Question: Using the information below, complete the consolidation worksheet at 30 June 2012 on the following page. Eliminations/adjustments should be identified using the letter (a), (b),

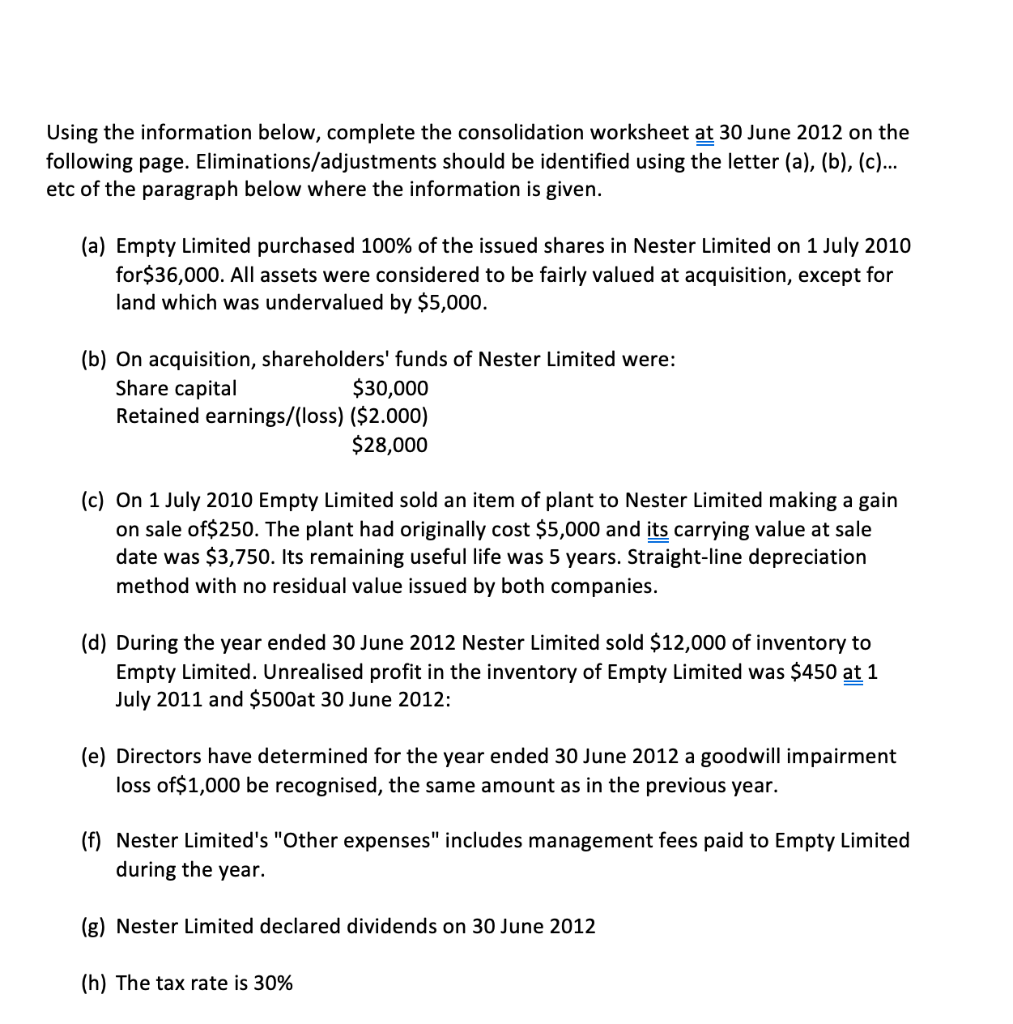

Using the information below, complete the consolidation worksheet at 30 June 2012 on the following page. Eliminations/adjustments should be identified using the letter (a), (b), (c)... etc of the paragraph below where the information is given. (a) Empty Limited purchased 100% of the issued shares in Nester Limited on 1 July 2010 for$36,000. All assets were considered to be fairly valued at acquisition, except for land which was undervalued by $5,000. (b) On acquisition, shareholders' funds of Nester Limited were: Share capital $30,000 Retained earnings/(loss) ($2.000) $28,000 (c) On 1 July 2010 Empty Limited sold an item of plant to Nester Limited making a gain on sale of$250. The plant had originally cost $5,000 and its carrying value at sale date was $3,750. Its remaining useful life was 5 years. Straight-line depreciation method with no residual value issued by both companies. (d) During the year ended 30 June 2012 Nester Limited sold $12,000 of inventory to Empty Limited. Unrealised profit in the inventory of Empty Limited was $450 at 1 July 2011 and $500at 30 June 2012: (e) Directors have determined for the year ended 30 June 2012 a goodwill impairment loss of$1,000 be recognised, the same amount as in the previous year. (f) Nester Limited's "Other expenses" includes management fees paid to Empty Limited during the year. (g) Nester Limited declared dividends on 30 June 2012 (h) The tax rate is 30% Using the information below, complete the consolidation worksheet at 30 June 2012 on the following page. Eliminations/adjustments should be identified using the letter (a), (b), (c)... etc of the paragraph below where the information is given. (a) Empty Limited purchased 100% of the issued shares in Nester Limited on 1 July 2010 for$36,000. All assets were considered to be fairly valued at acquisition, except for land which was undervalued by $5,000. (b) On acquisition, shareholders' funds of Nester Limited were: Share capital $30,000 Retained earnings/(loss) ($2.000) $28,000 (c) On 1 July 2010 Empty Limited sold an item of plant to Nester Limited making a gain on sale of$250. The plant had originally cost $5,000 and its carrying value at sale date was $3,750. Its remaining useful life was 5 years. Straight-line depreciation method with no residual value issued by both companies. (d) During the year ended 30 June 2012 Nester Limited sold $12,000 of inventory to Empty Limited. Unrealised profit in the inventory of Empty Limited was $450 at 1 July 2011 and $500at 30 June 2012: (e) Directors have determined for the year ended 30 June 2012 a goodwill impairment loss of$1,000 be recognised, the same amount as in the previous year. (f) Nester Limited's "Other expenses" includes management fees paid to Empty Limited during the year. (g) Nester Limited declared dividends on 30 June 2012 (h) The tax rate is 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts