Question: using the income statement and balence sheet analysis the average payment period, current ratio, operating margin and cash flow to debt. show all work. Assets

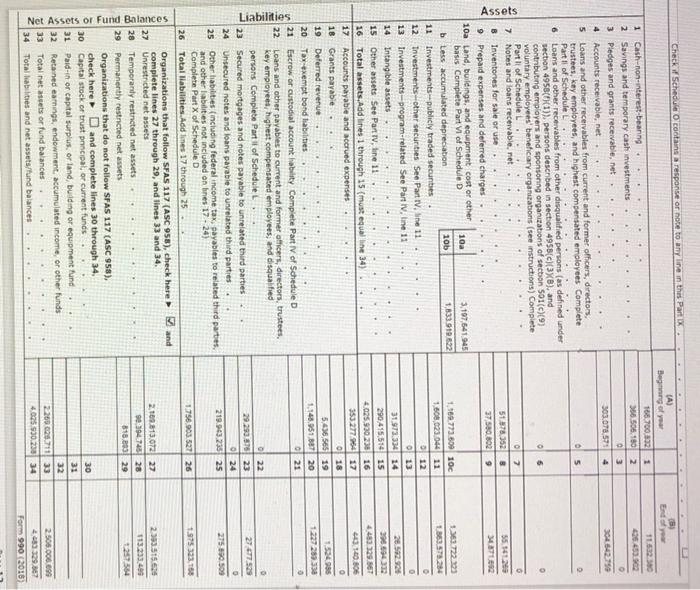

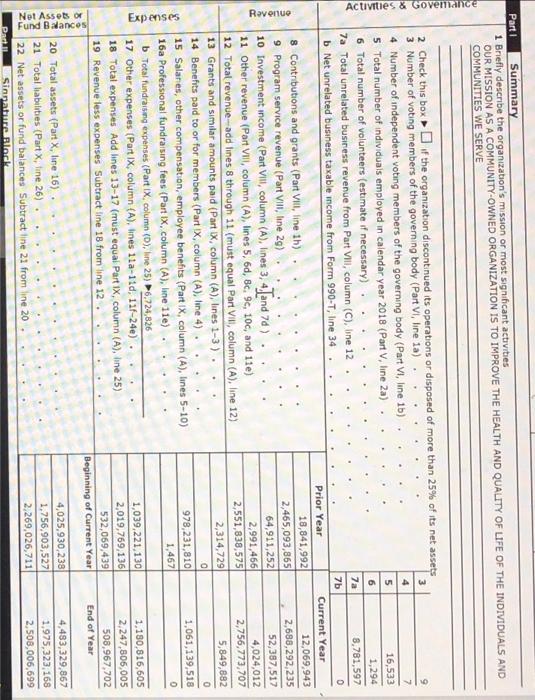

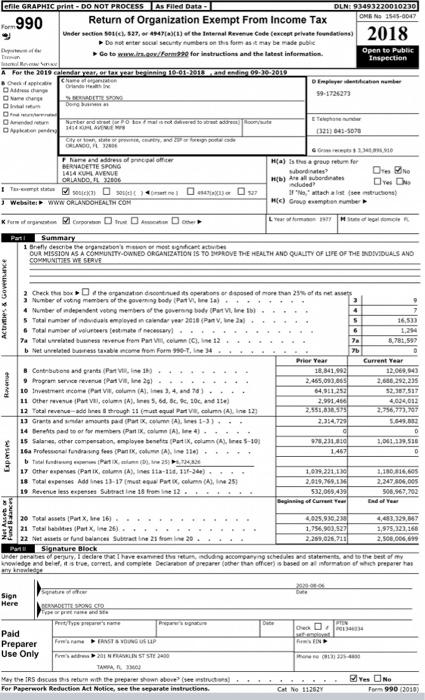

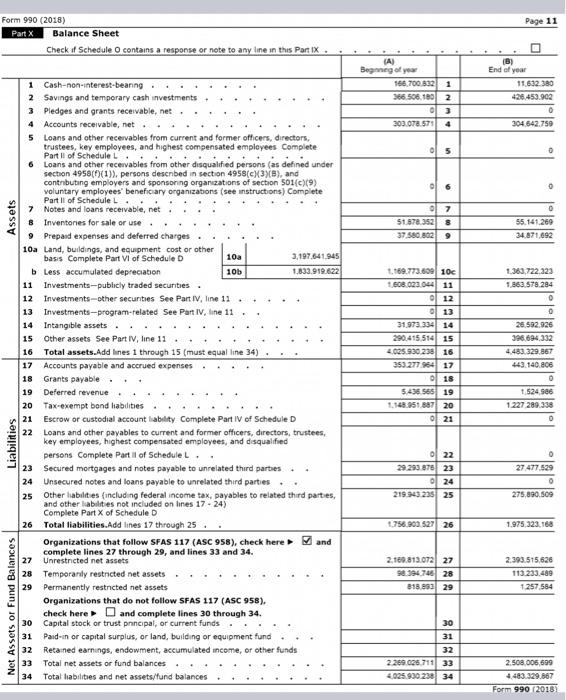

Assets Liabilities Check if Schedule O contains a response or note to any line in the Part X 1 Cash-non-interest-beaning. 2 Savings and temporary cash investments 3 Pledges and grants receivable, net 4 Accounts receivable, net 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees Complete Part I of Schedule L. 6 Loans and other receivables from other disqualified persons (as defined under section 4958((1)), persons described in section 4958(c)(3)(8), and contributing employers and sponsoring organizations of section 501(c)(9) voluntary employees' beneficiary organizations (see instructions) Complete Part It of Schedule L 7 Notes and loans receivable, net B Inventones for sale or use 9 Prepaid expenses and deferred charges 10a Land, buildings, and equipment cost or other basis Complete Part VI of Schedule D 10a 3,197,641.945 b Less accumulated depreciation 10b 1,833.919.622 Investments-publicly traded securities 12 Investments-other securities See Part IV, line 11. 13 Investments-program-related See Part IV, line 11 Intangible assets 14 15 Other assets See Part TV, line 11 16 Total assets,Add lines 1 through 15 (must equal line 34) Accounts payable and accrued expenses 17 18 Grants payable. Deferred revenue Tax-exempt bond liabilities 21 22 Escrow or custodial account hability Complete Part IV of Schedule D Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons Complete Part il of Schedule L 23 Secured mortgages and notes payable to unrelated third parties 24 Unsecured notes and loans payable to unrelated third parties 25 Other habilities (including federal income tax, payables to related third parties, and other labilities not included on bnes 17-24) Complete Part X of Schedule D 26 Total liabilities.Add lines 17 through 25 Organizations that follow SFAS 117 (ASC 958), check here and complete lines 27 through 29, and lines 33 and 34. 27 Unrestricted net assets 28 Temporanly restricted net assets 29 Permanently restricted net assets Organizations that do not follow SFAS 117 (ASC 958), check here and complete lines 30 through 34, 30 Capital stock or trust principal, or current funds 31 32 Paid-in or capital surplus, or land, building or equipment fund Retained earnings, endowment, accumulated income, or other funds Total net assets or fund balances 33 34 Total liabilities and net assets/fund balances Net Assets or Fund Balances 11 4855CE 19 20 (A) Beginning of year 166,700,832 1 366.506,180 2 0 3 303.078.571 4 05 06 o 7 B 51.878,352 37,580.802 9 1,169.773.609 10c 1,608,023,044 11 012 013 31.973.334 14 290,415,514 15 4.025.930 238 16 353.277.964 17 018 5.436.565 19 1,148.951.887 20 021 022 29.293.876 23 0 24 219.943.235 25 1.756.903.527 26 2.109.813.072 27 98.394.748 28 818.803 29 30 31 32 2.269.025.711 33 4.025.930.238 34 (8) End of year 11.632.380 304.642.759 55.141.299 34.871.002 1.363.722 323 1.863.578.284 0 0 26.592.926 296.694.332 4,483.329.867 443 140.806 1.524.986 1.227.289.338 27,477.529 275.890.509 1.975 323,168 2.383.515.625 113.233.499 1.257.564 2.506.006.099 4.483 329.867 Form 990 (2018) Activities & Govenance Ravenue Summary Part I 1 Briefly describe the organization's mission or most significant activities OUR MISSION AS A COMMUNITY-OWNED ORGANIZATION IS TO IMPROVE THE HEALTH AND QUALITY OF LIFE OF THE INDIVIDUALS AND COMMUNITIES WE SERVE 2 Check this box if the organization discontinued its operations or disposed of more than 25% of its net assets 3 Number of voting members of the governing body (Part VI, line 1a) 3 . 4 . 5 4 Number of independent voting members of the governing body (Part VI, line 1b) 5 Total number of individuals employed in calendar year 2018 (Part V, line 2a) 6 Total number of volunteers (estimate if necessary) 16,533 6 . . . 1,294 8,781,597 7a Total unrelated business revenue from Part VIII, column (C), line 12 7a A 7b 0 b Net unrelated business taxable income from Form 990-T, line 34 . Prior Year 8 Contributions and grants (Part VIII, line 1h). 12,069,943 9 Program service revenue (Part VIII, line 2g) 2,688,292,235 10 Investment income (Part Vill, column (A), lines 3, 4 and 7d) 52,387,517 11 Other revenue (Part VIII, column (A), lines 5, 6d, Bc. 9c, 10c, and 11e) 4,024,012 12 Total revenue-add lines 8 through 11 (must equal Part Vill, column (A), line 12) 2,756,773,707 5,849,882 13 Grants and similar amounts paid (Part IX, column (A), lines 1-3). . 14 Benefits paid to or for members (Part IX, column (A), line 4) 0 . 1,061,139,518 0 15 Salanes, other compensation, employee benefits (Part IX, column (A), lines 5-10) 16a Professional fundraising fees (Part IX, column (A), line 11e). b Total fundraising expenses (Part IX, column (D), line 25) 6,724,826 17 Other expenses (Part IX, column (A), lines 11a-11d, 11f-24e) 1,180,816,605 2,247,806,005 18 Total expenses Add lines 13-17 (must equal Part IX, column (A), line 25) 19 Revenue less expenses Subtract line 18 from line 12. 508,967,702 20 Total assets (Part X, line 16). 4,483,329,867 21 Total liabilities (Part X, line 26). 1,975,323,168 2,508,006,699 22 Net assets or fund balances Subtract line 21 from line 20 Part II Sinnature Block Expenses Net Assets or Fund Balances 18,841,992 2,465,093,865 64,911,252 2,991,466 2,551,838,575 2,314,729 0 978,231,810 1,467 1,039,221,130 2,019,769,136 532,069,439 Beginning of Current Year 4,025,930,238 1,756,903,527 2,269,026,711 Current Year End of Year efile GRAPHIC print - DO NOT PROCESS As Filed Data- 990 9 Tran Reven A For the 2019 calendar year, or tax year beginning 10-01-2018, and ending 09-30-2019 Check of appcnde Chame of ato D Emprecation number DA 59-1726273 Nach SADETE SPONG D Dong una d E Telephone nu Add Application de Number and street for 50 box mail is not delivered to best address)] oorste 1414 AVE (321) 041-5078 e town, state or province, country, and a foreign postal code ORLANDO, FL 3280 GG $13410 H(a) Is this a group return for Name and address of principal officer BERNADETTE SPONG 1414 KUL AVENUE ORLANDO, FL 32006 subordinates (b) Are all subordinates included IT-00) "No," attach a list (seestructions) 3. Website: www.ORLANDOHEALTH COM H(c) Group exemption number form of corporate D Parti Summary 1 Briefly describe the organization's mission of most significant activites OUR MISSION AS A COMMUNITY-OWNED ORGANIZATION IS TO IMPROVE THE HEALTH AND QUALITY OF LIFE OF THE INDIVIDUALS AND COMMUNITIES WE SERVE 2 Check this box the organization discontinued its operations or disposed of more than 25% of its net assets 3 Number of voting members of the governing body (Part V, line 1a). 3 4 Number of independent voting members of the governing body (Part V line 1b) 4 5 Total number of individuals employed in calendar year 2018 (Pan V, line 2 S 16,533 6 Total number of volunteers (estimate if necessary) 6 1,294 7a Total unrelated business revenue from Part VI, column (C), line 12 7a 8,781,597 b Net unrelated business taxable income from Form 990-7, 34 76 Prior Year 18,841,992 12,069,943 8 Contributions and grants (Part V, 18. Program service revenue (Part VI, Ine 2g). 2,465,093,865 2,688,292,235 10 Investment income (Part VIE, column (A), 3, 4, and 7) 64,911,252 52,387,517 2,991,466 4,024,012 11 Other revenue (Part VII, column (A), Imes 5, 6d, 8c. c. 10c, and 11) 12 Total revenue-add nes & through 11 (must equal Part VI, column (A), line 12) 13 Grants and simdar amounts paid (Part X, column (A), line 1-3). 2.551.836.375 2.756,773,707 2.314,729 5,049,032 14 Berents paid to or for members (Part IX, column (A), Ine 4). 15 Salanes, other compensation, employee benefits (Part IX, column (A), Inec 5-10) 1,001,139,518 978,211,810 1467 16a Professional fundraising fees (Pan K, column (A), 114) b Tal Fund (Part X, (D), 2572482 17 Other expenses (Pan IX, column (A), Ines 11a-1,3-34) 18 Total expenses Add lines 13-17 (must equal Part 0, column (A), line 25) 1,039,221.130 2,919,769.134 532,065,439 1,180,816,605 2,247 806,005 506,967,702 19 Revenue less expenses Subtract line 18 from line 12. Beginning of Current Year 20 Total assets (Part X, 16) 4,025,930,238 4,483,329,047 21 Total abilities (Part X, Ine 26). 1,756,903.527 1,975,323,166 22 Net assets or fund balances Subtract line 21 from 20 2,269,026,711 2,508,006,699 Parn Signature Block Under penalties of perjury, I declare that I have examined the return, induding accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge 2000.09.2 Signature of car Sign Here BERNADETTE SPONG CED Type or pret name and b PetType preparer's name Preprognature TRUN Lastampinat firms N F's name NST & YOUNG LLP Paid Preparer Use Only Fre's adds201 N FRANKLIN ST STE 2400 Maneno (813) 225-4800 TAMPA MO May the IRS discuss this return with the preparer shown above (see instructions). For Paperwork Reduction Act Notice, see the separate instructions. Activities & Governance Ravenue Expenses securg pung DLN: 93493220010230 OMB No 1545-0047 Return of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foto) 2018 Do not enter social security numbers on this form as it may be made public Go to www.is.29x/form990 for instructions and the latest information. Open to Public Inspection Asset or Cat No 11252 ON Ove Co Current Year End of Year Yes No Form 990 (2010) Form 990 (2018) Part X Assets Liabilities Net Assets or Fund Balances Balance Sheet Check if Schedule O contains a response or note to any line in this Part IX. 1 Cash-non-interest-bearing. 2 Savings and temporary cash investments 3 Pledges and grants receivable, net 4 Accounts receivable, net. 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees Complete Part II of Schedule L. . .. 6 Loans and other receivables from other disqualified persons (as defined under section 4958(f)(1)), persons described in section 4958(c)(3)(8), and contributing employers and sponsoring organizations of section 501(c)(9) voluntary employees' beneficiary organizations (see instructions) Complete Part II of Schedule L.. 7 Notes and loans receivable, net.. 8 Inventories for sale or use. 9 Prepaid expenses and deferred charges 10a Land, buildings, and equipment cost or other basis Complete Part VI of Schedule D 10a 3,197,641.945 1,833.919.622 b Less accumulated depreciation 10b 11 Investments-publicly traded securities. 12 Investments-other securities See Part IV, line 11 . 13 Investments-program-related See Part IV, line 11 14 Intangible assets. 15 Other assets See Part IV, line 11. 16 Total assets.Add lines 1 through 15 (must equal line 34) 17 Accounts payable and accrued expenses. 18 Grants payable. 19 Deferred revenue. 20 Tax-exempt bond liabilities. 21 Escrow or custodial account liability Complete Part IV of Schedule D 22 Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons Complete Part II of Schedule L.. 23 Secured mortgages and notes payable to unrelated third parties.. Unsecured notes and loans payable to unrelated third parties. 24 25 Other liabilities (including federal income tax, payables to related third parties, and other liabilities not included on lines 17-24) Complete Part X of Schedule D 26 Total liabilities.Add lines 17 through 25. Organizations that follow SFAS 117 (ASC 958), check here and complete lines 27 through 29, and lines 33 and 34. Unrestricted net assets 27 28 Temporarily restricted net assets 29 Permanently restricted net assets Organizations that do not follow SFAS 117 (ASC 958), check here and complete lines 30 through 34. 30 Capital stock or trust principal, or current funds 31 32 Paid-in or capital surplus, or land, building or equipment fund Retained earnings, endowment, accumulated income, or other funds Total net assets or fund balances 33 34 Total liabilities and net assets/fund balances (A) Beginning of year 166,700.832 1 366.506,180 2 3 303.078.571 4 05 06 7 51.878.352 8 37.580.802 9 1,169.773.609 10 1,608.023.044 11 012 013 31.973.334 14 290,415,514 15 4.025.930.238 16 353.277.964 17 018 5.436.565 19 1.148.951,887 20 21 022 29.293.876 23 024 219.943.235 25 1.756.903.527 26 2,169.813.072 27 98.394,746 28 818.893 29 30 31 32 2.269.026.711 33 4.025.930.238 34 Page 11 11.632.380 426,453.902 0 304,642.759 0 55.141.269 34.871,692 1,363,722.323 1,863.578.284 26.592.926 396.694.332 4.483.329,867 443.140.806 1,524,986 1.227.289.338 27.477.529 0 275,890.509 1.975,323,168 2.393.515,626 113.233.489 1.257.584 2.508,006,699 4.483.329.867 Form 990 (2018) (B) End of year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts