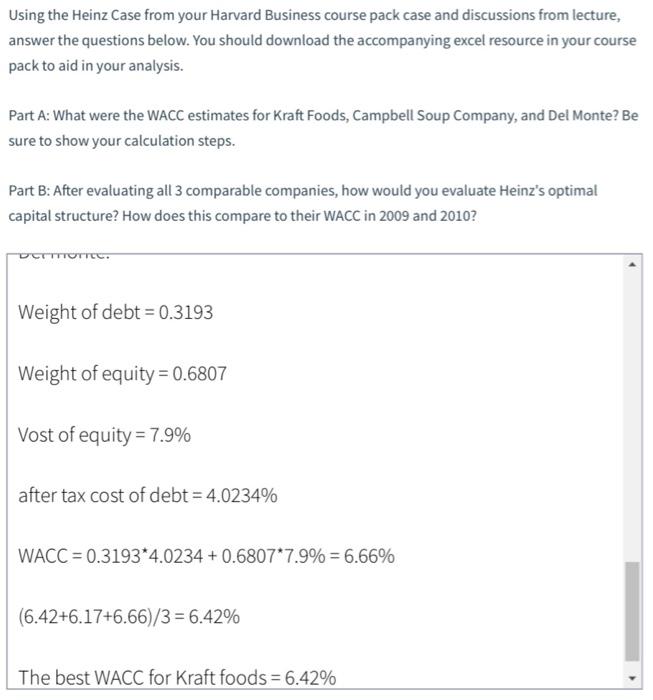

Using the Heinz Case from your Harvard Business course pack case and discussions from lecture, answer the questions below. You should download the accompanying excel resource in your course pack to aid in your analysis. Part A: What were the WACC estimates for Kraft Foods, Campbell Soup Company, and Del Monte? Be sure to show your calculation steps. Part B: After evaluating all 3 comparable companies, how would you evaluate Heinz's optimal capital structure? How does this compare to their WACC in 2009 and 2010? DETTOTIES Weight of debt = 0.3193 Weight of equity = 0.6807 Vost of equity = 7.9% after tax cost of debt = 4.0234% WACC = 0.3193-4.0234 + 0.6807*7.9% = 6.66% (6.42+6.17+6.66)/3 = 6.42% The best WACC for Kraft foods = 6.42% Using the Heinz Case from your Harvard Business course pack case and discussions from lecture, answer the questions below. You should download the accompanying excel resource in your course pack to aid in your analysis. Part A: What were the WACC estimates for Kraft Foods, Campbell Soup Company, and Del Monte? Be sure to show your calculation steps. Part B: After evaluating all 3 comparable companies, how would you evaluate Heinz's optimal capital structure? How does this compare to their WACC in 2009 and 2010? DETTOTIES Weight of debt = 0.3193 Weight of equity = 0.6807 Vost of equity = 7.9% after tax cost of debt = 4.0234% WACC = 0.3193-4.0234 + 0.6807*7.9% = 6.66% (6.42+6.17+6.66)/3 = 6.42% The best WACC for Kraft foods = 6.42%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts