Question: Using the information below, compute total accrual purchases Alpha keeps its accounting records on a cash basis during the year. At year - end, it

Using the information below, compute total accrual purchases

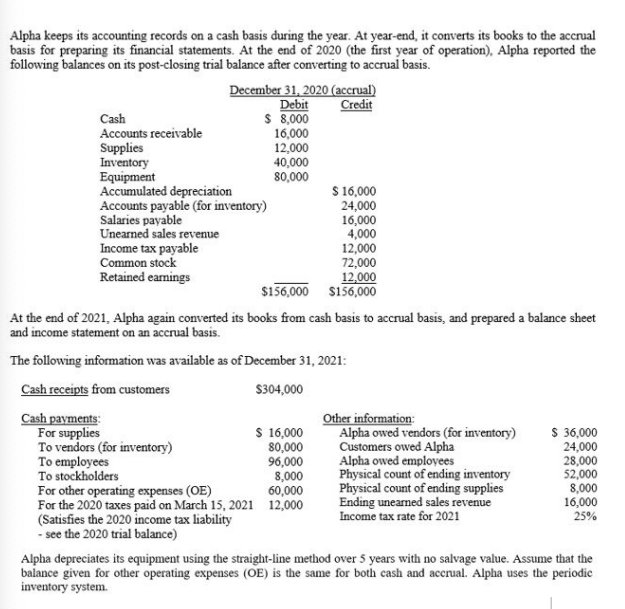

Alpha keeps its accounting records on a cash basis during the year. At yearend, it converts its books to the accrual

basis for preparing its financial statements. At the end of the first year of operation Alpha reported the

following balances on its postclosing trial balance after converting to accrual basis.

At the end of Alpha again converted its books from cash basis to accrual basis, and prepared a balance sheet

and income statement on an accrual basis.

The following information was available as of December :

Cash receipts from customers

$

Cash payments:

For supplies

Other information:

To vendors for inventory

To employees

To stockholders

For other operating expenses OE

For the taxes paid on March

Satisfies the income tax liability

see the trial balance

Alpha depreciates its equipment using the straightline method over years with no salvage value. Assume that the

balance given for other operating expenses OE is the same for both cash and accrual. Alpha uses the periodic

inventory system.

The answer is $ I just need help calculating it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock