Question: using the information here how do i calculate bad debt expense for January 2012? i know it is supposed to be 340 but how do

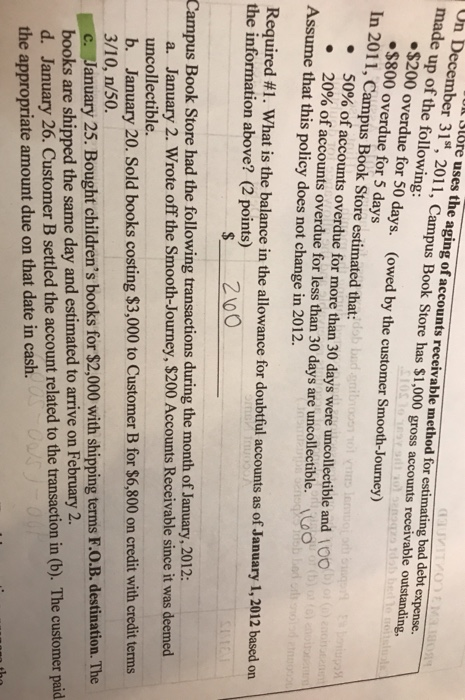

U Store uses the aging of accounts receivable method for estimating bad debt expense. Un December 31st, 2011, Campus Book Store has $1,000 gross accounts receivable outstanding, made up of the following: $200 overdue for 50 days. (owed by the customer Smooth-Journey) $800 overdue for 5 days In 2011, Campus Book Store estimated that:b bad gnibnoon o1 y leoor 50% of accounts overdue for more than 30 days were uncollectible and OO 20% of accounts overdue for less than 30 days are uncollectible. oqo tdab bed e noslo o ) eo Assume that this policy does not change in 2012 Required # 1. What is the balance in the allowance for doubtful accounts as of January 1,2012 based on the information above? (2 points) ne Tmuoo0A $ 200 Campus Book Store had the following transactions during the month of January, 2012: a. January 2. Wrote off the Smooth-Journey, $200 Accounts Receivable since it was deemed uncollectible. January 20. Sold books costing $3,000 to Customer B for $6,800 on credit with credit terms 3/10, n/50. C. January 25. Bought children's books for $2,000 with shipping terms F.O.B. destination. The books are shipped the same day and estimated to arrive on February 2 d. January 26. Customer B settled the account related to the transaction in (b). The customer paid the appropriate amount due on that date in cash. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts