Question: using the information given above answer the question: 1. Begin by preparing a Base Case master budget (and label this Excel spreadsheet Base Case) for

using the information given above answer the question:

1. Begin by preparing a Base Case master budget (and label this Excel spreadsheet Base Case)

for Dog Pound Golf for each quarter of 2020 and for the year in total. The following

component budgets must be included (also see the Marking Rubric):

a. Beginning balance sheet (classified).

b. Sales budget

c. Schedule of receipts

d. Production budget

e. Direct materials purchases budget

f. Schedule of disbursements for materials

g. Direct labour budget

h. Overhead budget (be sure to show disbursements for overhead).

i. Selling and administrative budget (be sure to show disbursements for selling and

administrative expenses).

j. Cash budget

Prepare the following (in good form) for the year, 2020, in total (these do not need to be

quarterly).

h. Cost of goods manufactured budget

i. Cost of goods sold budget

j. Pro forma income statement (using absorption costing)

k. Pro forma classified balance sheet

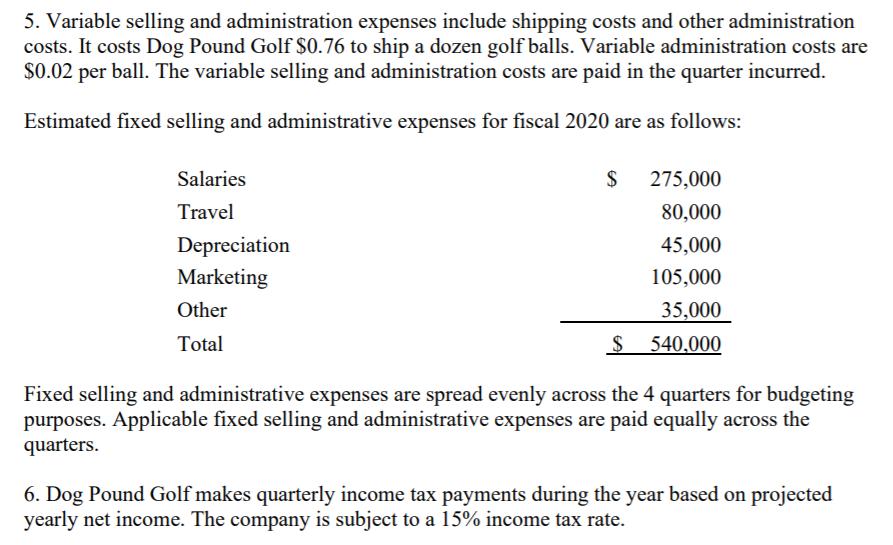

5. Variable selling and administration expenses include shipping costs and other administration costs. It costs Dog Pound Golf $0.76 to ship a dozen golf balls. Variable administration costs are $0.02 per ball. The variable selling and administration costs are paid in the quarter incurred. Estimated fixed selling and administrative expenses for fiscal 2020 are as follows: Salaries Travel Depreciation Marketing Other Total $ 275,000 80,000 45,000 105,000 35,000 540,000 $ Fixed selling and administrative expenses are spread evenly across the 4 quarters for budgeting purposes. Applicable fixed selling and administrative expenses are paid equally across the quarters. 6. Dog Pound Golf makes quarterly income tax payments during the year based on projected yearly net income. The company is subject to a 15% income tax rate.

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

1a Beginning Balance Sheet Classified Assets Cash 100000 Accounts Receivable 400000 Inventory 300000 Prepaid Expenses 50000 Total Current Assets 850000 Property Plant and Equipment 2000000 Less Accumu... View full answer

Get step-by-step solutions from verified subject matter experts