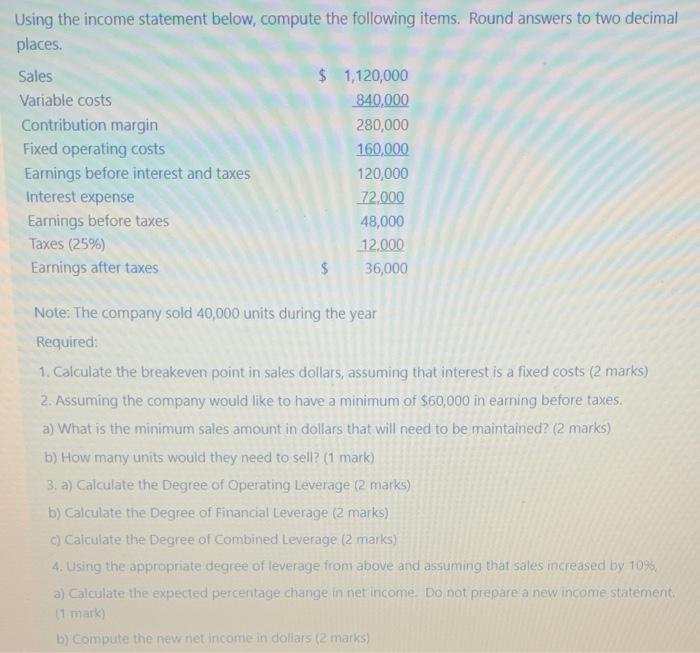

Question: Using the income statement below, compute the following items. Round answers to two decimal places. Sales $ 1,120,000 Variable costs 840,000 Contribution margin 280,000 Fixed

Using the income statement below, compute the following items. Round answers to two decimal places. Sales $ 1,120,000 Variable costs 840,000 Contribution margin 280,000 Fixed operating costs 160,000 Earnings before interest and taxes 120,000 Interest expense 72,000 Earnings before taxes 48,000 Taxes (25%) 12.000 Earnings after taxes $ 36,000 Note: The company sold 40,000 units during the year Required: 1. Calculate the breakeven point in sales dollars, assuming that interest is a fixed costs (2 marks) 2. Assuming the company would like to have a minimum of $60,000 in earning before taxes. a) What is the minimum sales amount in dollars that will need to be maintained? (2 marks) b) How many units would they need to sell? (1 mark) 3. a) Calculate the Degree of Operating Leverage (2 marks) b) Calculate the Degree of Financial Leverage (2 marks) c) Calculate the Degree of Combined Leverage (2 marks) 4. Using the appropriate degree of leverage from above and assuming that sales increased by 10%, a) Calculate the expected percentage change in net income. Do not prepare a new income statement (1 mark) b) Compute the new net income in dollars (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts