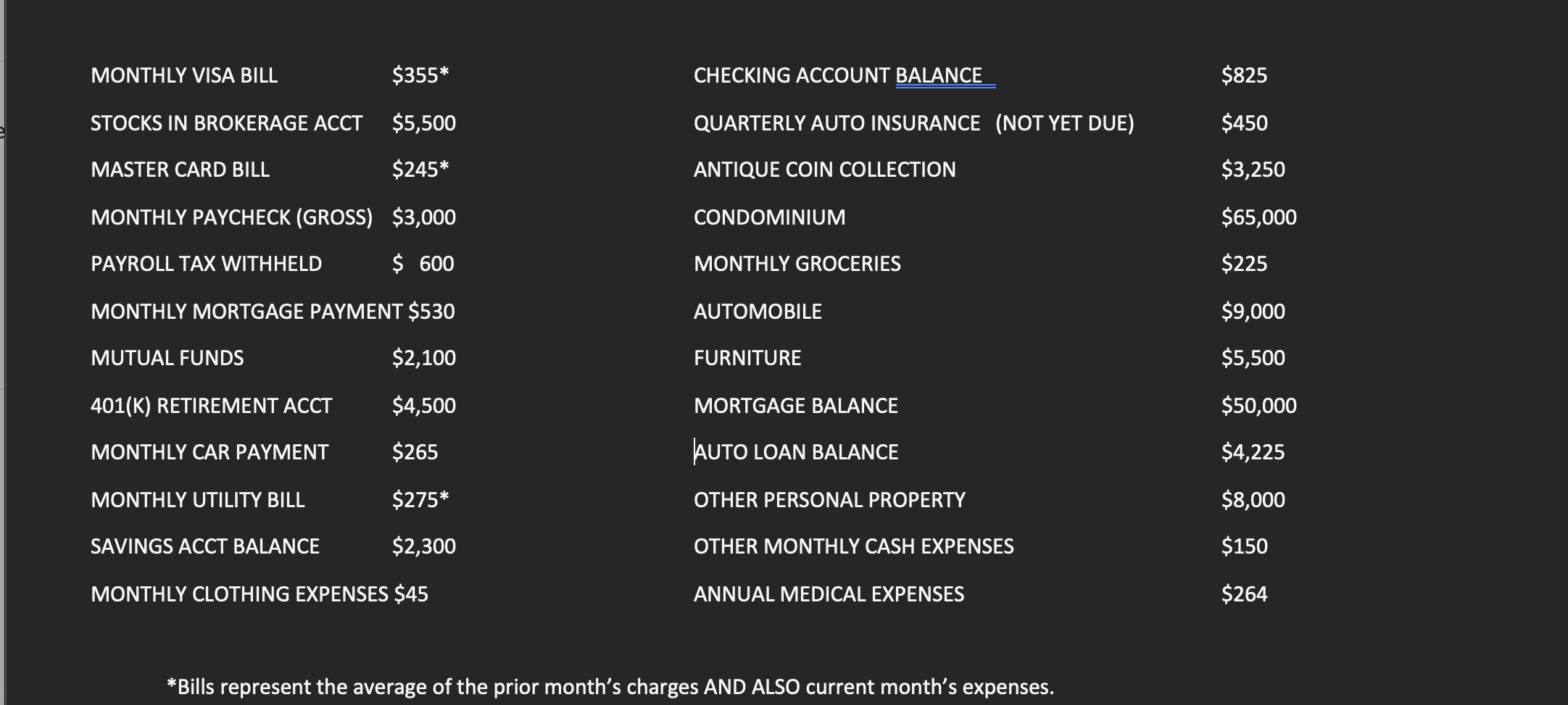

Question: Using the information below answer the following Questions : 2) What is the take Home Pay? 3) What are the total MonthlyLiving Expenditures? 4) What

Using the information below answer the following Questions : 2) What is the take Home Pay?

3) What are the total MonthlyLiving Expenditures?

4) What is the Monthly income Available for Savings & Investment?

5) What is the Savings Ratio?

6) What is the Months Living Expenses covered ratio?

7) What is the Long Term debt Coverage Ratio?

8) What suggestions would you give your client to better help her financial situation?

HINT: Since they are average amounts you may assume that the credit card and utility bills are both a debt (related to the prior month) and an expense (related to the current month).

\begin{tabular}{lllr} MONTHLY VISA BILL & $355 & \multicolumn{1}{c}{ CHECKING ACCOUNT BALANCE } & $825 \\ STOCKS IN BROKERAGE ACCT & $5,500 & QUARTERLY AUTO INSURANCE & (NOT YET DUE) \\ MASTER CARD BILL & $245 & ANTIQUE COIN COLLECTION & $450 \\ MONTHLY PAYCHECK (GROSS) & $3,000 & CONDOMINIUM & $65,000 \\ PAYROLL TAX WITHHELD & $600 & MONTHLY GROCERIES & $2250 \\ MONTHLY MORTGAGE PAYMENT $530 & AUTOMOBILE & $9,000 \\ MUTUAL FUNDS & $2,100 & FURNITURE & $5,500 \\ 401(K) RETIREMENT ACCT & $4,500 & MORTGAGE BALANCE & $50,000 \\ MONTHLY CAR PAYMENT & $265 & AUTO LOAN BALANCE & $4,225 \\ MONTHLY UTILITY BILL & $275 & OTHER PERSONAL PROPERTY & $8,000 \\ SAVINGS ACCT BALANCE & $2,300 & OTHER MONTHLY CASH EXPENSES & $150 \\ MONTHLY CLOTHING EXPENSES $45 & ANNUAL MEDICAL EXPENSES & $264 \end{tabular} *Bills represent the average of the prior month's charges AND ALSO current month's expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts