Question: Using the information below, please help fill in this table. Please provide detailed equations, excel formulas, and explanations to better understand this process. Thank You!

Using the information below, please help fill in this table. Please provide detailed equations, excel formulas, and explanations to better understand this process. Thank You!

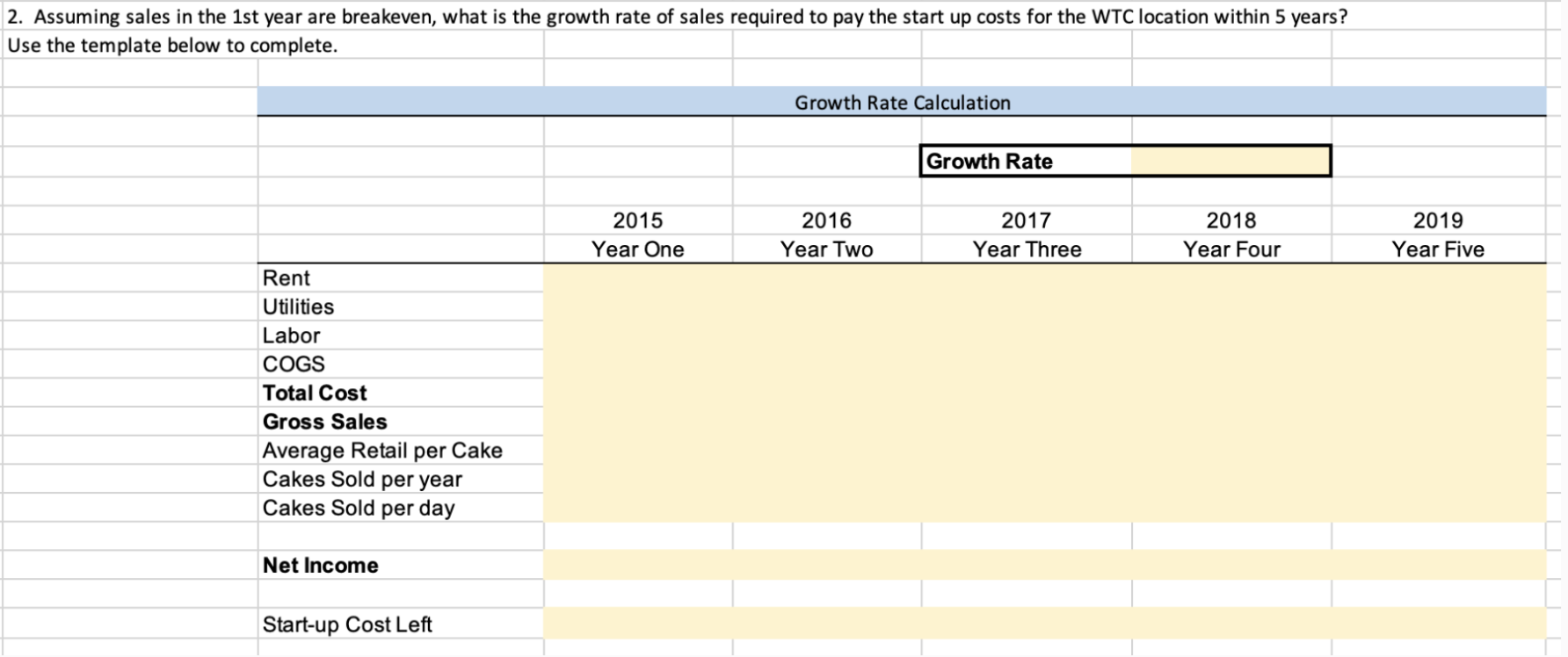

Question: Assuming sales in thest year are breakeven, what is the growth rate of sales required to pay the start up costs for the WTC location within years?

Break Even Number of Cakes:

Rent $ Annual Escalation

Utility Costs $ Annual Escalation

Labor Costs $ Annual Escalation

Cakes $

COGS $AssumptionTotal Fixed Costs: $

In forecasting the next five years, Romaniszyn and Tom assumed the following:

Annual sales growth would be for in since the World Trade Center location would potentially be opening in late and for the three years afterward.

They assumed an annual sales growth rate of in perpetuity.

Cost of goods sold had consistently been approximately of sales but had been dipping in the past two years. They expected it to remain approximately constant over the next five years.

With rent and labor costs making up a large portion of their expenses, Romaniszyn and Tom expected SG&A costs to remain approximately the same as prior years, but to decrease by one percentage point each year.

Although R&D costs had been negligible in the past, they decided they should probably assume some cost in the future as well, albeit only of sales.

With the prospect of opening a new store in the following year, the two decided to allocate $ for capital expenditures in After that, however, they assumed that no new stores would be opened and capital expenditures would remain approximately of sales.

Depreciation was expected to rise by five percentage points each year starting in becoming of capital expenditures in

Additions to intangibles would be zero.

Amortization would be zero.

The tax rate would continue to be

The two expected the change in working capital to remain a constant percent of the change in sales and behave similarly to

In order to do a discounted cash flow analysis, Romaniszyn and Tom assumed Lady Ms weighted average cost of capital was They chose a x EBITDA multiple.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock