Question: Using the information for the journal entries, complete the adjusting journal entries on the first page. The first page is one problem. Refer to the

Using the information for the journal entries, complete the adjusting journal entries on the first page. The first page is one problem. Refer to the pictures and not to information below it is the same information, Chegg formatting would not let me delete Thanks!

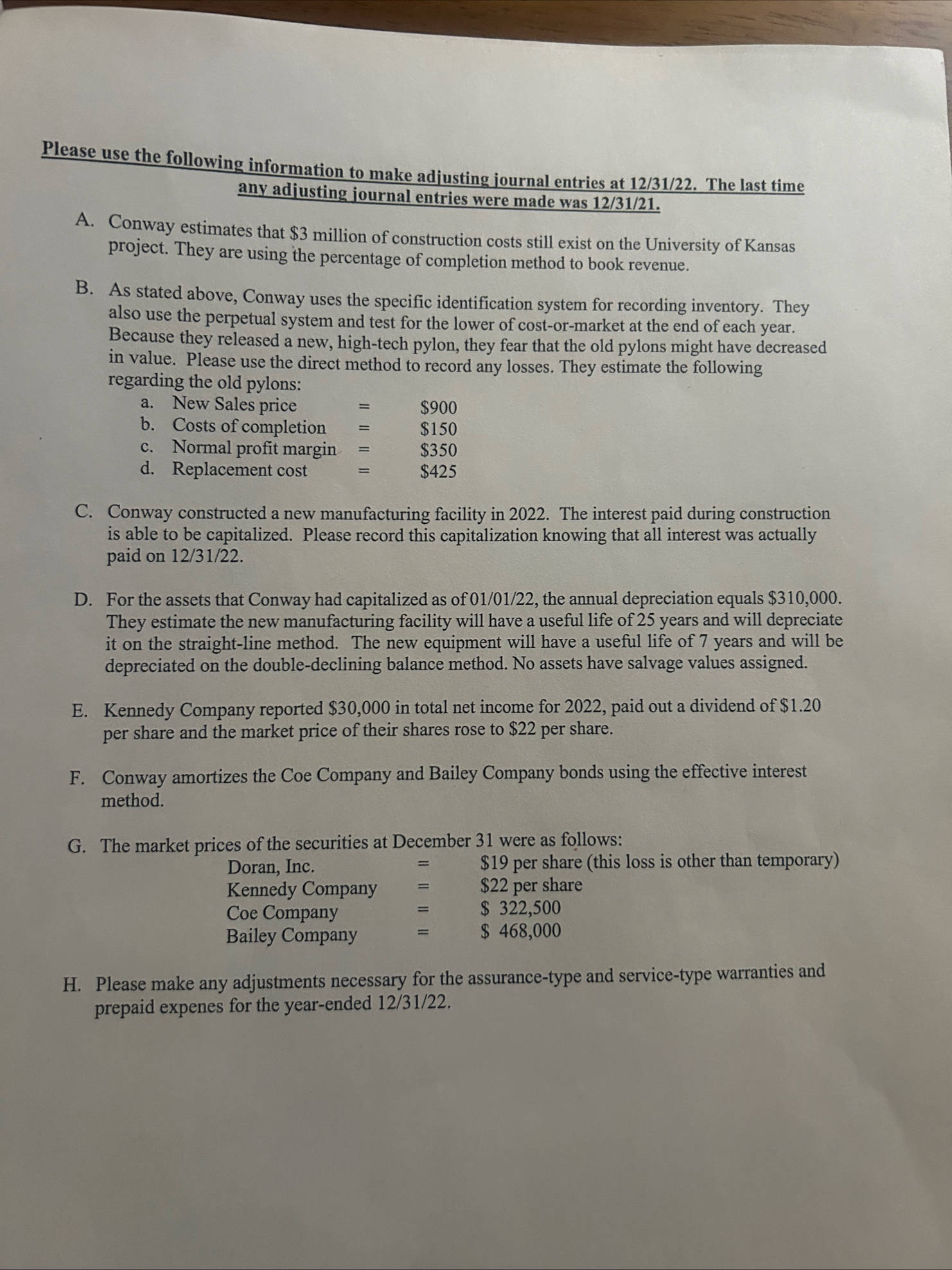

The information below describes the activities of Conway, Inc. for the yearended Conway, Inc. constructs football stadiums for universities across the United States. Additionally, inventory that differentiates between old pylons and new hightech pylons. All parts were requisitioned from the Raw Materials inventory warehouse.

December

Conway makes their first annual payment to First Federal Bank for the manufacturing facility construction loan. You will need to create an amortization schedule to calculate the interest and principle for each payment.they manufacture and install custom upgrades to existing stadiums. Past projects have included manufacturing and installing custom leather seats for box seat sections and manufacturing and installing custom lighting, seating, and audiovisual equipment for locker rooms and coaches offices. They also manufacture and sell pylon cameras. The business has existed for ten years prior to Following are some notes regarding the trial balance.

Conway had $ in Cash and Cash Equivalents no restrictions

Finished Goods Inventory consists of old pylons that were manufactured at a cost of $ pylon.

Raw Materials Inventory includes all the parts to manufacture the old pylons.

Land of $

Conway had $ in their Common Stock account $ par value

Retained Earnings of $

January

January

January

U January

Conway trades a piece of land for another piece of land closer to their manufacturing building. On this date, the original cost of the land traded away was $ and the fair market value was $ In return, they received a piece of land from Merton Company valued at $ Conway also paid $ to Merton to complete the trade. The trade lacks commercial substance.

Conway starts a construction project at University of Kansas. They will be renovating the existing football stadium for $ million. They anticipate the construction will take months at a cost of $ million. The architectural renderings are completed for $ Conway pays the architect the full amount and bills the University of Kansas for the full amount.

Conway enters a purchase commitment with Holmes, Inc. to purchase concrete for the University of Kansas renovations. They agree to purchase yards of concrete at a $ yard to be delivered in increments over the next months.

Conway has entered a contract to start providing hightech pylon cameras to all NCAA Division I schools. To increase production they start construction of new building to manufacture pylon cameras on the land they acquired on On this date they pay $ for architectural renderings, tear down on old building for $ and make the first payment to Brown Construction in the amount of $ All amounts are paid in cash. Additionally, on this day, they take out a $ construction loan annual rate over years, with annual

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock