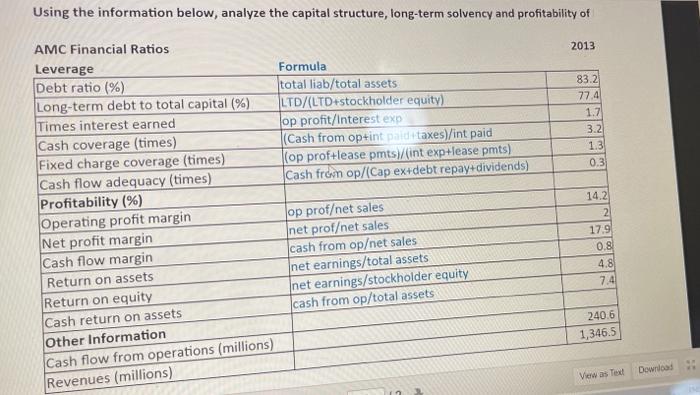

Question: Using the information below, analyze the capital structure, long-term solvency and profitability of AMC Financial Ratios 2013 Formula total liab/total assets LTD/LTD+stockholder equity) op profit/Interest

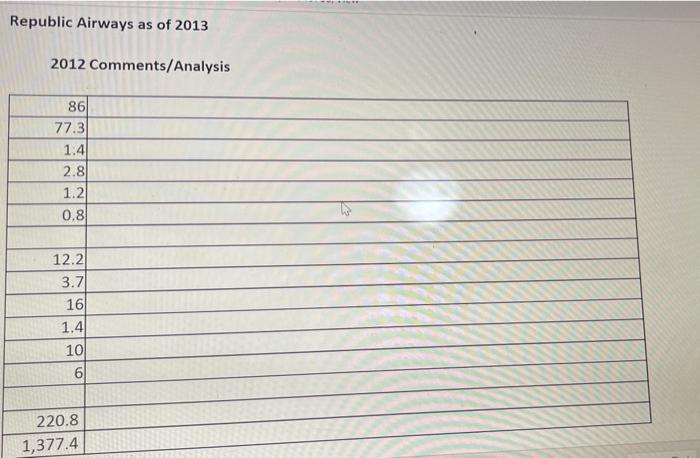

Using the information below, analyze the capital structure, long-term solvency and profitability of AMC Financial Ratios 2013 Formula total liab/total assets LTD/LTD+stockholder equity) op profit/Interest exo (Cash from op+int paid taxes)/int paid (op prof+lease pmts)/(int exp+lease pmts) Cash fron op/(Cap ex+debt repay+dividends) 83.2 77.4 1.7 3.2 1.3 0.3 Leverage Debt ratio (%) Long-term debt to total capital (%) Times interest earned Cash coverage (times) Fixed charge coverage (times) Cash flow adequacy (times) Profitability (%) Operating profit margin Net profit margin Cash flow margin Return on assets Return on equity Cash return on assets Other Information Cash flow from operations (millions) Revenues (millions) op profet sales net profet sales cash from opet sales net earnings/total assets net earnings/stockholder equity cash from op/total assets 14.2 2 17.9 0.8 4.8 7.4 240.6 1,346.5 Download Views Ted Republic Airways as of 2013 2012 Comments/Analysis 86 77.3 1.41 2.8 1.2 0.8 12.2 3.7 16 1.4 10 6 220.8 1,377.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts