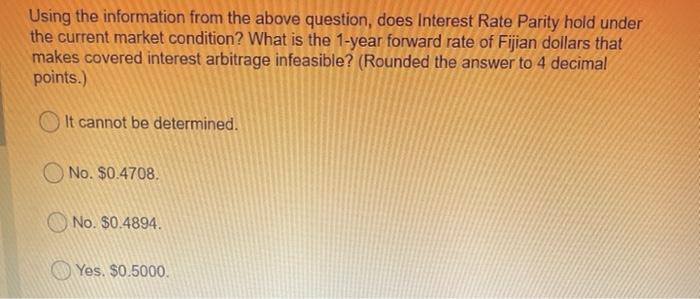

Question: Using the information from the above question, does Interest Rate Parity hold under the current market condition? What is the 1-year forward rate of Fijian

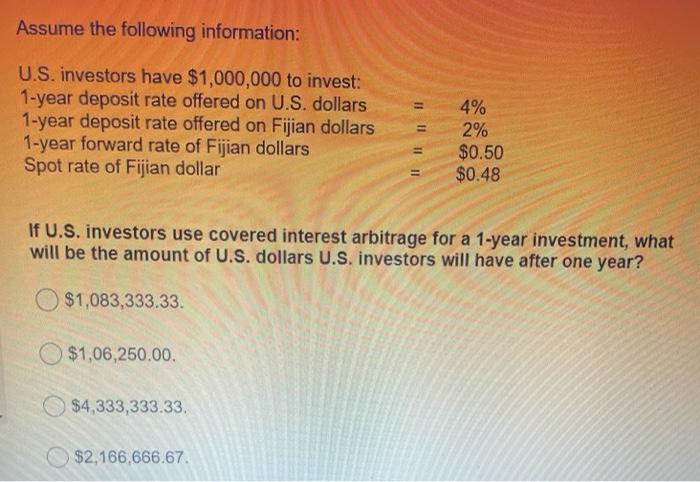

Using the information from the above question, does Interest Rate Parity hold under the current market condition? What is the 1-year forward rate of Fijian dollars that makes covered interest arbitrage infeasible? (Rounded the answer to 4 decimal points.) It cannot be determined. No. $0.4708. No. $0.4894 Yes. $0.5000 Assume the following information: U.S. investors have $1,000,000 to invest: 1-year deposit rate offered on U.S. dollars 1-year deposit rate offered on Fijian dollars 1-year forward rate of Fijian dollars Spot rate of Fijian dollar II 11 11 11 4% 2% $0.50 $0.48 If U.S. investors use covered interest arbitrage for a 1-year investment, what will be the amount of U.S. dollars U.S. investors will have after one year? $1,083,333.33 $1,06,250.00 $4,333,333.33 $2,166,666.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts