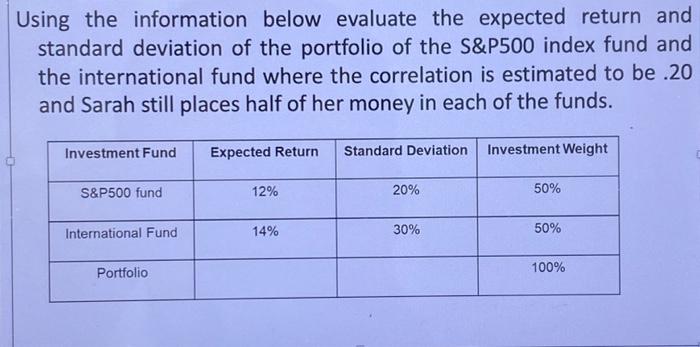

Question: Using the information below evaluate the expected return and standard deviation of the portfolio of the S&P500 index fund and the international fund where

Using the information below evaluate the expected return and standard deviation of the portfolio of the S&P500 index fund and the international fund where the correlation is estimated to be .20 and Sarah still places half of her money in each of the funds. Investment Fund S&P500 fund International Fund Portfolio Expected Return Standard Deviation Investment Weight 12% 14% 20% 30% 50% 50% 100%

Step by Step Solution

There are 3 Steps involved in it

To calculate the expected return and standard deviation of Sarahs portfolio we can use the following ... View full answer

Get step-by-step solutions from verified subject matter experts