Question: USING THE IFORMATION FILL OUT SCHEDULE C FORM LINE 5 IS GIVEN 1:9-72 George Large (SSN 000-11-1111) and his wife Marge Large (SSN 000-22-2222) live

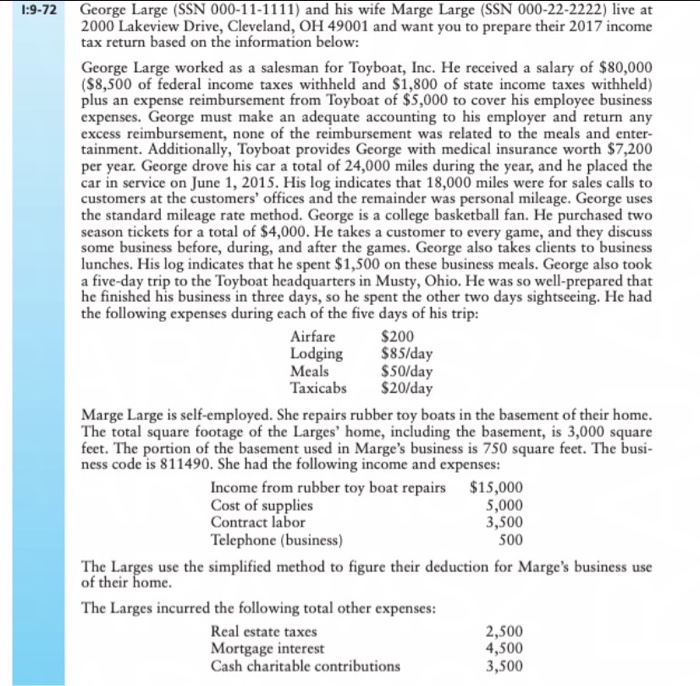

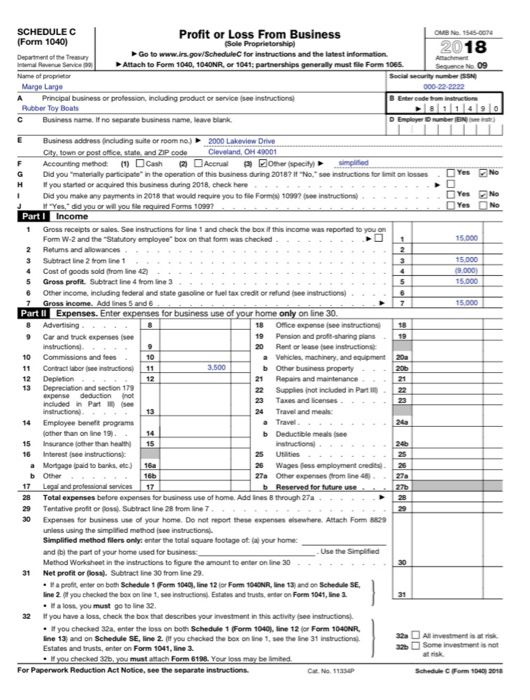

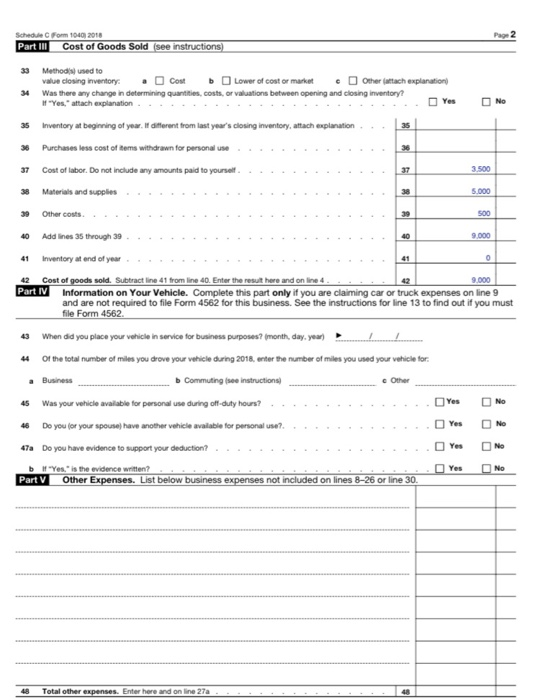

1:9-72 George Large (SSN 000-11-1111) and his wife Marge Large (SSN 000-22-2222) live at 2000 Lakeview Drive, Cleveland, OH 49001 and want you to prepare their 2017 income tax return based on the information below: George Large worked as a salesman for Toyboat, Inc. He received a salary of $80,000 ($8,500 of federal income taxes withheld and $1,800 of state income taxes withheld) plus an expense reimbursement from Toyboat of $5,000 to cover his employee business expenses. George must make an adequate accounting to his employer and return any excess reimbursement, none of the reimbursement was related to the meals and enter- tainment. Additionally, Toyboat provides George with medical insurance worth $7,200 per year. George drove his car a total of 24,000 miles during the year, and he placed the car in service on June 1, 2015. His log indicates that 18,000 miles were for sales calls to customers at the customers' offices and the remainder was personal mileage. George uses the standard mileage rate method. George is a college basketball fan. He purchased two season tickets for a total of $4,000. He takes a customer to every game, and they discuss some business before, during, and after the games. George also takes clients to business lunches. His log indicates that he spent $1,500 on these business meals. George also took a five-day trip to the Toyboat headquarters in Musty, Ohio. He was so well-prepared that he finished his business in three days, so he spent the other two days sightseeing. He had the following expenses during each of the five days of his trip: Airfare $200 Lodging $85/day Meals $50/day Taxicabs $20/day Marge Large is self-employed. She repairs rubber toy boats in the basement of their home. The total square footage of the Larges' home, including the basement, is 3,000 square feet. The portion of the basement used in Marge's business is 750 square feet. The busi- ness code is 811490. She had the following income and expenses: Income from rubber toy boat repairs $15,000 Cost of supplies 5,000 Contract labor 3,500 Telephone (business) 500 The Larges use the simplified method to figure their deduction for Marge's business use of their home. The Larges incurred the following total other expenses: Real estate taxes 2,500 Mortgage interest 4,500 Cash charitable contributions 3,500 SCHEDULEC (Form 1040) Profit or Loss From Business Sole Proprietorship Go to www.ingow/Schedule for instructions and the latest information Attach to Form 1040,104NR. 1041: partnerships generally must Form 1065 2018 Sac Marge Large A Principal bus Toy Boots or pro n ouding product or service instructions 0000 Business address including room ) 2000 Lei Drive C on poste and ZIP code Chevad, OH 01 Accounting method Cash Accrual other specify simplified Did you ma y participate in the operation of this business during 2018? No n structions for you started or uns during 2018 check here Did you make any payments in 2018 that would require you to file Form10997 instructions Yes did you w oulured Forms 10997 Part I Income 1 Gross receptor sales. See instructions for line and check the box if this income was reported to you on For W-2 and the Story employee box on that form was checked 2 Reums and allowances 3 Subtract line 2 from line 1 4 Cost of goods sold from line 2 5 Gross profit. Subtract line from line 3 6 Other income including federal and state gasoline or fuel tax creditor refund instructions) 7 Gross income Addnes 5 and 6. Part II Expenses. Enter expenses for business use of your home only on line 30 & Advertising 18 Office expenses instructions Car and truck expensesse 19 Pension and proft-sharing plans instructions 20 Rent or lease see instructions 10 Commissions and fees a Vehicles machinery and equipment 11 Contract aber se instructions b Other business property 12 Depletion 21 Repairs and maintenance 13 Depreciation and section 179 22 Supplies not included in Part expense deduction not 23 included in Part see Taxes and licenses. - - - instructions 24 Travel and me 14 Employee bent programs other an online 19 b Deductible meals 15 surance other than health 15 16 W rest instructions 25 Utilities . Mortgage pad tobakso 26 Wageses amployment credits 27a Other expenses from in 17 Legal and professional services 17 Reserved for ture Total expenses before expenses for business use of home. Add lines through 27a.. 29 Tentative profit or Subtractine 28 from line 7 30 Expenses for business of your home. Do not report these expenses were Attach Fom using the method instructions Simplified method flers only enter the total square footage ot your home and the part of your home used for business _ Use the Simplified Method Wors t in the instructions to figure the amount to enter on line 30 . . . . . . 31 Net profor Subtractine from line 29 . pro b o Schedule form 100 12 for 1NR. 13 don Schedule SE Ine2you checked the box online structions and on Form 1041, .Halos you must go to line 32 32 you have to check the box that describes your month s activity instructions you checked the b onbon Schedule 1 Form 10401 ne 12 for Form 10ANR ne 13 undon ScheduleSEine 2 yow checked the box onnets the 31structions Estates and bu o n Form 1041.inea you checked mustach Form 1. You may be limited For Paperwork Reduction Act Notice, see the separate instructions Part II Cost of Goods Sold see instructions) 33 Methods used to value closing inventory Cont Lower of cost ormar Otherwachplanation Was there any change in determining quantities, costs, or valuations between opening and closing inventory? 34 as Inventory at beginning of your rent from last year's closing inventory attach explanation Purchases less cost of them withdrawn for personal use ..... 37 Cost of labor. Do not include any amounts paid to yoursel.. 5.000 40 Addes 35 through 39 - - - - - - - - 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result there and on line 4. Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562 43 When did you place your vehicle in service for business purposes? (month day, year) .... ...... 44 of the total number of miles you drove your vehicle during 2018, enter the number of miles you used your vehicle for: Business Commuting see instructions 45 was your vehicle available for personal use during off-duty hours? - 46 Do you for your spouse have another vehicle available for personal use?. ........ .. bOOO 4Ta Do you have evidence to support your deduction - Yes "Yes" is the evidence written? Part V Other Expenses. List below business expenses not included on lines 8-26 or line 30. 1:9-72 George Large (SSN 000-11-1111) and his wife Marge Large (SSN 000-22-2222) live at 2000 Lakeview Drive, Cleveland, OH 49001 and want you to prepare their 2017 income tax return based on the information below: George Large worked as a salesman for Toyboat, Inc. He received a salary of $80,000 ($8,500 of federal income taxes withheld and $1,800 of state income taxes withheld) plus an expense reimbursement from Toyboat of $5,000 to cover his employee business expenses. George must make an adequate accounting to his employer and return any excess reimbursement, none of the reimbursement was related to the meals and enter- tainment. Additionally, Toyboat provides George with medical insurance worth $7,200 per year. George drove his car a total of 24,000 miles during the year, and he placed the car in service on June 1, 2015. His log indicates that 18,000 miles were for sales calls to customers at the customers' offices and the remainder was personal mileage. George uses the standard mileage rate method. George is a college basketball fan. He purchased two season tickets for a total of $4,000. He takes a customer to every game, and they discuss some business before, during, and after the games. George also takes clients to business lunches. His log indicates that he spent $1,500 on these business meals. George also took a five-day trip to the Toyboat headquarters in Musty, Ohio. He was so well-prepared that he finished his business in three days, so he spent the other two days sightseeing. He had the following expenses during each of the five days of his trip: Airfare $200 Lodging $85/day Meals $50/day Taxicabs $20/day Marge Large is self-employed. She repairs rubber toy boats in the basement of their home. The total square footage of the Larges' home, including the basement, is 3,000 square feet. The portion of the basement used in Marge's business is 750 square feet. The busi- ness code is 811490. She had the following income and expenses: Income from rubber toy boat repairs $15,000 Cost of supplies 5,000 Contract labor 3,500 Telephone (business) 500 The Larges use the simplified method to figure their deduction for Marge's business use of their home. The Larges incurred the following total other expenses: Real estate taxes 2,500 Mortgage interest 4,500 Cash charitable contributions 3,500 SCHEDULEC (Form 1040) Profit or Loss From Business Sole Proprietorship Go to www.ingow/Schedule for instructions and the latest information Attach to Form 1040,104NR. 1041: partnerships generally must Form 1065 2018 Sac Marge Large A Principal bus Toy Boots or pro n ouding product or service instructions 0000 Business address including room ) 2000 Lei Drive C on poste and ZIP code Chevad, OH 01 Accounting method Cash Accrual other specify simplified Did you ma y participate in the operation of this business during 2018? No n structions for you started or uns during 2018 check here Did you make any payments in 2018 that would require you to file Form10997 instructions Yes did you w oulured Forms 10997 Part I Income 1 Gross receptor sales. See instructions for line and check the box if this income was reported to you on For W-2 and the Story employee box on that form was checked 2 Reums and allowances 3 Subtract line 2 from line 1 4 Cost of goods sold from line 2 5 Gross profit. Subtract line from line 3 6 Other income including federal and state gasoline or fuel tax creditor refund instructions) 7 Gross income Addnes 5 and 6. Part II Expenses. Enter expenses for business use of your home only on line 30 & Advertising 18 Office expenses instructions Car and truck expensesse 19 Pension and proft-sharing plans instructions 20 Rent or lease see instructions 10 Commissions and fees a Vehicles machinery and equipment 11 Contract aber se instructions b Other business property 12 Depletion 21 Repairs and maintenance 13 Depreciation and section 179 22 Supplies not included in Part expense deduction not 23 included in Part see Taxes and licenses. - - - instructions 24 Travel and me 14 Employee bent programs other an online 19 b Deductible meals 15 surance other than health 15 16 W rest instructions 25 Utilities . Mortgage pad tobakso 26 Wageses amployment credits 27a Other expenses from in 17 Legal and professional services 17 Reserved for ture Total expenses before expenses for business use of home. Add lines through 27a.. 29 Tentative profit or Subtractine 28 from line 7 30 Expenses for business of your home. Do not report these expenses were Attach Fom using the method instructions Simplified method flers only enter the total square footage ot your home and the part of your home used for business _ Use the Simplified Method Wors t in the instructions to figure the amount to enter on line 30 . . . . . . 31 Net profor Subtractine from line 29 . pro b o Schedule form 100 12 for 1NR. 13 don Schedule SE Ine2you checked the box online structions and on Form 1041, .Halos you must go to line 32 32 you have to check the box that describes your month s activity instructions you checked the b onbon Schedule 1 Form 10401 ne 12 for Form 10ANR ne 13 undon ScheduleSEine 2 yow checked the box onnets the 31structions Estates and bu o n Form 1041.inea you checked mustach Form 1. You may be limited For Paperwork Reduction Act Notice, see the separate instructions Part II Cost of Goods Sold see instructions) 33 Methods used to value closing inventory Cont Lower of cost ormar Otherwachplanation Was there any change in determining quantities, costs, or valuations between opening and closing inventory? 34 as Inventory at beginning of your rent from last year's closing inventory attach explanation Purchases less cost of them withdrawn for personal use ..... 37 Cost of labor. Do not include any amounts paid to yoursel.. 5.000 40 Addes 35 through 39 - - - - - - - - 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result there and on line 4. Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562 43 When did you place your vehicle in service for business purposes? (month day, year) .... ...... 44 of the total number of miles you drove your vehicle during 2018, enter the number of miles you used your vehicle for: Business Commuting see instructions 45 was your vehicle available for personal use during off-duty hours? - 46 Do you for your spouse have another vehicle available for personal use?. ........ .. bOOO 4Ta Do you have evidence to support your deduction - Yes "Yes" is the evidence written? Part V Other Expenses. List below business expenses not included on lines 8-26 or line 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts