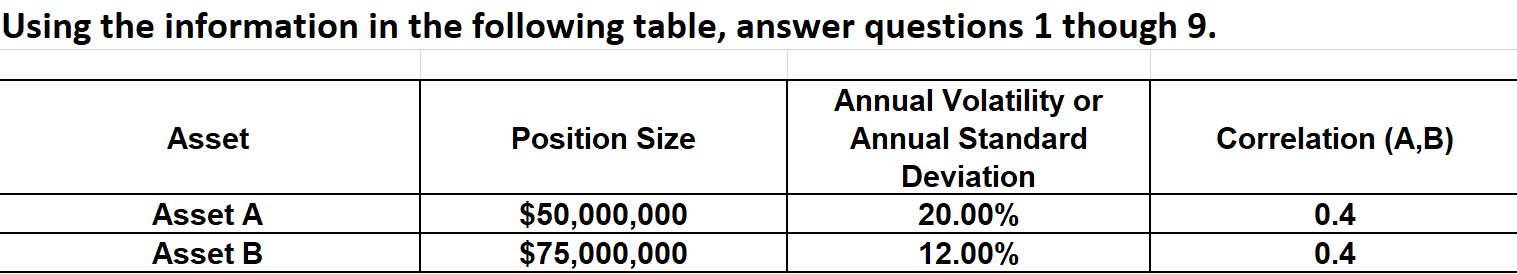

Question: Using the information in the following table, answer questions 1 though 9. Asset Position Size Correlation (A,B) Annual Volatility or Annual Standard Deviation 20.00% 12.00%

Using the information in the following table, answer questions 1 though 9. Asset Position Size Correlation (A,B) Annual Volatility or Annual Standard Deviation 20.00% 12.00% Asset A Asset B $50,000,000 $75,000,000 0.4 0.4 6. What is the 10-day 99.0% VaR in USD or $'s for the portfolio consisting of Asset A and Asset B? 7. What is the probability that the portfolio consisting of Asset A and Asset B will have a market value less than $124,000,000 after 1-day? 8. What is the probability that the portfolio consisting of Asset A and Asset B will have a market value greater than $125,000,000 after 4-days? a 9. How do you interpret or describe the VaR value calculated in Question 6? Using the information in the following table, answer questions 1 though 9. Asset Position Size Correlation (A,B) Annual Volatility or Annual Standard Deviation 20.00% 12.00% Asset A Asset B $50,000,000 $75,000,000 0.4 0.4 6. What is the 10-day 99.0% VaR in USD or $'s for the portfolio consisting of Asset A and Asset B? 7. What is the probability that the portfolio consisting of Asset A and Asset B will have a market value less than $124,000,000 after 1-day? 8. What is the probability that the portfolio consisting of Asset A and Asset B will have a market value greater than $125,000,000 after 4-days? a 9. How do you interpret or describe the VaR value calculated in Question 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts