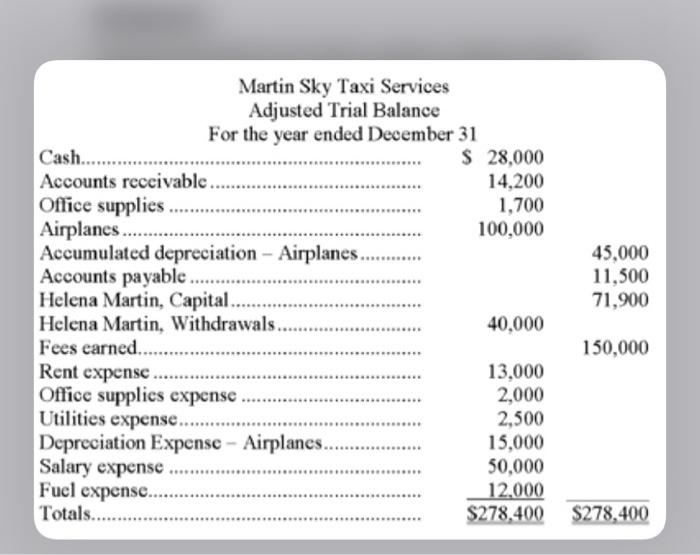

Question: Using the information given below, prepare a balance sheet for Martin Sky Taxi Services from the adjusted trial balance. Helena Martin did not make any

Martin Sky Taxi Services Adjusted Trial Balance For the year ended December 31 Cash......... $ 28,000 Accounts receivable 14,200 Office supplies 1.700 Airplanes......... 100,000 Accumulated depreciation - Airplanes.. Accounts payable .......... Helena Martin, Capital ................. Helena Martin, Withdrawals...................... 40,000 Fees earned............ Rent expense 13,000 Office supplies expense 2,000 Utilities expense.... 2,500 Depreciation Expense - Airplanes. 15,000 Salary expense ............ 50,000 Fuel expense.... 12.000 Totals.......... $278.400 45,000 11,500 71,900 150,000 *** $278.400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts