Question: Using the flexible price monetary model (FPMM), sticky price monetary model (SPMM) and real interest rate differential model (RID), outline whether the parameters a0

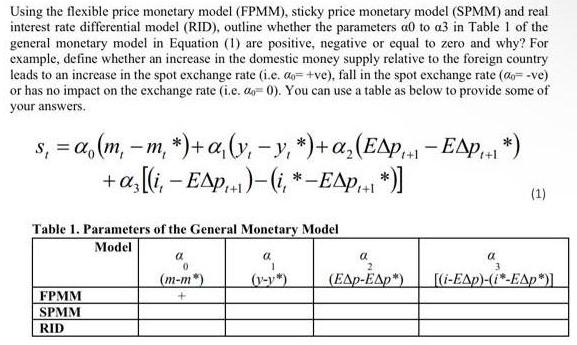

Using the flexible price monetary model (FPMM), sticky price monetary model (SPMM) and real interest rate differential model (RID), outline whether the parameters a0 to a3 in Table 1 of the general monetary model in Equation (1) are positive, negative or equal to zero and why? For example, define whether an increase in the domestic money supply relative to the foreign country leads to an increase in the spot exchange rate (i.e. do +ve), fall in the spot exchange rate (=-ve) or has no impact on the exchange rate (i.e. a=0). You can use a table as below to provide some of your answers. s = a (m, - m, *)+ a(y y, *)+ a (Ep - EAP+1 *) + a[(i - EAP)-(i,*-EAP+1 *)] Table 1. Parameters of the General Monetary Model Model FPMM SPMM RID a 0 (m-m*) + a (v-y*) a (EAP-EAp*) (1) a [(i-EAp)-(i*-EAp*)]

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts