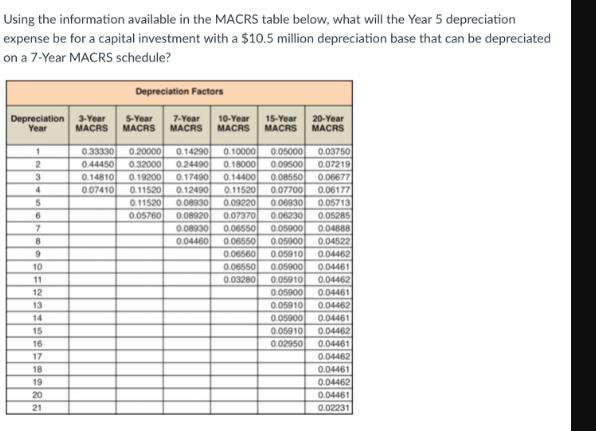

Question: Using the information available in the MACRS table below, what will the Year 5 depreciation expense be for a capital investment with a $10.5

Using the information available in the MACRS table below, what will the Year 5 depreciation expense be for a capital investment with a $10.5 million depreciation base that can be depreciated on a 7-Year MACRS schedule? Depreciation Factors Depreciation 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year MACRS MACRS MACRS MACRS MACRS MACRS 1 0.33330 0.20000 0.14290 0.10000 0.05000 0.03750 2 3 4 5 6 7 0.44450 0.32000 0.24490 0.18000 0.09500 0.07219 0.14810 0.19200 0.17490 0.14400 0.08550 0.06677 0.07410 0.11520 0.12490 0.11520 0.07700 0.06177 0.11520 0.08930 0.09220 0.06930 0.05713 0.05760 0.08920 0.07370 0.06230 0.05285 0.08930 0.06550 0.05900 0.04888 8 0.04460 0.06550 0.05900 0.04522 9 10 11 12 0.06560 0.05910 0.04462 0.06550 0.05900 0.04461 0.03280 0.05910 0.04462 0.05900 0.04461 13 14 0.05910 0.04462 0.05900 0.04461 15 0.05910 0.04462 16 17 18 19 20 21 0.02950 0.04461 0.04462 0.04461 0.04462 0.04461 0.02231

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts