Question: Using the information from the prior problem, calculate the winning price assuming there is also a non-competitive bid of $1 billion. What is the discount

Using the information from the prior problem, calculate the winning price assuming there is also a non-competitive bid of $1 billion.

What is the discount rate implied by the price in the scenario with the competitive bidder?

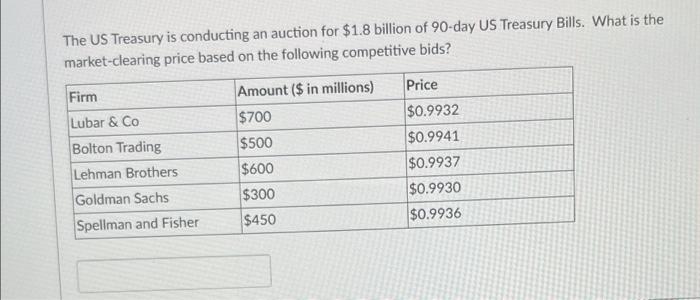

The US Treasury is conducting an auction for $1.8 billion of 90-day US Treasury Bills. What is the market-clearing price based on the following competitive bids? Firm Amount ($ in millions) $700 $500 Lubar & Co Bolton Trading Lehman Brothers Goldman Sachs Spellman and Fisher Price $0.9932 $0.9941 $0.9937 $0.9930 $0.9936 $600 $300 $450

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock