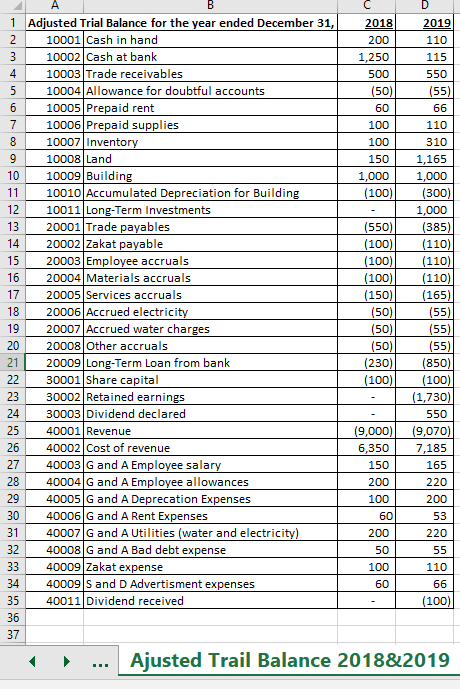

Question: Using the information in the adjusted trial balance 2018 & 2019, prepare the statement of cash flows for the year ending December 31, 2019 B

Using the information in the adjusted trial balance 2018 & 2019, prepare the statement of cash flows for the year ending December 31, 2019

B D 1 Adjusted Trial Balance for the year ended December 31, 2018 2019 2 10001 Cash in hand 200 110 3 10002 Cash at bank 1,250 115 4 10003 Trade receivables 500 550 5 10004 Allowance for doubtful accounts (50) (55) 6 10005 Prepaid rent 60 66 7 10006 Prepaid supplies 100 110 8 10007 Inventory 100 310 9 10008 Land 150 1,165 10 10009 Building 1,000 1,000 11 10010 Accumulated Depreciation for Building (100) (300) 12 10011 Long-Term Investments 1,000 13 20001 Trade payables (550) (385) 14 20002 Zakat payable (100) (110) 15 20003 Employee accruals (100) (110) 16 20004 Materials accruals (100) (110) 17 20005 Services accruals (150) (165) 18 20006 Accrued electricity (50) (55) 19 20007 Accrued water charges (50) (55) 20 20008 Other accruals (50) (55) 21 20009 Long-Term Loan from bank (230) (850) 22 30001 Share capital (100) (100) 23 30002 Retained earnings (1,730) 24 30003 Dividend declared 550 25 40001 Revenue (9,000)| (9,070) 26 40002 Cost of revenue 6,350 7,185 27 40003 G and A Employee salary 150 165 28 40004 G and A Employee allowances 200 220 29 40005 G and A Deprecation Expenses 100 200 30 40006 G and A Rent Expenses 60 31 40007 G and A Utilities (water and electricity) 200 220 32 40008 G and A Bad debt expense 50 55 33 40009 Zakat expense 100 110 34 40009 S and D Advertisment expenses 60 66 35 40011 Dividend received (100) 36 37 Ajusted Trail Balance 2018&2019 53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts