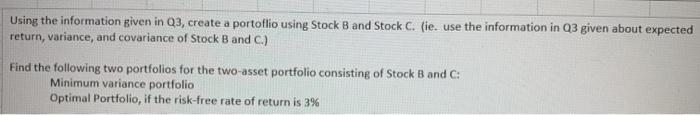

Question: Using the information given in Q3, create a portoflio using Stock B and Stock C. (ie. use the information in 23 given about expected return,

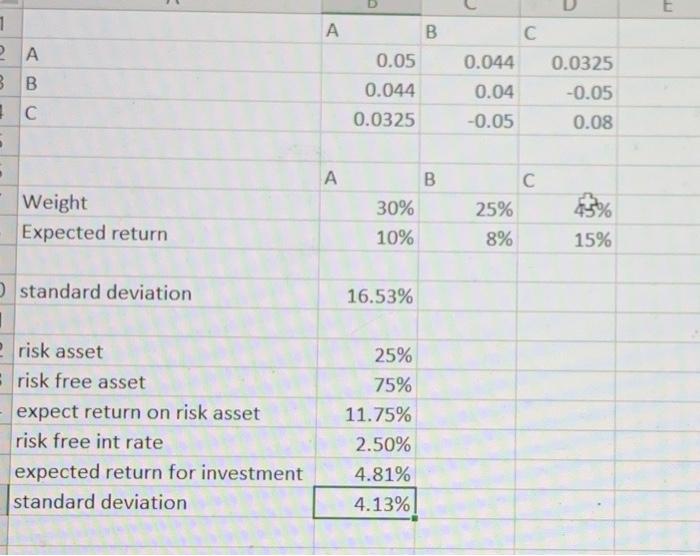

Using the information given in Q3, create a portoflio using Stock B and Stock C. (ie. use the information in 23 given about expected return, variance, and covariance of Stock B and C.) Find the following two portfolios for the two-asset portfolio consisting of Stock Band C: Minimum variance portfolio Optimal Portfolio, if the risk-free rate of return is 3% A 1 2 A BB B 0.05 0.044 0.0325 0.044 0.04 -0.05 0.0325 -0.05 0.08 - . A Weight Expected return B 30% 10% 25% 8% 15% 16.53% standard deviation 1 risk asset risk free asset - expect return on risk asset risk free int rate expected return for investment standard deviation 25% 75% 11.75% 2.50% 4.81% 4.13%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts