Question: Using the infor below: First, what is the annual operating cash flow of the project for year? 1? ?First, what is the annual operating cash

Using the infor below:

First, what is the annual operating cash flow of the project for year? 1?

?First, what is the annual operating cash flow of the project for year? 2?

?First, what is the annual operating cash flow of the project for year? 3?

?First, what is the annual operating cash flow of the project for year? 4?

?First, what is the annual operating cash flow of the project for year? 5?

? Next, what is the? after-tax cash flow of the equipment at? disposal?

Then, what is the incremental cash flow of the project in year? 0?

What is the incremental cash flow of the project in year? 1???

What is the incremental cash flow of the project in year? 2???

What is the incremental cash flow of the project in year? 3???

What is the incremental cash flow of the project in year? 4???

What is the incremental cash flow of the project in year? 5???

So, what is the IRR of the? project?

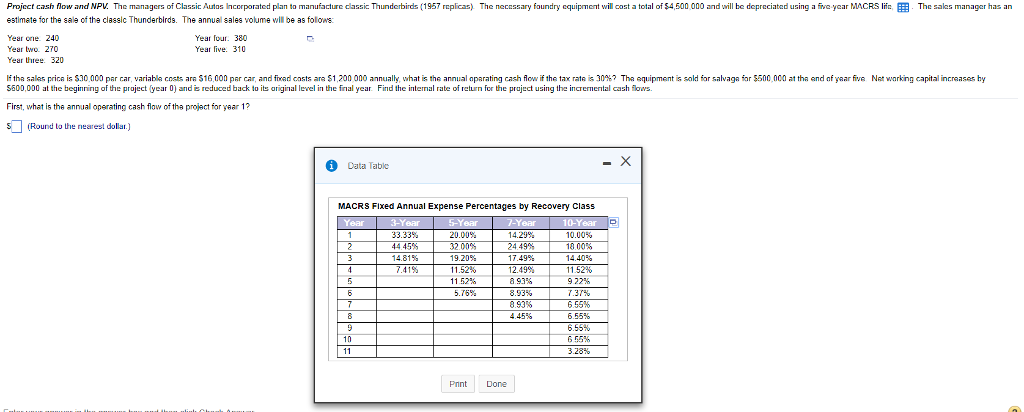

Project cash flow and NPV. The managers of Classic Autas Inccrporated plan to manufacture clThunderbirds 1957 replicas) eeary faundry equipment will cost a total of $4,500 000 and will be depreciated using a five year MACRS ifThe sas manager has an estimate for the sale of annual sales volume will be as folows the classic Thunderbirds. The Year ee 240 Year wo 270 Year Uhree 320 Year fou. 380 Year live. 310 lf ha sales pri 1s $10000 par car variable cns s ara $16.00n par car and n casts an $1.2on ono annually, what is he annual aparating cash flow he ax rate s 30 67 T equipment $500,000 at the beginning of the project (yr)d reduced back to its original lewel in the frnal year Find the intenal rate of fer the project using the incremerital cash flows sold ar salvaga ar $500 at th end af yaar we NR wark ng capital increases by First, what is the annual operating cash flaw of tha project for year 1? Round to the nearest dollar.) 6 Data Table MACRS Fixed Annual Expense Percentages by Recovery Class 5-Y 20.00% 00% 19.20% 52% 11 52% 5.76% 14.29% 49% 7. 49% 12.49% a 93 8.93% 10.UO% 18 00% 14.40% 52% 9 22% 44 45% 14.81% 41% 5556 6 55% 4 45% 3.28% Pnnt Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts