Question: Using the information below assist with requirements 4 - 7. Assist with the below requirements. Requirement 4: Requirement 5: Requirement 6: Prepare the adjusted trial

Using the information below assist with requirements 4 - 7.

Assist with the below requirements.

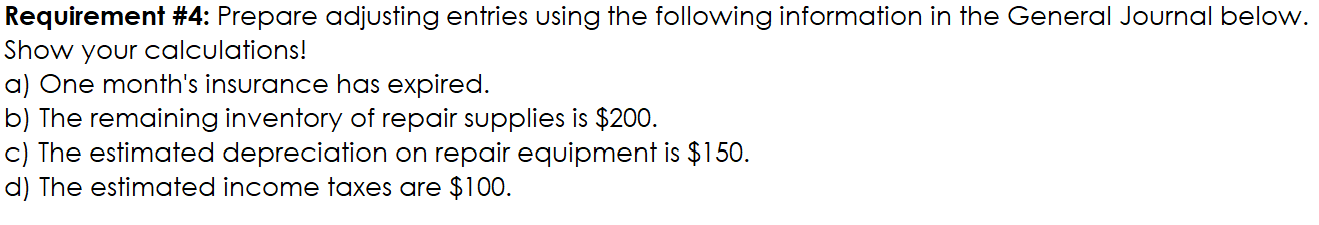

Requirement 4:

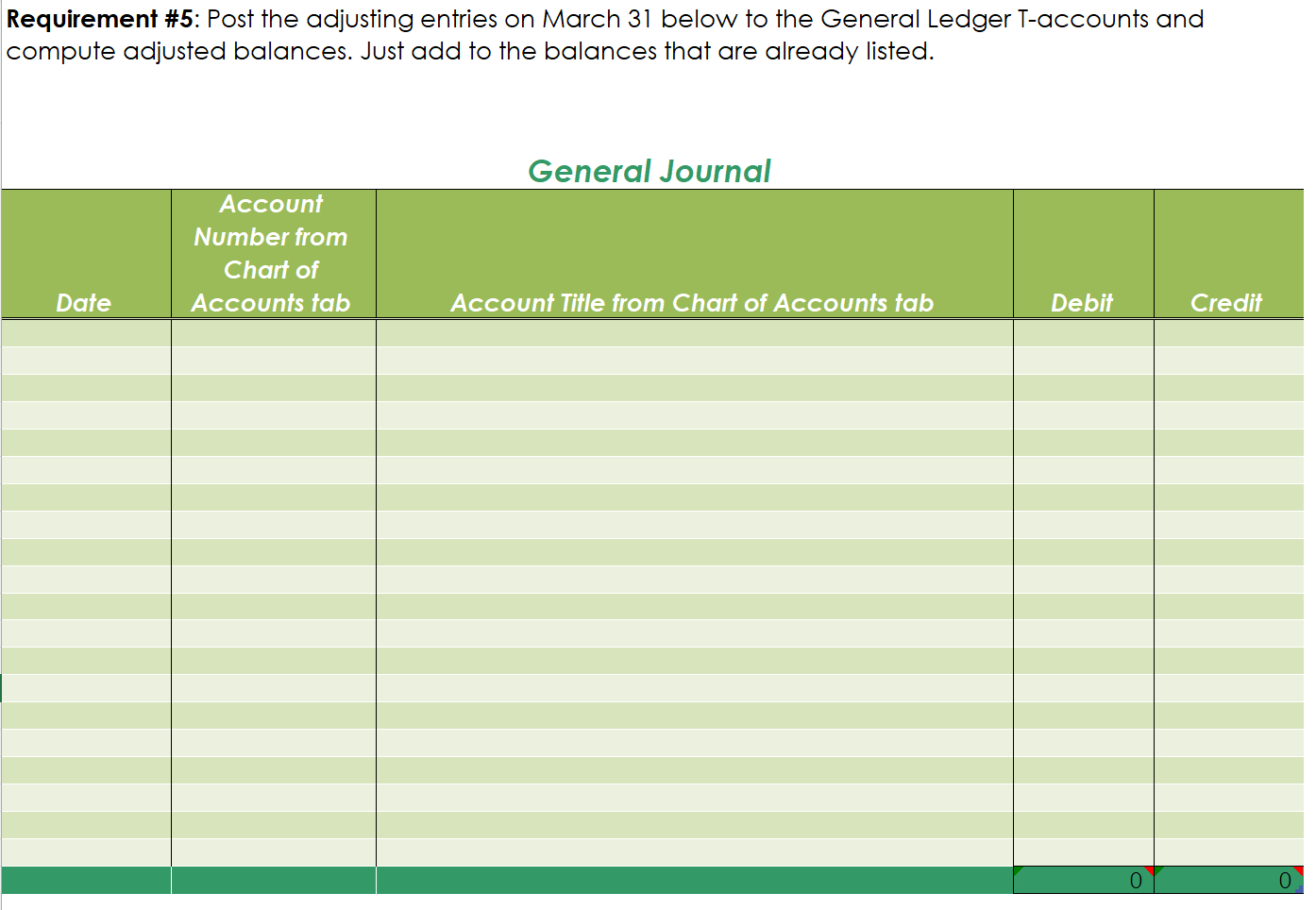

Requirement 5:

Requirement 6:

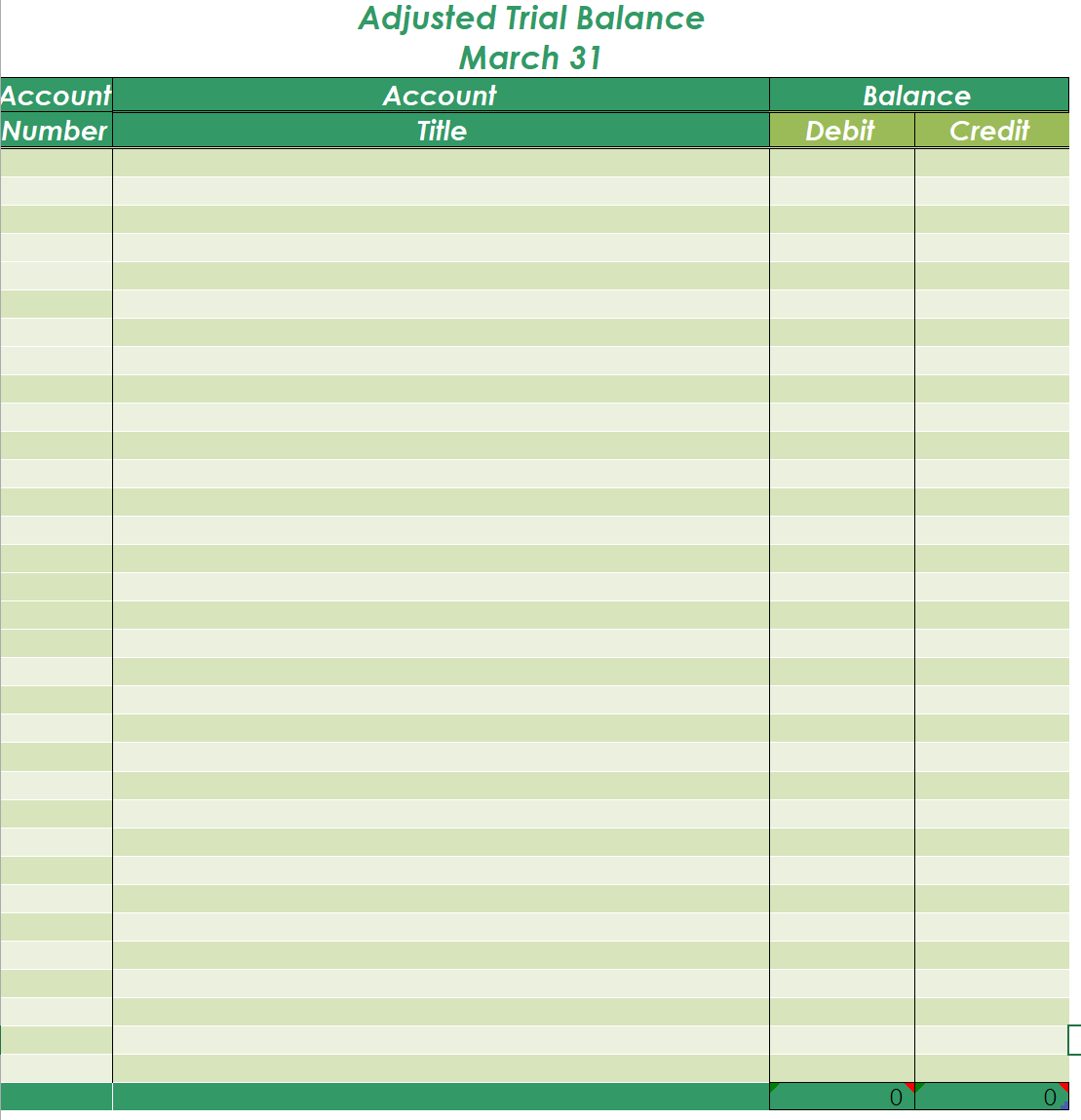

Prepare the adjusted trial balance.

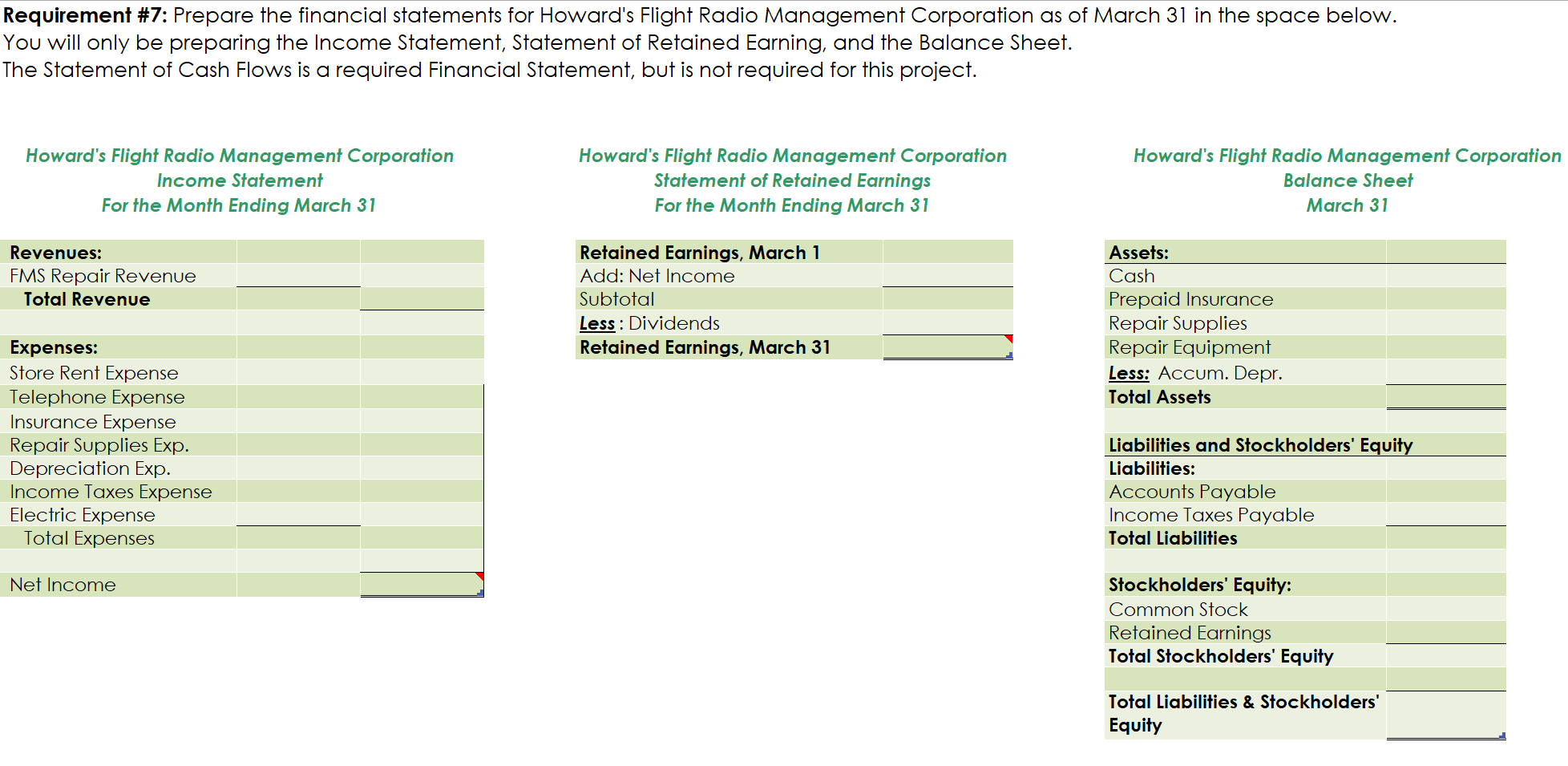

Requirement 7:

Thank You!

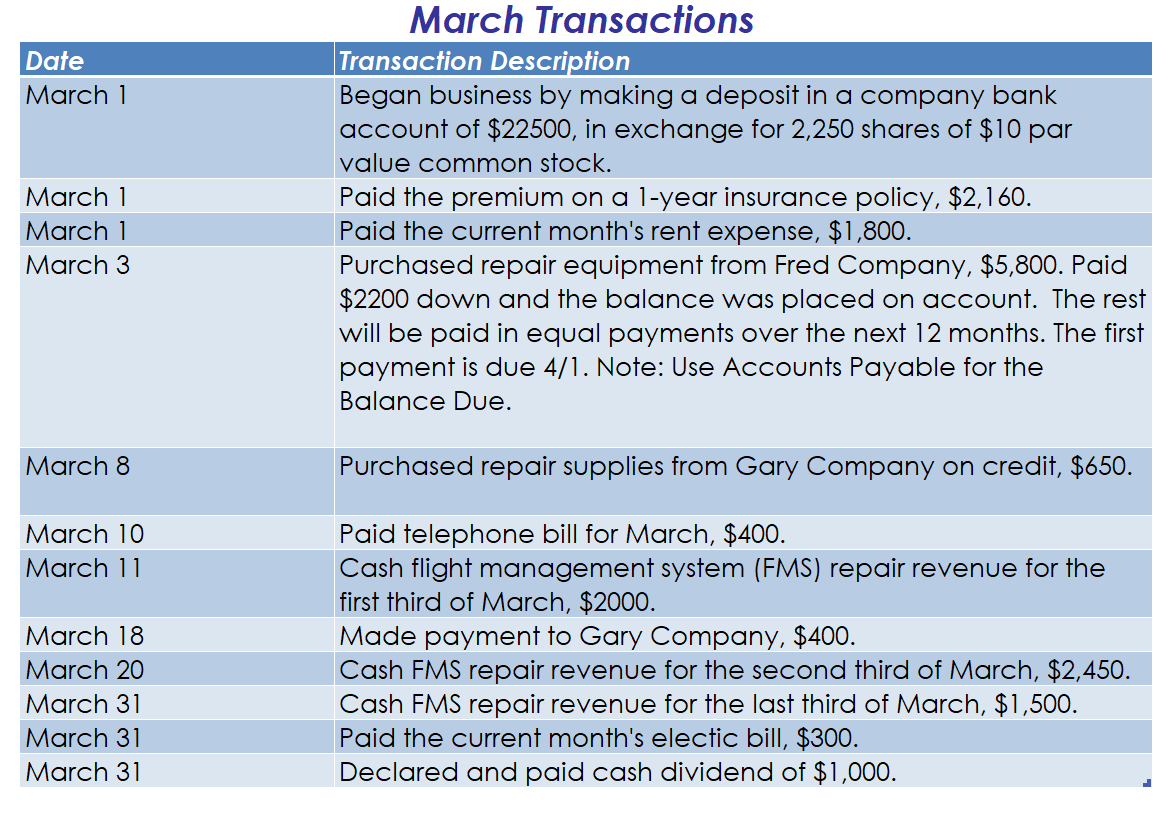

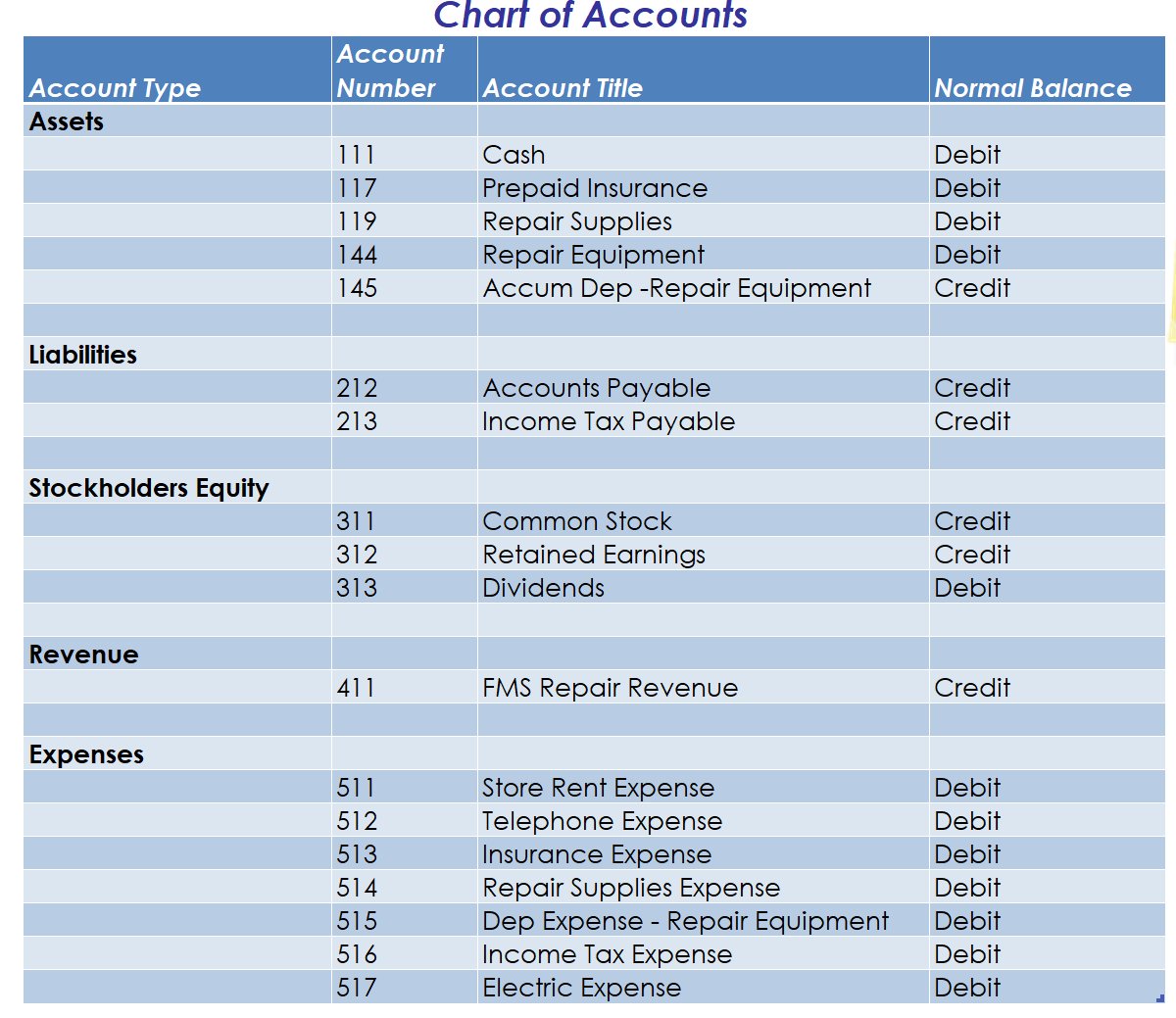

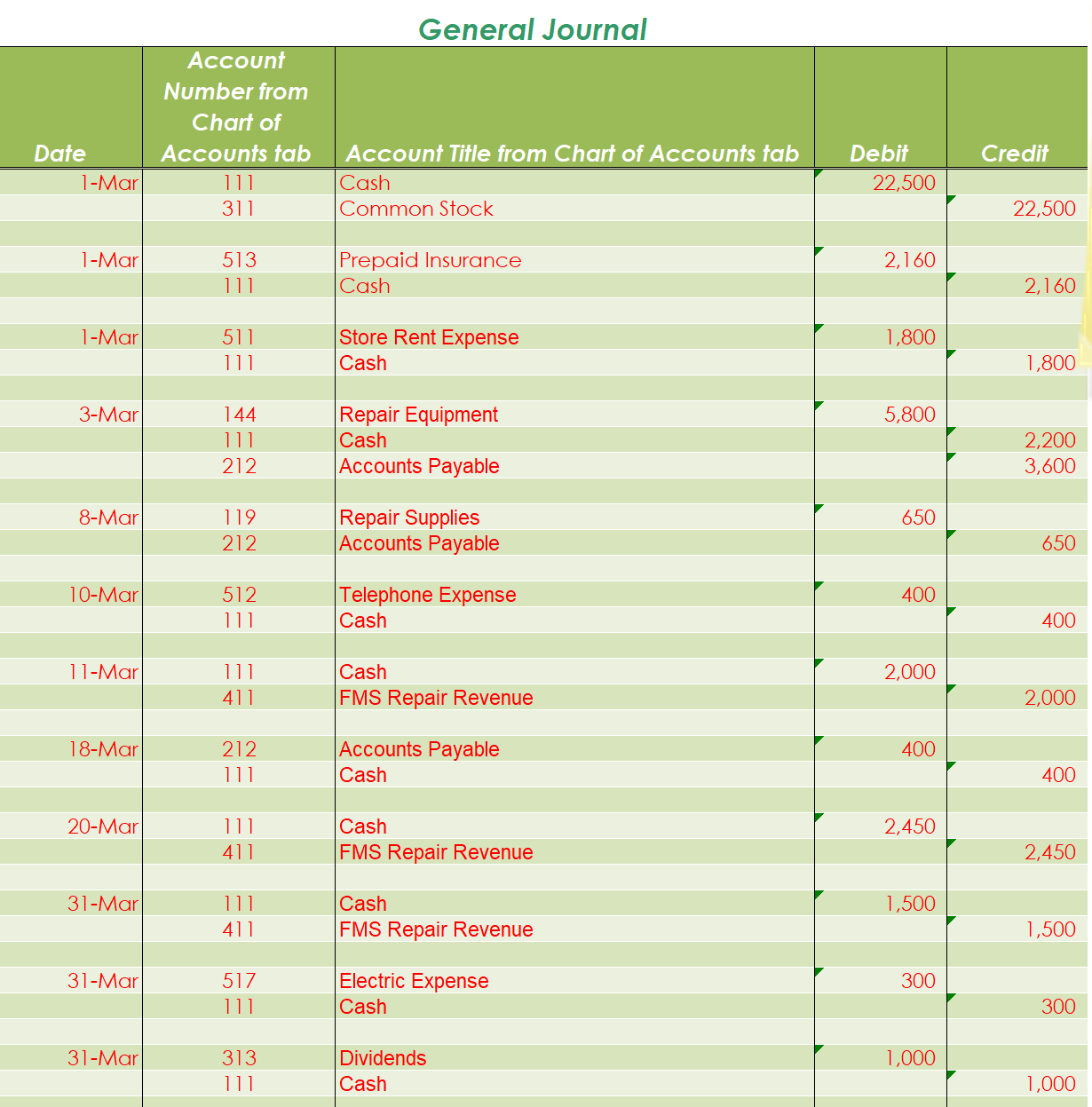

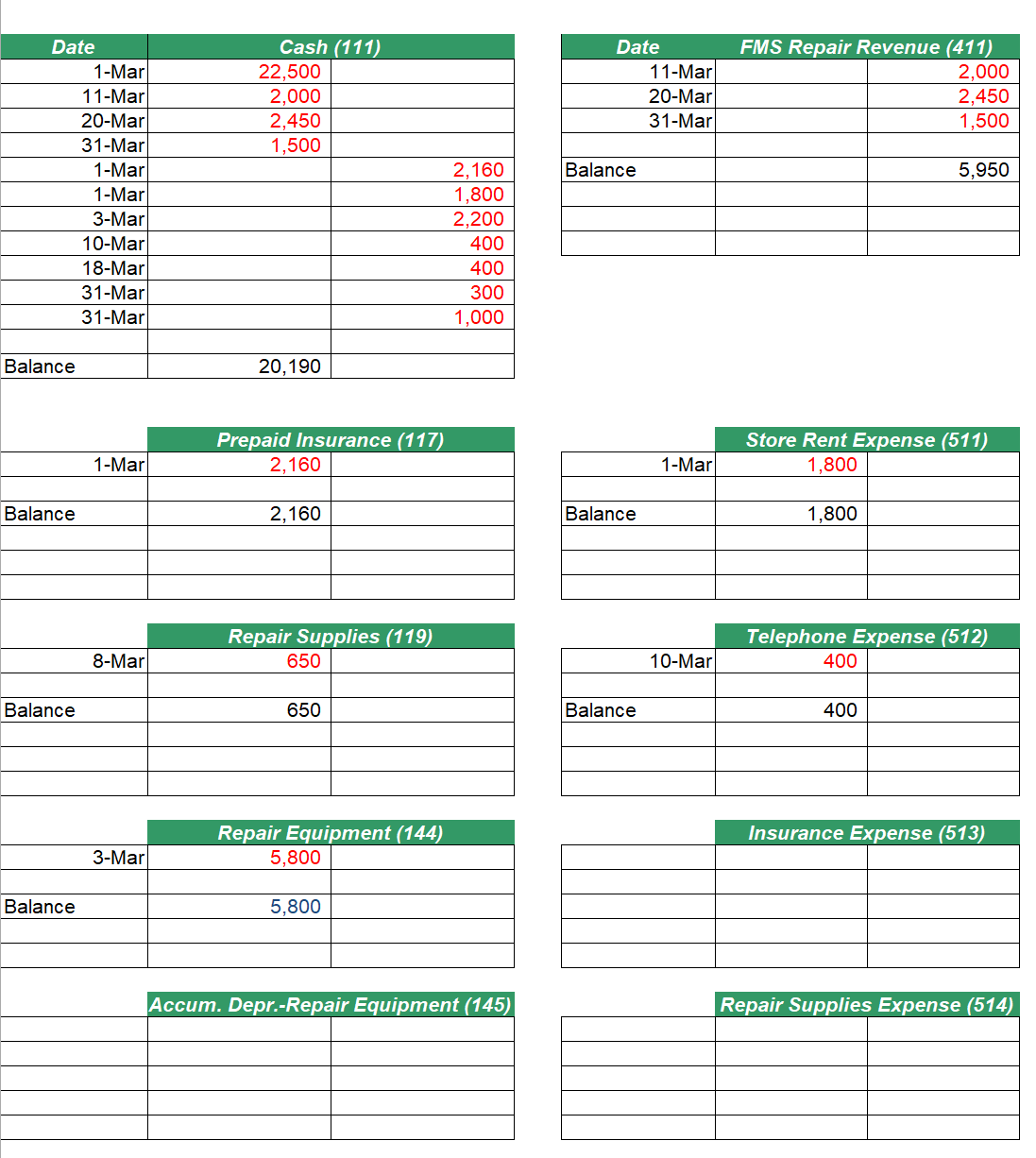

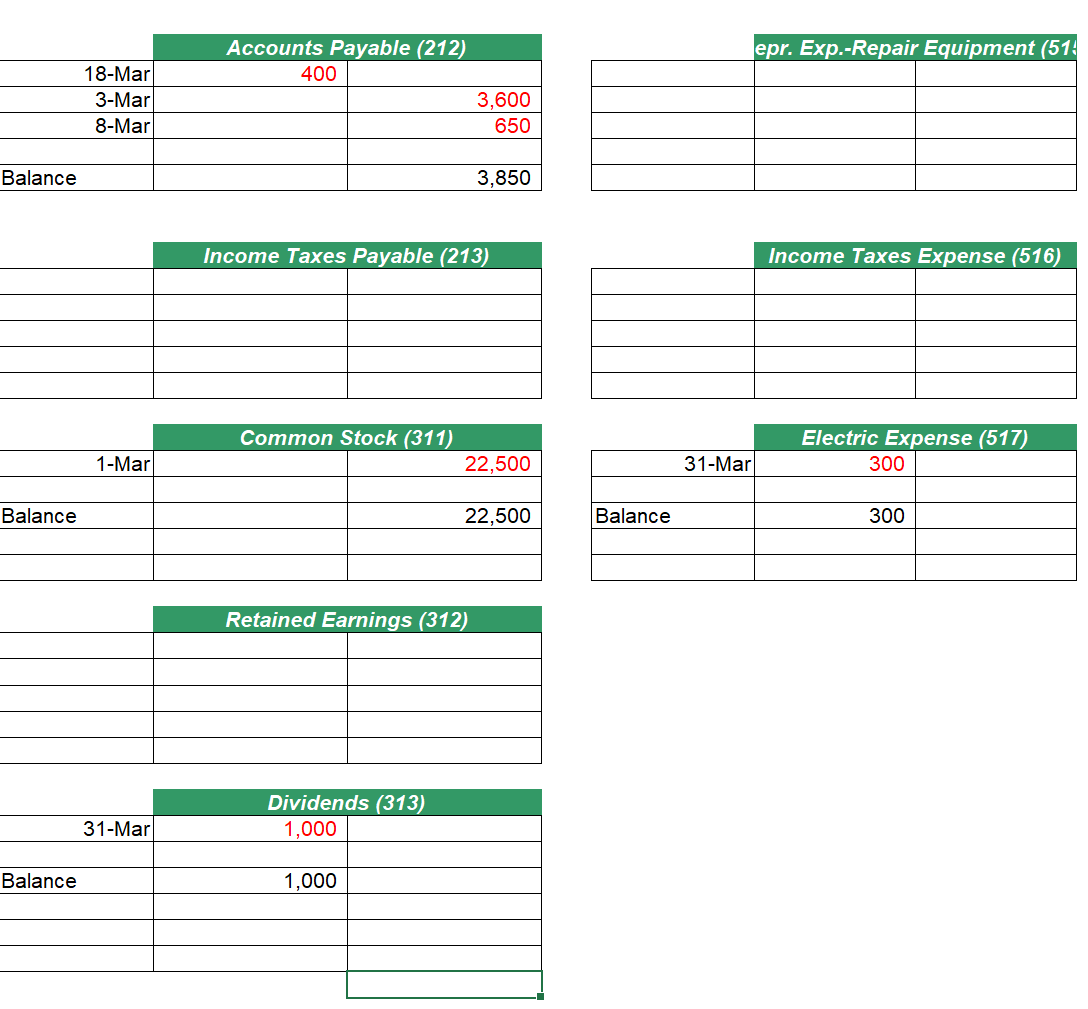

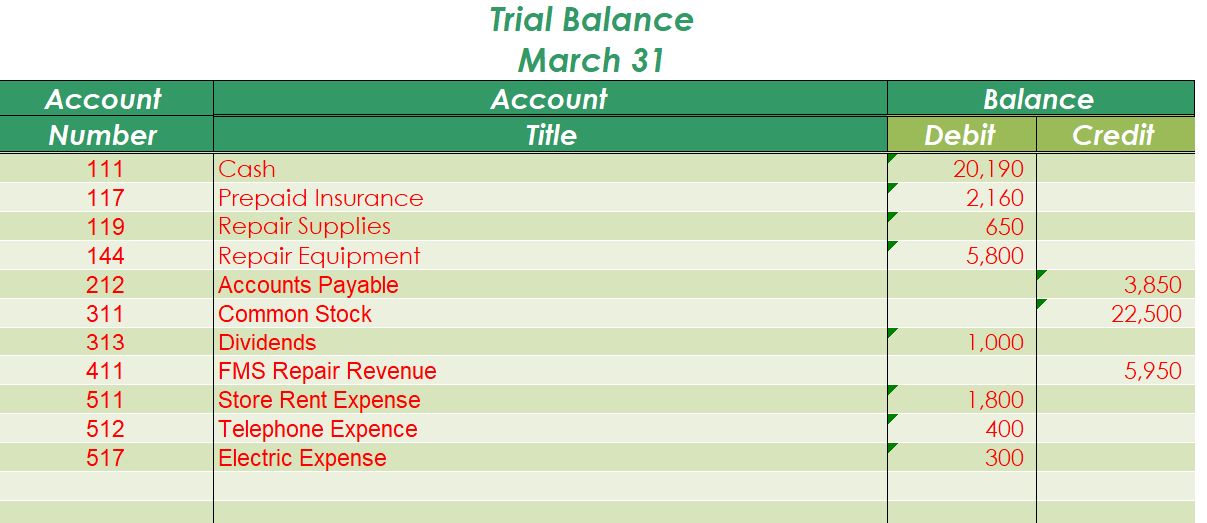

Requirement \#5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. Requirement \#7: Prepare the financial statements for Howard's Flight Radio Management Corporation as of March 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project. Howard's Flight Radio Management Corporation Income Statement For the Month Ending March 31 Howard's Flight Radio Management Corporation Statement of Retained Earnings For the Month Ending March 31 Howard's Flight Radio Management Corporation Balance Sheet March 31 Chart of Accounts \begin{tabular}{|r|r|r|} \multicolumn{1}{c|}{ Date } & \multicolumn{2}{|c|}{ Cash (111) } \\ \hline 1-Mar & 22,500 & \\ \hline 11-Mar & 2,000 & \\ \hline 20-Mar & 2,450 & 2,160 \\ \hline 31-Mar & 1,500 & 1,800 \\ \hline 1-Mar & & 2,200 \\ \hline 1-Mar & & 400 \\ \hline 3-Mar & & 400 \\ \hline 10-Mar & & 300 \\ \hline 18-Mar & & 1,000 \\ \hline 31-Mar & & \\ \hline 3alance & 20,190 & \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline \multicolumn{2}{|c|}{ Date } & FMS Repair Revenue (411) \\ \hline 11-Mar & & 2,000 \\ \hline 20-Mar & & 2,450 \\ \hline 31-Mar & & 1,500 \\ \hline & & 5,950 \\ \hline Balance & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} & \multicolumn{2}{|c|}{ Prepaid Insurance (117) } \\ \hline 1-Mar & 2,160 & \\ \hline & & \\ \hline Balance & 2,160 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Store Rent Expense (511) } \\ \hline & 1,800 & \\ \hline 1-Mar & & \\ \hline & 1,800 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} & \multicolumn{3}{|c|}{ Repair Supplies (119) } \\ \hline 8-Mar & 650 & \\ \hline & & \\ \hline Balance & 650 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Telephone Expense (512) } \\ \hline 10-Mar & 400 & \\ \hline Balance & & \\ \hline & 400 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \hline & \multicolumn{2}{|c|}{ Repair Equipment (144) } \\ \hline 3-Mar & 5,800 & \\ \hline & & \\ \hline Balance & 5,800 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Insurance Expense (513) } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Accum. Depr.-Repair Equipment (145) Repair Supplies Expense (514) \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} March Transactions Requirement \#4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $150. d) The estimated income taxes are $100. \begin{tabular}{|r|r|r|} \multicolumn{2}{|c|}{ Accounts Payable (212) } \\ \hline 18-Mar & 400 & \\ \hline 3-Mar & & 3,600 \\ \hline 8-Mar & & 650 \\ \hline Balance & & 3,850 \\ \hline \end{tabular} epr. Exp.-Repair Equipment (51 \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Income Taxes Expense (516) \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Electric Expense (517) } \\ \hline 31-Mar & 300 & \\ \hline & & \\ \hline Balance & 300 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ Retained Earnings (312) } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \hline & \multicolumn{2}{|c|}{ Dividends (313) } \\ \hline & 1,000 & \\ \hline 31-Mar & & \\ \hline Balance & 1,000 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \cline { 1 - 3 } & & \\ \cline { 2 - 3 } & & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts