Question: Using the information below, prepare in good form (showing also non cash transactions if any) a Statement of Cash Flows for MAMA Corporation for the

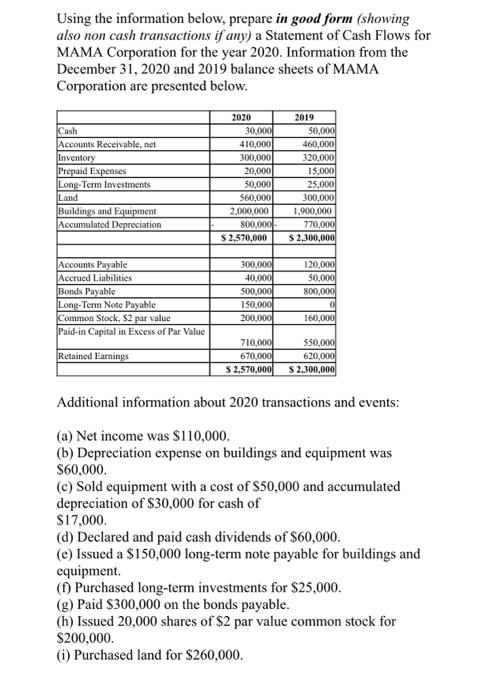

Using the information below, prepare in good form (showing also non cash transactions if any) a Statement of Cash Flows for MAMA Corporation for the year 2020. Information from the December 31, 2020 and 2019 balance sheets of MAMA Corporation are presented below. Cash Accounts Receivable, nel Inventory Prepaid Expenses Long-Term Investments Land Buildings and Equipment Accumulated Depreciation 2020 30,000 410,000 300,000 20,000 50,000 560,000 2.000.000 800,000 $ 2,570,000 2019 50,000 460,000 320,000 15,000 25,000 300,000 1.900.000 770,000 $ 2,300,000 Accounts Payable Accrued Liabilities Bonds Payable Long-Term Note Payable Common Stock, S2 par value Paid-in Capital in Excess of Par Value 300,000 40,000 500,000 150,000 200,000 120,000 50,000 800,000 O 160,000 Retained Earnings 710,000 670,000 5 2.570,000 550,000 620,000 $ 2,300,000 Additional information about 2020 transactions and events: (a) Net income was $110,000. (b) Depreciation expense on buildings and equipment was $60,000. (c) Sold equipment with a cost of $50,000 and accumulated depreciation of $30,000 for cash of $17,000 (d) Declared and paid cash dividends of $60,000. (e) Issued a $150,000 long-term note payable for buildings and equipment ( Purchased long-term investments for $25,000. (g) Paid $300,000 on the bonds payable. (h) Issued 20,000 shares of $2 par value common stock for $200,000. (1) Purchased land for $260,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts