Question: Using the information below please answer the following: Describe one strength and one weakness of both the automation and the outsourcing alternatives. Recommend a strategy

Using the information below please answer the following:

| Describe one strength and one weakness of both the automation and the outsourcing alternatives. Recommend a strategy to management and explain why in a short paragraph. |

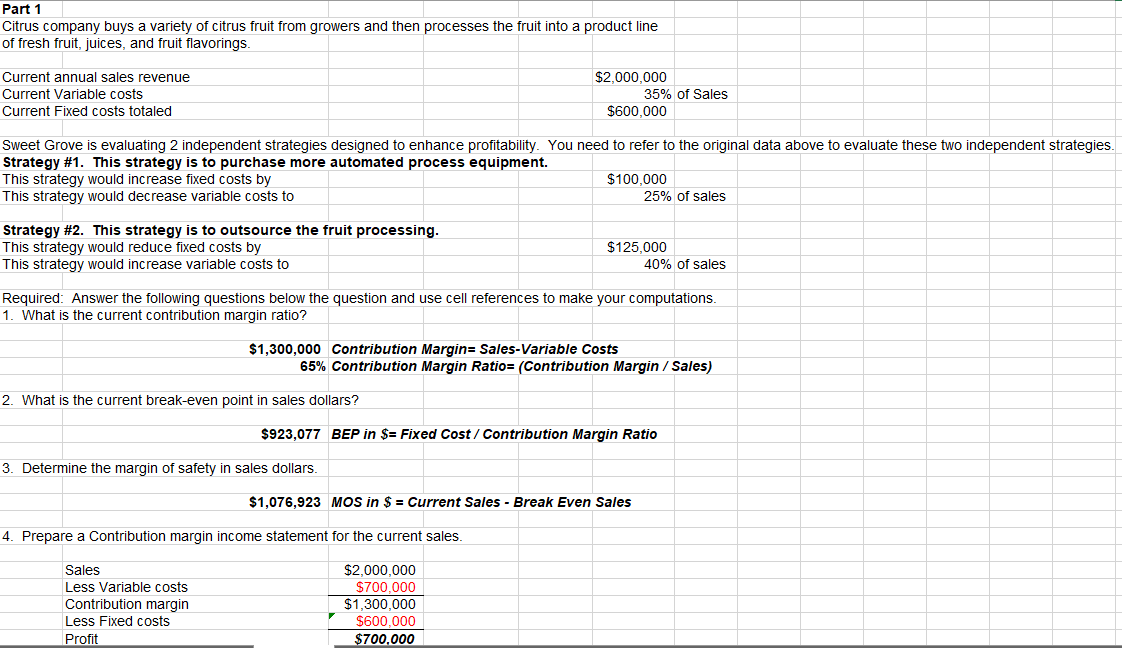

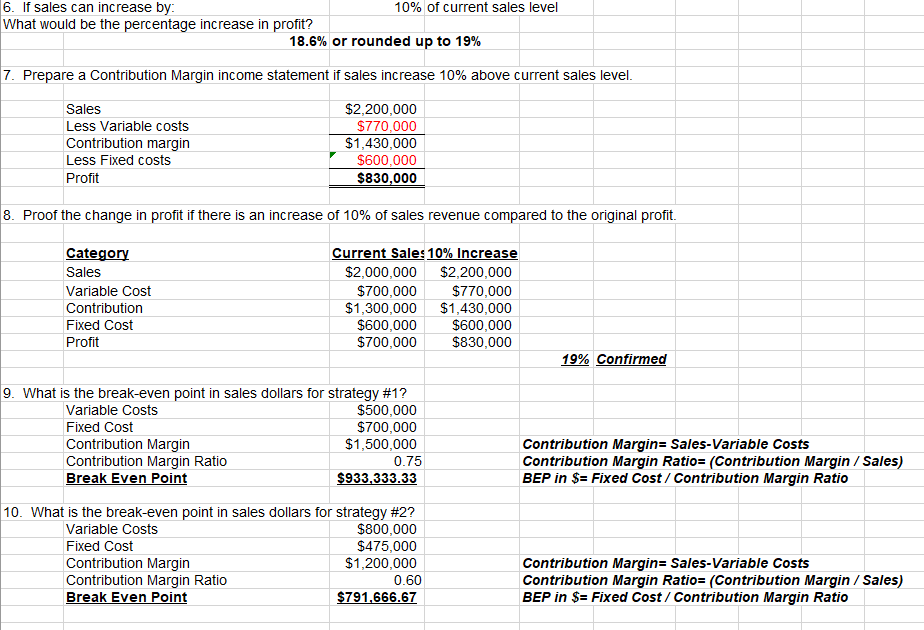

Part 1 Citrus company buys a variety of citrus fruit from growers and then processes the fruit into a product line of fresh fruit, juices, and fruit flavorings. Current annual sales revenue Current Variable costs Current Fixed costs totaled $2,000,000 35% of Sales $600,000 Sweet Grove is evaluating 2 independent strategies designed to enhance profitability. You need to refer to the original data above to evaluate these two independent strategies. Strategy #1. This strategy is to purchase more automated process equipment. This strategy would increase fixed costs by $100,000 This strategy would decrease variable costs to 25% of sales Strategy #2. This strategy is to outsource the fruit processing. This strategy would reduce fixed costs by This strategy would increase variable costs to $125,000 40% of sales Required: Answer the following questions below the question and use cell references to make your computations. 1. What is the current contribution margin ratio? $1,300,000 Contribution Margin= Sales-Variable Costs 65% Contribution Margin Ratio= (Contribution Margin / Sales) 2. What is the current break-even point in sales dollars? $923,077 BEP in $= Fixed Cost / Contribution Margin Ratio 3. Determine the margin of safety in sales dollars. $1,076,923 MOS in $ = Current Sales - Break Even Sales 4. Prepare a Contribution margin income statement for the current sales. Sales Less Variable costs Contribution margin Less Fixed costs Profit $2,000,000 $700,000 $1,300,000 $600.000 $700.000 6. If sales can increase by: 10% of current sales level What would be the percentage increase in profit? 18.6% or rounded up to 19% 7. Prepare a Contribution Margin income statement if sales increase 10% above current sales level. Sales Less Variable costs Contribution margin Less Fixed costs Profit $2,200,000 $770,000 $1,430,000 $600.000 $830,000 8. Proof the change in profit if there is an increase of 10% of sales revenue compared to the original profit. Category Sales Variable Cost Contribution Fixed Cost Profit Current Sales 10% Increase $2,000,000 $2,200,000 $700,000 $770,000 $1,300,000 $1,430,000 $600,000 $600,000 $700,000 $830,000 19% Confirmed 9. What is the break-even point in sales dollars for strategy #1? Variable Costs $500,000 Fixed Cost $700,000 Contribution Margin $1,500,000 Contribution Margin Ratio 0.75 Break Even Point $933,333.33 Contribution Margin= Sales-Variable Costs Contribution Margin Ratio= (Contribution Margin / Sales) BEP in $= Fixed Cost / Contribution Margin Ratio 10. What is the break-even point in sales dollars for strategy #2? Variable Costs $800,000 Fixed Cost $475,000 Contribution Margin $1,200,000 Contribution Margin Ratio 0.60 Break Even Point $791,666.67 Contribution Margin= Sales-Variable Costs Contribution Margin Ratio= (Contribution Margin / Sales) BEP in $= Fixed Cost / Contribution Margin Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts