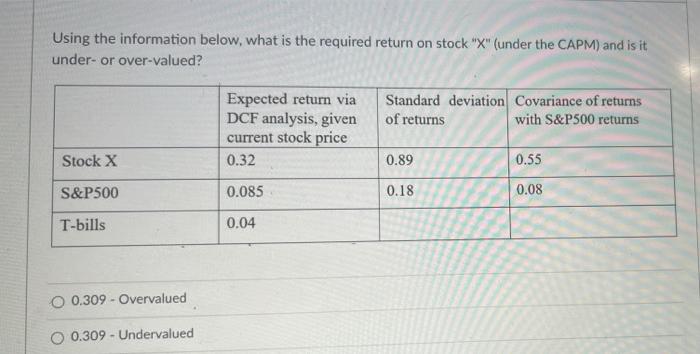

Question: Using the information below, what is the required return on stock X (under the CAPM) and is it under- or over-valued? Expected return via DCF

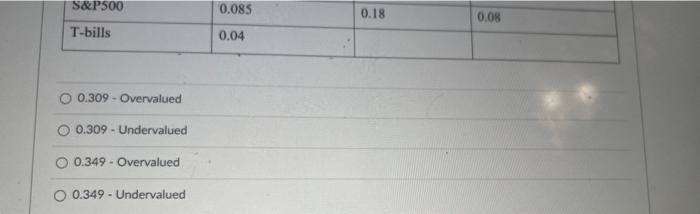

Using the information below, what is the required return on stock "X" (under the CAPM) and is it under- or over-valued? Expected return via DCF analysis, given current stock price 0.32 Standard deviation Covariance of returns of returns with S&P500 returns Stock X 0.89 0.55 S&P500 0.085 0.18 0.08 T-bills 0.04 O 0.309 - Overvalued 0.309 - Undervalued S&P500 0.085 0.18 0.08 T-bills 0.04 0.309 - Overvalued - 0.309 - Undervalued O 0.349 - Overvalued O 0.349 - Undervalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts