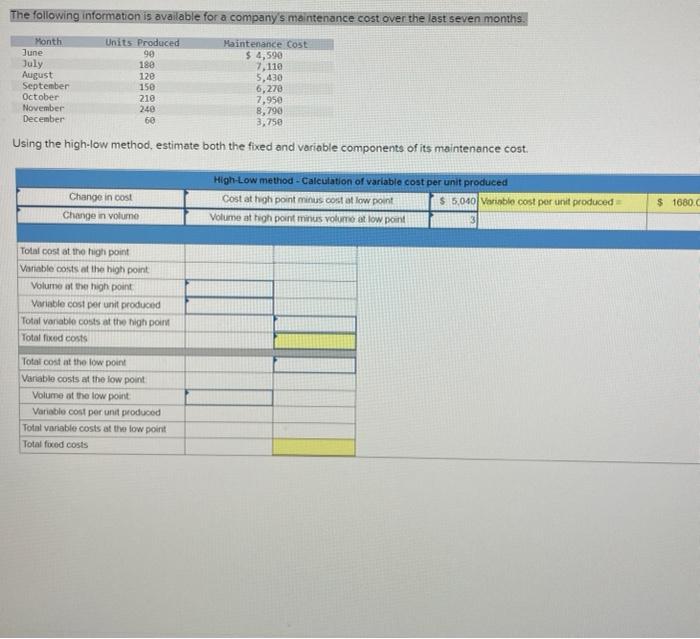

Question: Using the high-low method. estimate both the fixed and variable components of its maintenance cost The following information is available for a company's maintenance cost

The following information is available for a company's maintenance cost over the last seven months Units Produced 90 180 Month June July August September October November December 120 150 210 240 60 Maintenance cost $ 4,590 7,110 5.430 6,270 7,950 8,790 3,750 Using the high-low method, estimate both the fixed and variable components of its maintenance cost. Change in cost Charge in volume High-Low method - Calculation of variable cost per unit produced Cost at hoh point minus cost at low point $ 5,040 Variable cost per unit produced Volume at high point minus volume at low point $ 1680. Total cost at the high point Variable costs at the high point Volume at the high point Variable cost per unit produced Total vanable costs at the high point Total fixed costs Total cost at the low point Vanable costs at the low point Volume of the low point Variable cost per unit produced Total variable costs at the low point Total food costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts