Question: Using the information from Apple, solve and interpret the following ratios and questions. Explain what the ratios mean and make sure to include calculation formula:

Using the information from Apple, solve and interpret the following ratios and questions. Explain what the ratios mean and make sure to include calculation formula:

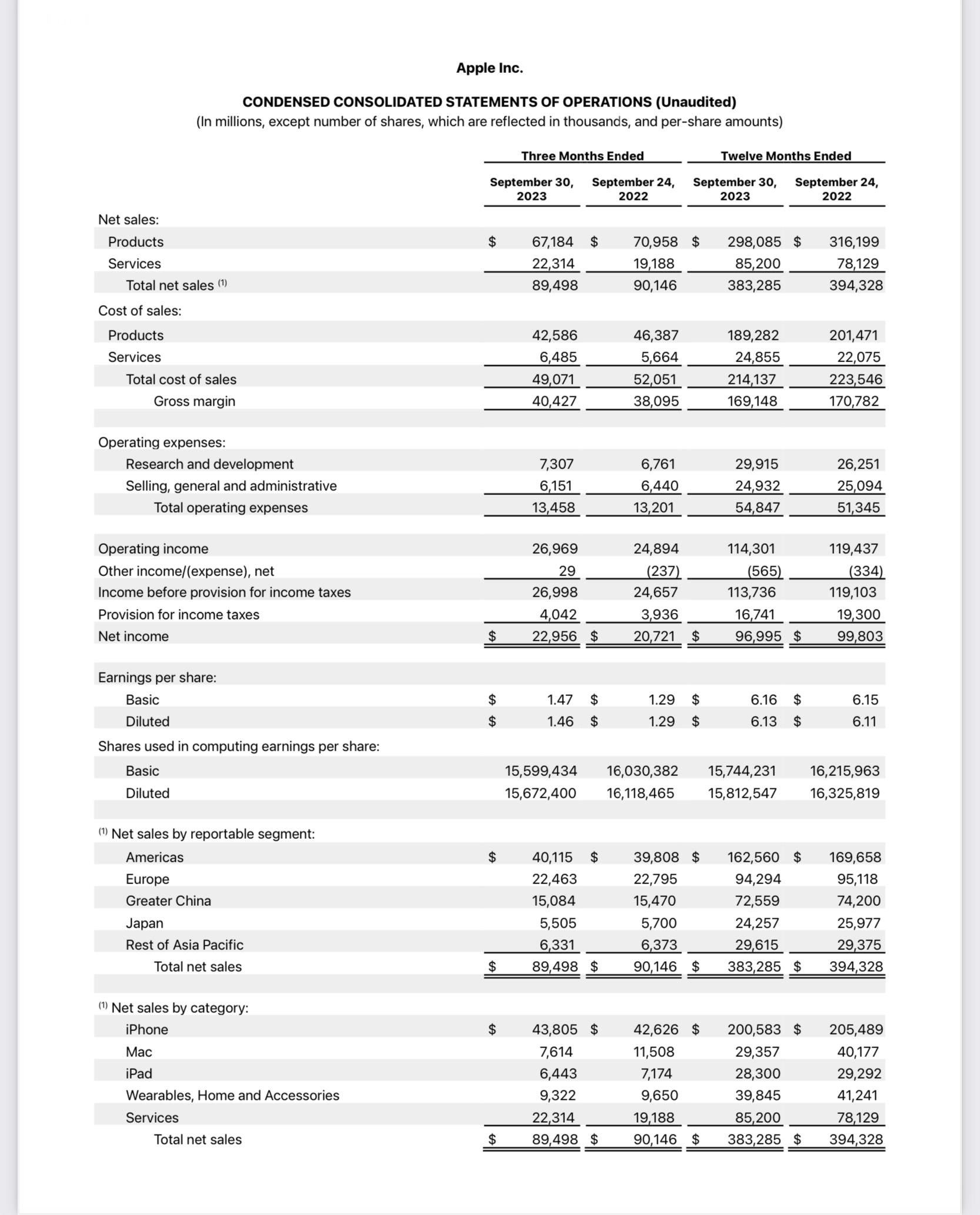

Item 6 -Operating Margin and Profit Margin Ratios

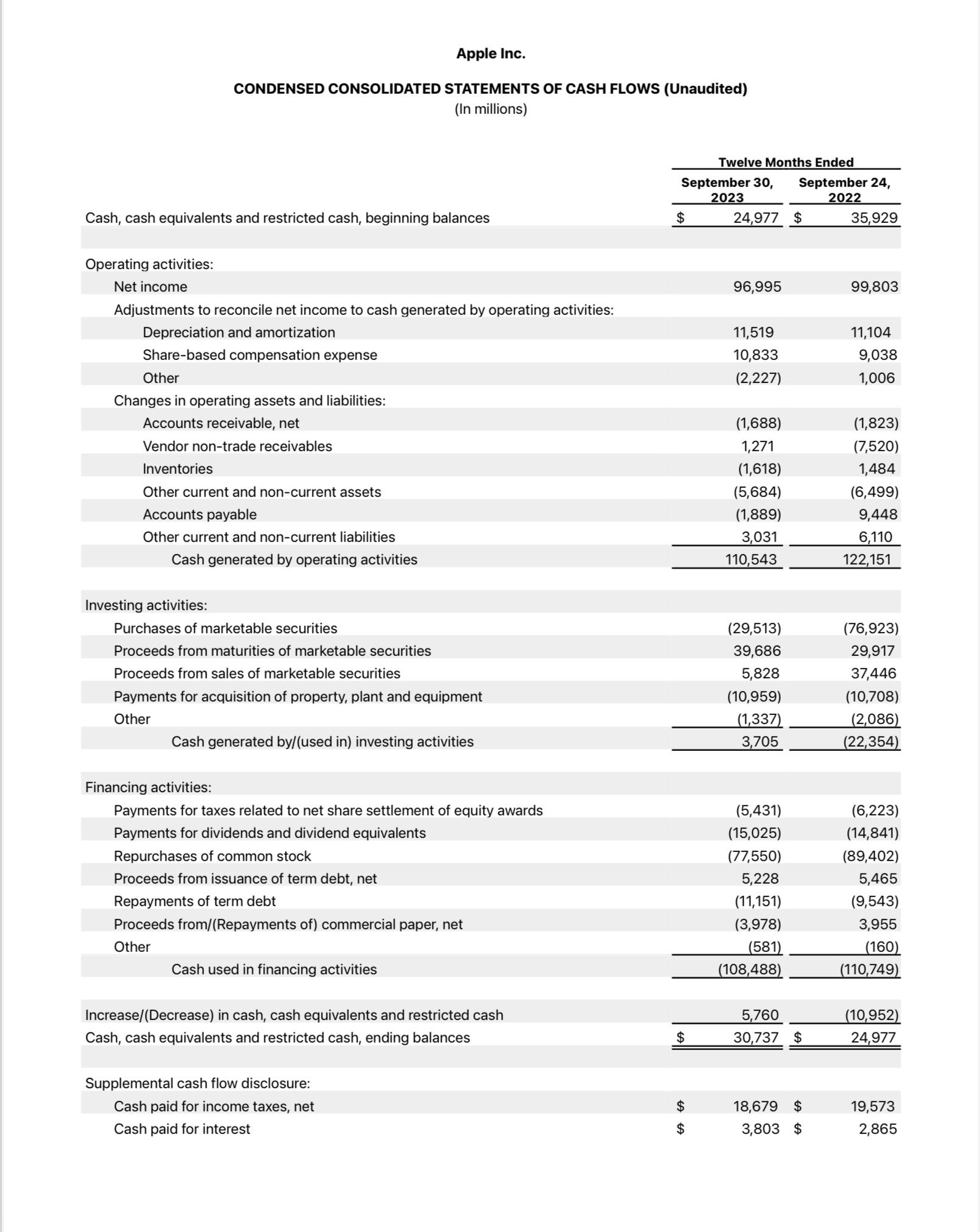

Item 7- ROA and ROE

Item 8- What are some factors that can affect your financial analysis of APPLE Inc.?

Item 9 - Would you buy or sell APPLE Stock and Why?

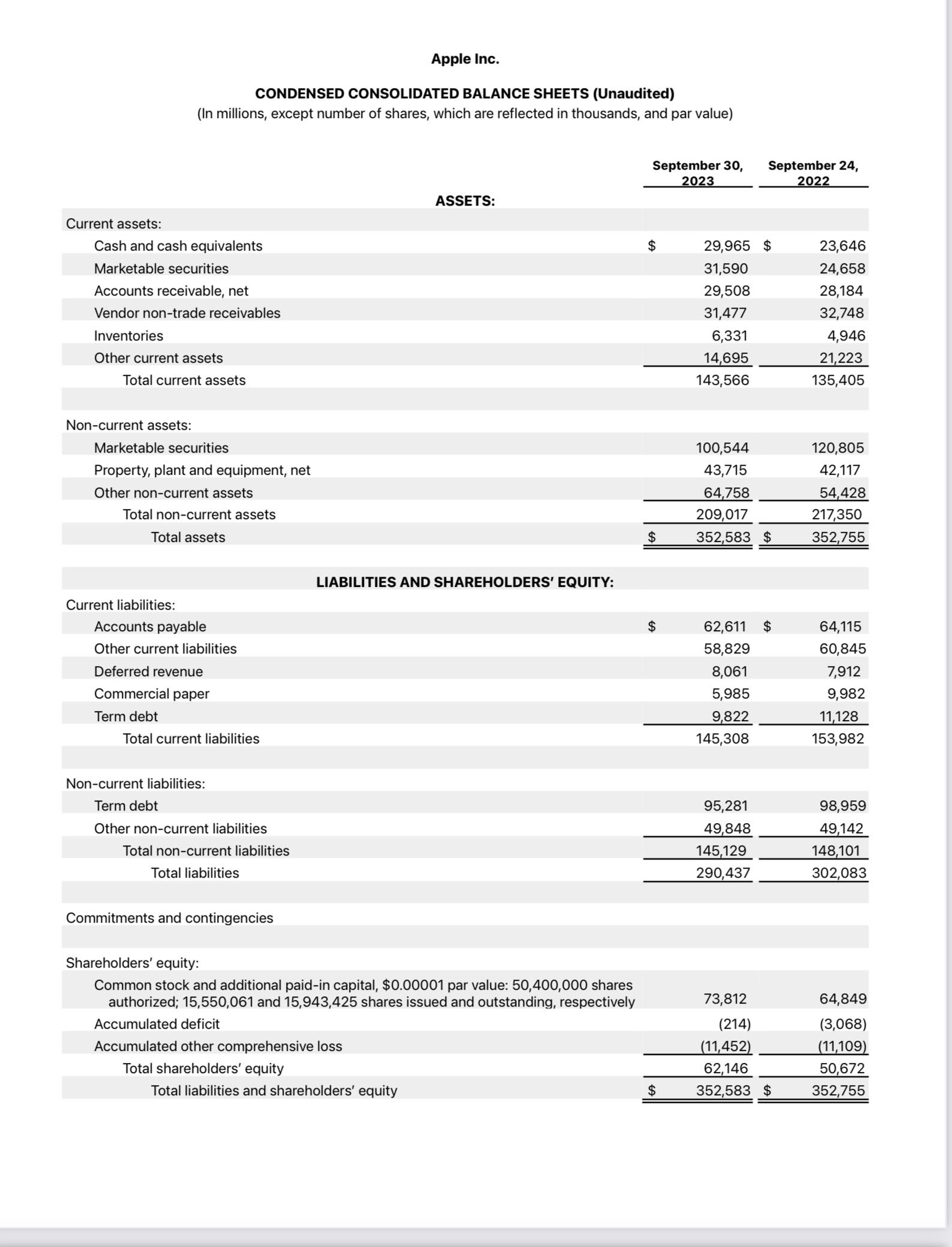

Apple Inc. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (In millions, except number of shares, which are reflected in thousands, and par value) Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Vendor non-trade receivables Inventories Other current assets Total current assets Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities Commitments and contingencies Shareholders' equity: ASSETS: LIABILITIES AND SHAREHOLDERS' EQUITY: September 30, September 24, 2023 2022 $ 29,965 $ 23,646 31,590 24,658 29,508 28,184 31,477 32,748 6,331 4,946 14,695 21,223 143,566 135,405 100,544 120,805 43,715 42,117 64,758 54,428 209,017 217,350 $ 352,583 $ 352,755 $ 62,611 $ 64,115 58,829 60,845 8,061 7,912 5,985 9,982 9,822 11,128 145,308 153,982 95,281 98,959 49,848 49,142 145,129 148,101 290,437 302,083 Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 15,550,061 and 15,943,425 shares issued and outstanding, respectively Accumulated deficit 73,812 64,849 (214) (3,068) Accumulated other comprehensive loss (11,452) (11,109) Total shareholders' equity Total liabilities and shareholders' equity 62,146 50,672 $ 352,583 $ 352,755

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts